Stock Rallies

After making one of the biggest single-day gains, LULU is currently trading sharply above its long-term average. Going by the company’s resilience to recent market headwinds and management’s positive guidance, the stock looks poised to maintain the upward momentum in the coming weeks. It offers an entry point for those looking for long-term engagement, though the valuation is not cheap.

The Vancouver-headquartered firm recovered quickly from the slowdown experienced soon after the COVID-19 outbreak more than two years ago and maintained stable earnings and sales performance since then. All along, the headline numbers either topped or matched Wall Street’s expectations every quarter.

Strong Numbers

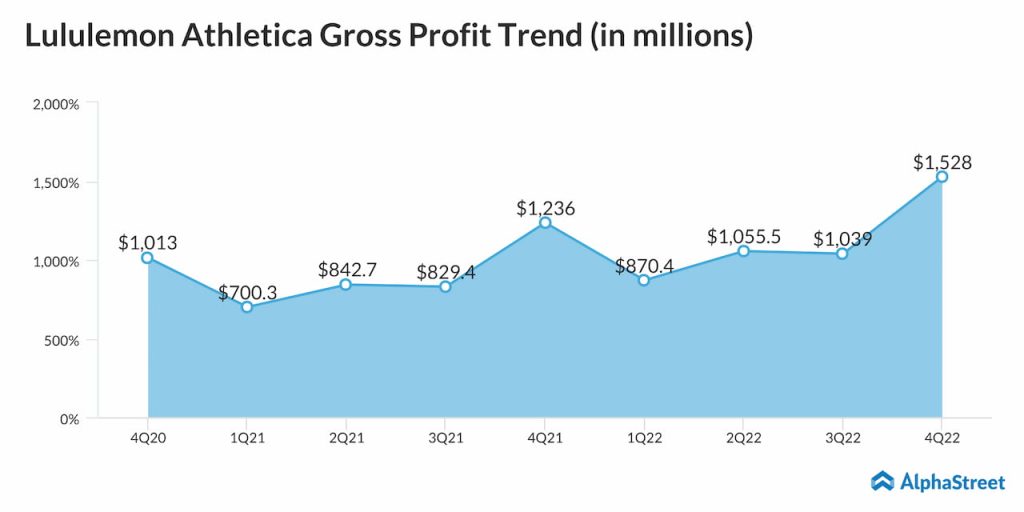

The company had an upbeat start to 2023, reporting robust sales and earnings for the final three months of the last fiscal year. Net profit, adjusted for non-recurring items, climbed 31% annually to $4.40 per share in the January quarter, aided by a 30% growth in revenues to $2.77 billion. It opened 32 net new company-operated stores during the quarter, taking the total to 655 units globally. Comparable sales, a metric that measures sales from stores open continuously for at least 12 months, rose sharply by 27% during the period.

Commenting on the results, Lululemon’s chief executive officer Calvin McDonald said, “our continued high level of performance is a reflection of the hard work and agility of our incredible teams and the deep connections they create with our guests and communities around the world. As we enter 2023, we look forward to another year of strong momentum across the globe and delivering on our Power of Three ×2 growth plan.”

Outlook

Encouraged by the positive outcome, the management forecasts 2023 revenues in the $9.3 billion-$9.41 billion range, which is above the consensus estimates. Full-year profit is expected to be between $11.50 and $11.72 per share, the mid-point of which comes in above the market’s projection. Having recovered from inventory issues, Lululemon looks all set to expand its international footprint and continue growing the men’s business. The weakness in pricing will likely be offset by stable customer traffic. Meanwhile, the dip in margins, reflecting the pricing pressure, remains a cause for concern.

Over the past three years, the company’s market share expanded at a compound annual rate of 24% in North America, while its international market share grew by 39%. On Wednesday, LULU gained a whopping 13% within a few hours after opening, continuing the post-earnings rally. The stock has gained 23% since last week.