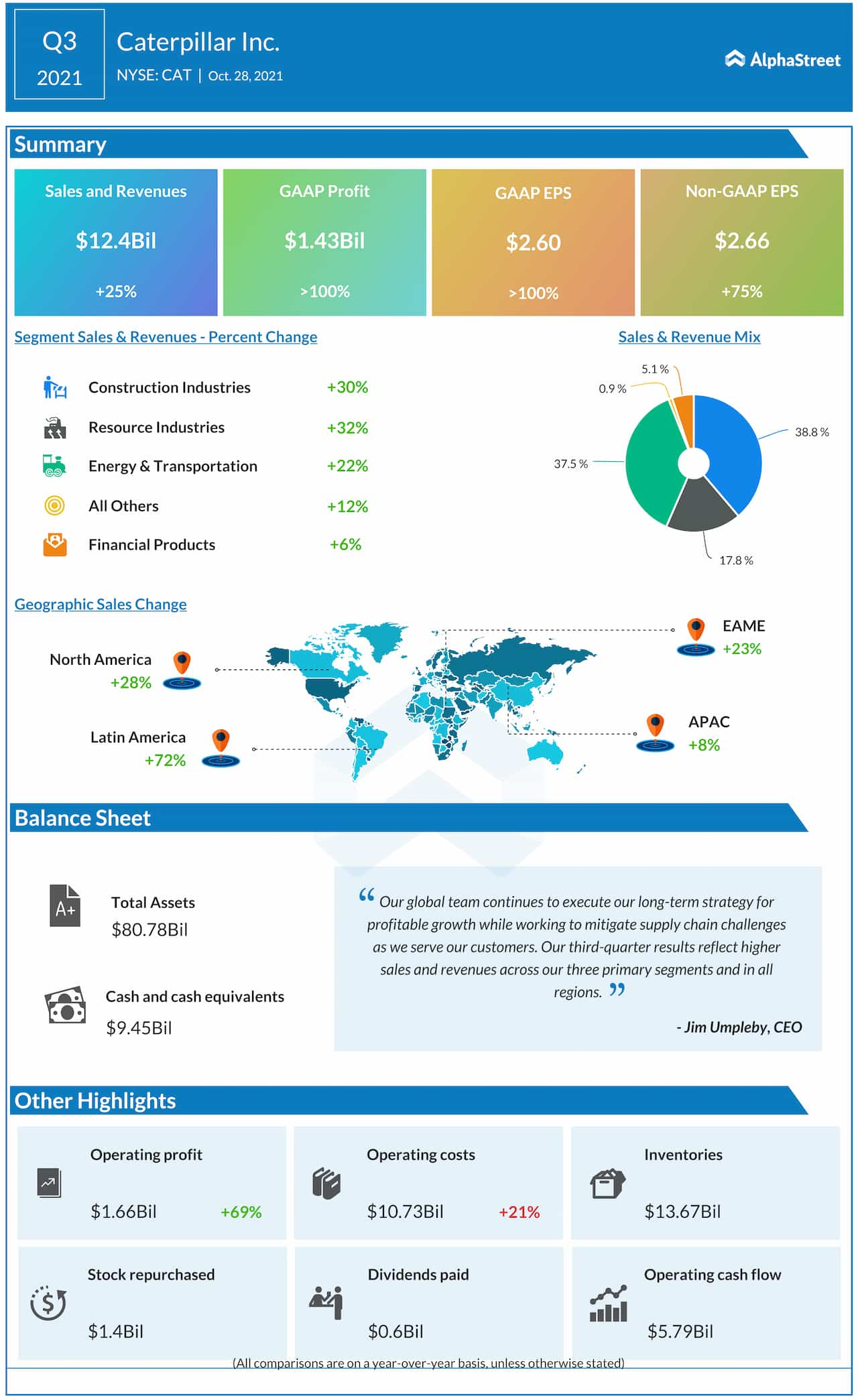

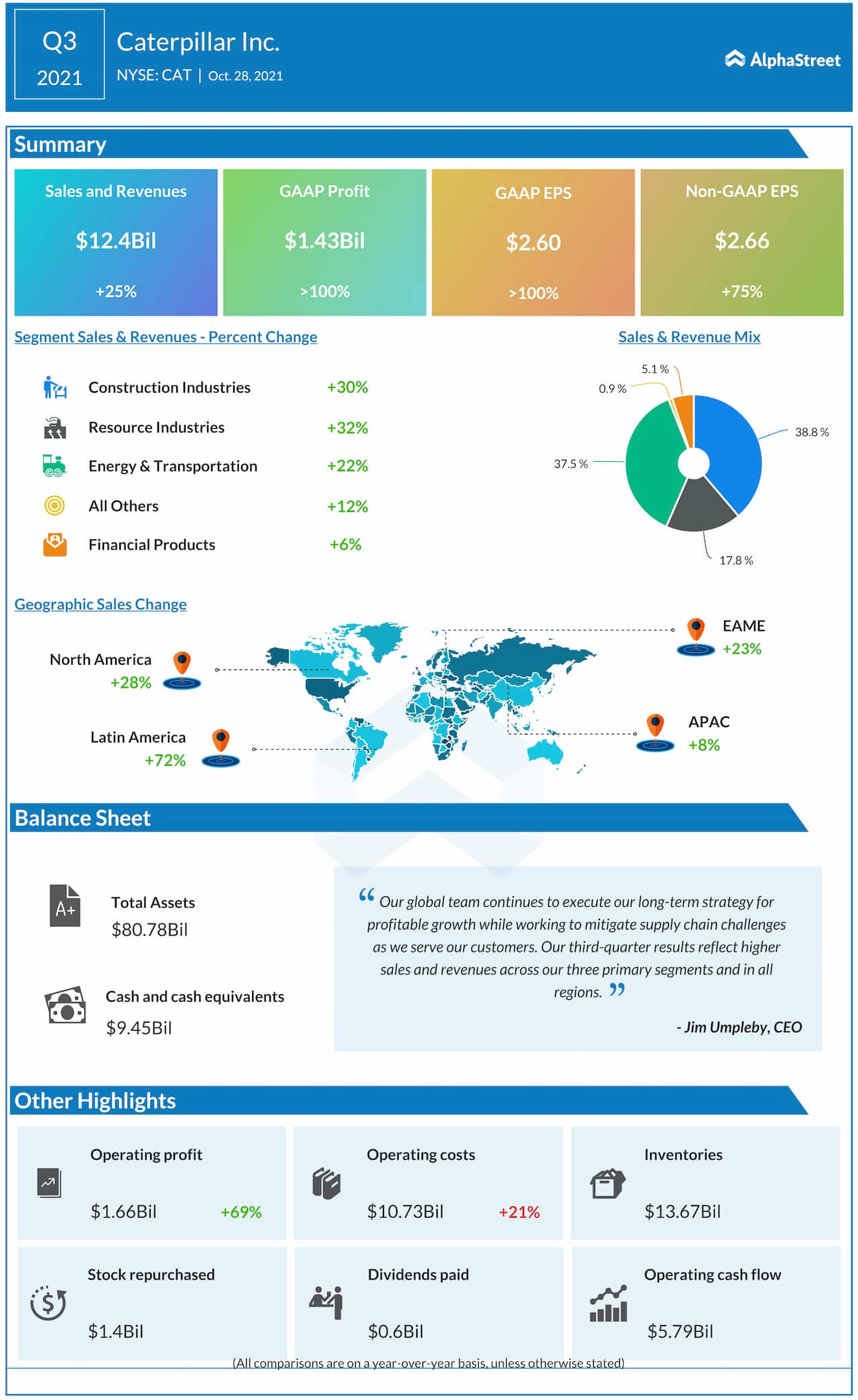

Caterpillar Inc. (NYSE: CAT) reported a three-fourths increase in adjusted profit for the third quarter, when the heavy equipment giant’s revenues climbed 25%. Strong sales growth across the key operating segments and geographical divisions more than offset the supply chain issues. The numbers also beat estimates, sending the company’s stock higher.

Total sales and revenues advanced to $12.4 billion in the September quarter from $9.9 billion in the year-ago period, reflecting double-digit growth in the Construction, Resource, and Energy &Transportation divisions. Analysts had predicted a lower number for the latest quarter.

EPS up 75%

The positive results reflect higher end-user demand for equipment and services, favorable changes in dealer inventories, and better price realization, which was partially offset by higher expenses, especially costs of sales. The top-line growth translated into a 75% increase in adjusted earnings to $2.66 per share, which also topped expectations. Net income was $1.43 billion or $2.60 per share, compared to $668 million or $1.22 per share in the third quarter of 2020.

Read management/analysts’ comments on Caterpillar’s Q3 earnings

During the third quarter, the management returned around $2 billion to shareholders in the form of stock buybacks and dividends. The company has paid higher dividends for as many as 27 consecutive years. The favorable changes in business conditions — such as resurgence in construction activity, recovery in drilling for energy, and re-engagement in heavy industries like mining — are expected to persist in the coming months.

Bullish Outlook

Buoyed by the positive results, Caterpillar executives said they are expecting stronger sales for the fourth quarter. While full-year operating profit margin, on an adjusted basis, is seen dropping sequentially due to seasonal factors, it is expected to meet the management’s Investor Day target.

“We continue to remain focused on sustainability. We’re developing products and services that facilitate fuel transition, increase operational efficiency and reduce emissions to help our customers achieve their environmental and carbon reduction goals. We had a strong third-quarter overall with volume growth in all three primary segments and sales gains in every region. Operating profit margin expanded due largely to the volume gains. While the material costs in freight have risen so has price realization. With strong performance year-to-date, we remain on track to meet our Investor Day targets for ME&T margins and free cash flow for the year,” said Jim Umpleby, chief executive officer of Caterpillar.

Stock Recovers

Caterpillar’s stock rallied after the earnings announcement last week, extending the recent recovery. It maintained the uptrend since then and traded higher on Monday afternoon. The latest gains followed a losing streak that lasted for several months. CAT had lost about 10% in the past six months.