Positive View

As per the outlook issued by the Intuit leadership a few months ago, adjusted profit is expected to be $1.80 per share to $1.85 per share in the fourth quarter. The midpoint of the guidance range, $1.83 per share, is slightly below analysts’ consensus earnings estimate of $1.84 per share for Q4. In the year-ago quarter, the Mountain View-headquartered tech firm earned $1.65 per share, excluding one-off items. The company will be publishing the report on Thursday, August 22, at 4:00 pm ET.

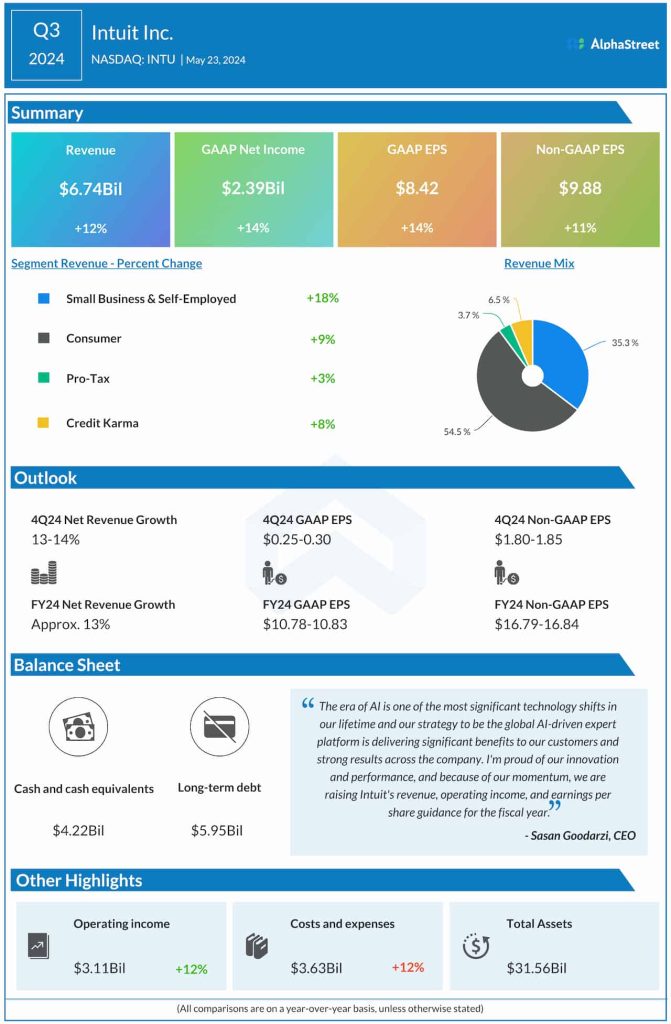

The management is looking for 13-14% revenue growth for the July quarter, while market watchers expect the top line to grow 13.6% year-over-year to $3.08 billion. For fiscal 2024, the company projects adjusted net income in the range of $16.79 per share to $16.84 per share. The forecast for revenue growth has been revised up to 13% from the earlier estimate of 11%.

In Growth Mode

The company’s primary strength is its unique and successful business model. The healthy cash flow enables it to reinvest in the business and return cash to shareholders. Intuit looks poised to stay on the growth path, benefitting from the integration of AI tools and a growing customer base. The business has been largely resilient to macro uncertainties and the recent cutback on enterprise spending on technology.

Commenting on the company’s recent performance, CEO Sasan Goodarzi said, “We are seeing a lot of green shoots with all the work that we’ve been doing in the last several years, really digitizing the whole process of estimating to invoicing to getting paid and having multiple paying options, along with the Bill Pay capabilities that we’ve built that we are now rolling out to our customers. We’re seeing a lot of green shoots in both of those areas. You saw in a pretty tough macro environment; our overall total payments volume was up 22%. And that’s an area where we’re accelerating our investment.”

Q3 Outcome

The Small Business & Self-Employed business segment, the main growth driver that accounts for about 35% of total revenues, has grown in double-digits in recent quarters. In the April quarter, the top line increased 12% from last year to $6.74 billion, with revenue growing across all four operating divisions. As a result, adjusted profit advanced 11% year-over-year to $9.88 per share.

On Monday, Intuit’s stock opened around $65 and traded slightly higher in the early part of the session. The stock price is broadly in line with its value three months ago.