Guidance Lifted

Also see: Retail space gets busy as firms see new opportunitys

As per the revised outlook, the number of sales executives in the US will be doubled to around 800 from last year’s levels. Considering the increase in the frequency of calls to health professional targets, the number of physicians will be raised by 50% to around 75,000. Also, there is expected to be a two-fold increase in inventory purchases, to about $250 million. That, together with other expenses, could result in a $200-$250-million increase in operating expenses in the next fiscal.

Long-term View

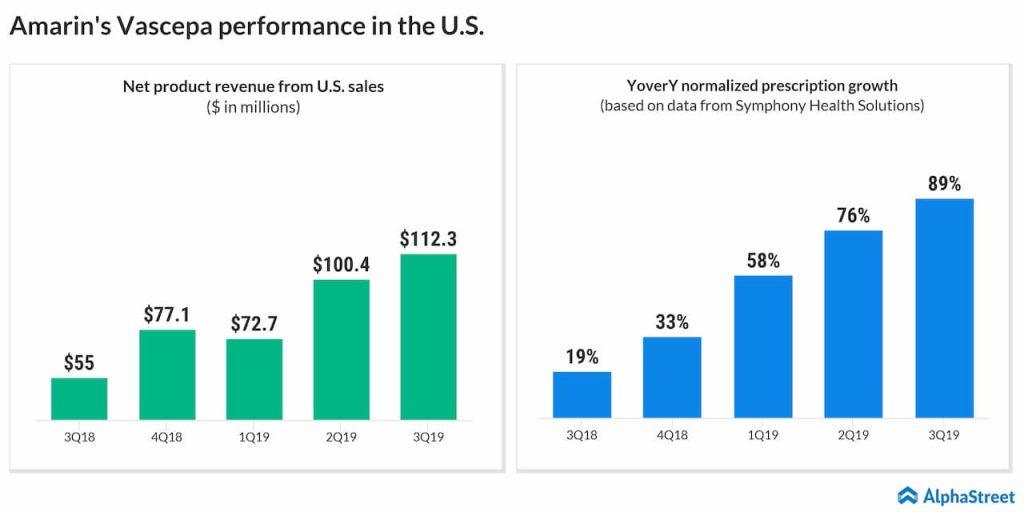

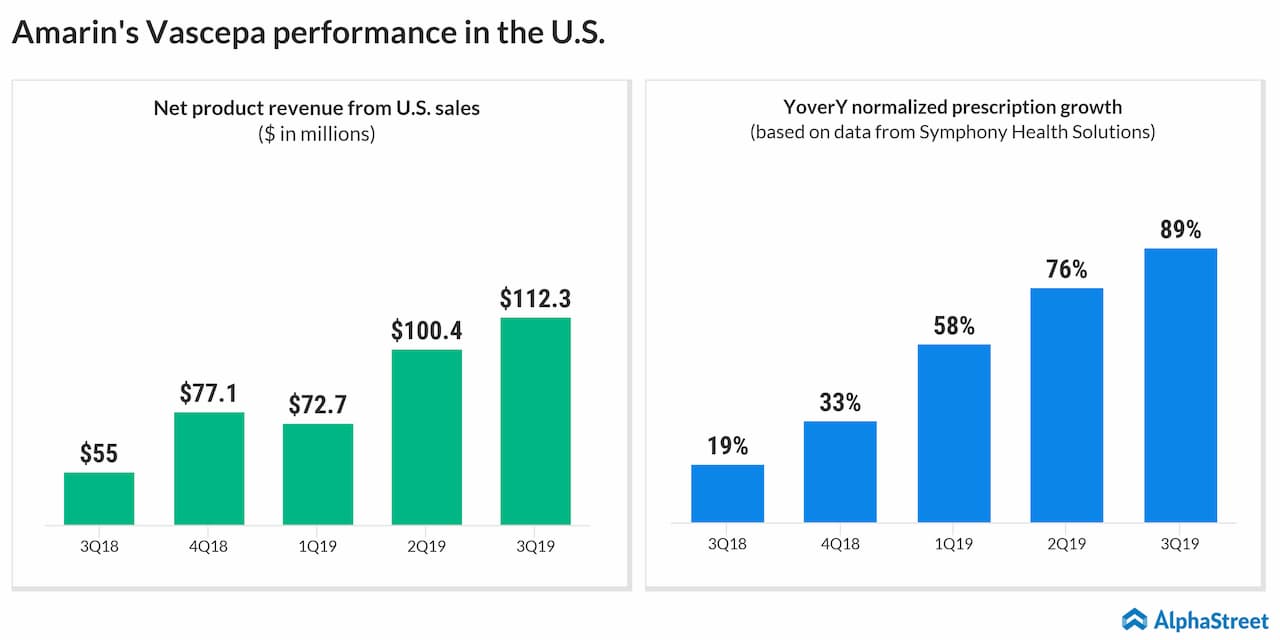

The workforce expansion should contribute to revenue expansion in the near term. Looking ahead, the company expects the top-line growth to accelerate sharply in the upcoming years, aided by the steady rise in the prescriptions for Vascepa. The management will be discussing the revised outlook at the J.P. Morgan Healthcare Conference to be held next week.

“Early feedback from physicians and medical societies have been positive regarding the new indication for VASCEPA. With extraordinary employees, broad support from leading physicians, good payor coverage, a large patient need, and the only approved indication to address this need, Amarin commences 2020 with confidence and focus. Our aim is to make VASCEPA a new standard of care for the benefit of millions of patients,” said CEO John Thero.

FDA Nod for Vascepa

Adding to the uptick in optimism, the company recently obtained FDA approval for the label expansion of Vascepa, sending the stock sharply higher. The sanction cleared the decks for the drug to reach millions of patients, with new prescriptions to patients with a high risk of heart attack and currently receiving other forms of therapy.

A few months ago, Amarin’s shares made sharp gains and reached the highest level in more than a decade. The stock closed the last trading session higher.