AMD’s stock has stayed unaffected by the pandemic since its onset and maintained stable momentum throughout last year. After withdrawing from the recent peak, the stock regained strength this week. While the price is seen growing double-digits this year, the dip in valuation makes the stock an attractive investment.

Broad-based Growth

The recovery of the PC market and the spike in video game consumption during the COVID-related shutdown, combined with data center expansion and cloud adoption, contributed to the recent sales growth. In an effort to take on rivals like Intel Corp. (INTC), the company recently rolled out its third-generation EPYC processor for data-center. The new Ryzen Pro 5000 mobile processors featuring Zen 3 core also hit the market this week, with more launches expected in the coming months.

From AMD’s Q4 2020 earnings conference call:

“We expect our data center business to accelerate in 2021 as we further extend our performance, efficiency and TCO leadership with the launch of our next-gen server processors codenamed Milan. Milan production began in the fourth quarter as planned with initial shipments to cloud and HPC customers. We are very pleased with the performance of Milan. We conducted the first public preview of Milan at CES, highlighting 68% better performance compared to two of the highest-end dual-socket processors from our competition when running a compute-intensive whether modeling simulation.”

Read management/analysts’ comments on AMD’s Q4 results

The demand for advanced computing remains elevated. Considering that, AMD unveiled its latest server processor and graphics card while tackling the industry-wide challenges caused by COVID. Cloud remains a highly promising area, with market leaders like Amazon (AMZN) Web Services and Microsoft (MSFT) expanding their AMD-powered offerings. Also, IBM (IBM) clinched a deal for the joint development of ‘open’ technologies for enterprise-cloud.

Strong Q4 Outcome

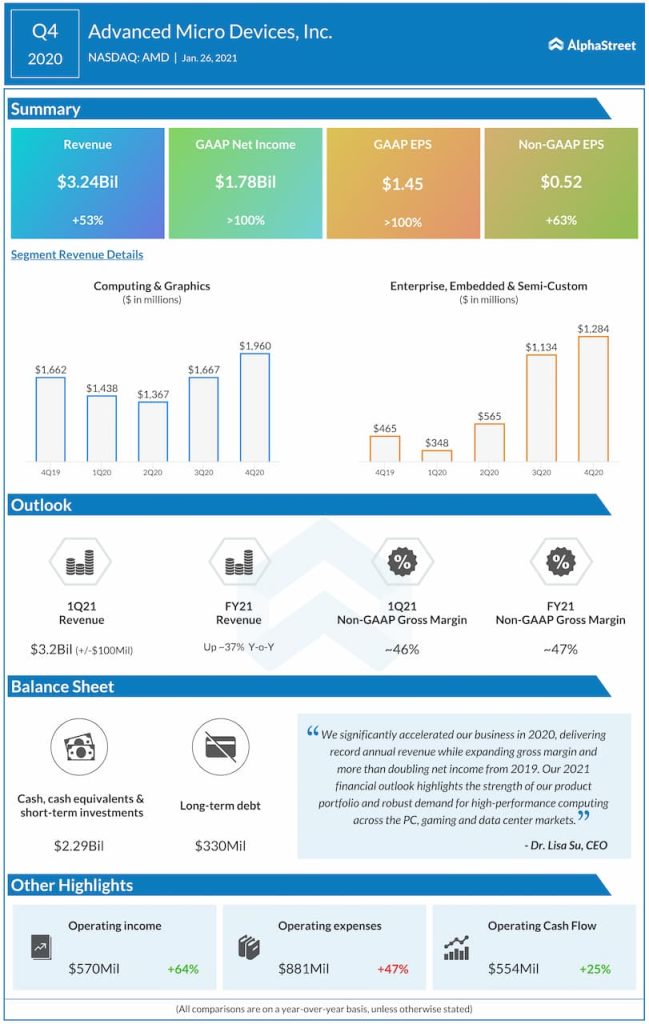

AMD’s earnings have either matched or beat analysts’ predictions in the past several quarters. In the fourth quarter, revenues of the server segment nearly tripled, driving up the top-line by 53% to $3.2 billion and above the forecast. Consequently, adjusted earnings surged 63% to $0.52 per share and topped the Street view.

With non-core markets like the automotive industry being hit hard by the chip shortage, the future looks bright for CPU suppliers like AMD. That said, the semiconductor industry is highly competitive and cyclical in nature, which casts a shadow on its prospects at a time when the market is experiencing high volatility.

Xilinx Deal

Meanwhile, a special meeting is being planned next month to seek shareholders’ approval for the proposed acquisition of Xilinx by AMD. Earlier, the $35-billion deal got the green signal from the boards of directors of the companies.

After hitting an all-time high towards the end of last year, AMD’s stock pulled back and slipped to a five-month low this month. The value more than doubled in the past twelve months. The shares traded higher in the early hours of Tuesday, after closing the last session higher.