Road Ahead

Meanwhile, the management has warned that sales would slow down in the second half of the year, citing macroeconomic uncertainties and supply chain issues. In the long term, the hybrid manufacturing model, secular growth trends and the diversified portfolio should help the business navigate the short-term business cycles. It is worth noting that the importance of semiconductors is increasing steadily and they have become vital for economic development. The company’s chips are widely used in the thriving automotive, consumer, industrial, and communications markets.

Analog looks to benefit from its alignment with new trends in data processing, like the shift from Cloud to the edge — it delivers advanced solutions for the Intelligent Edge.

Q2 Outcome

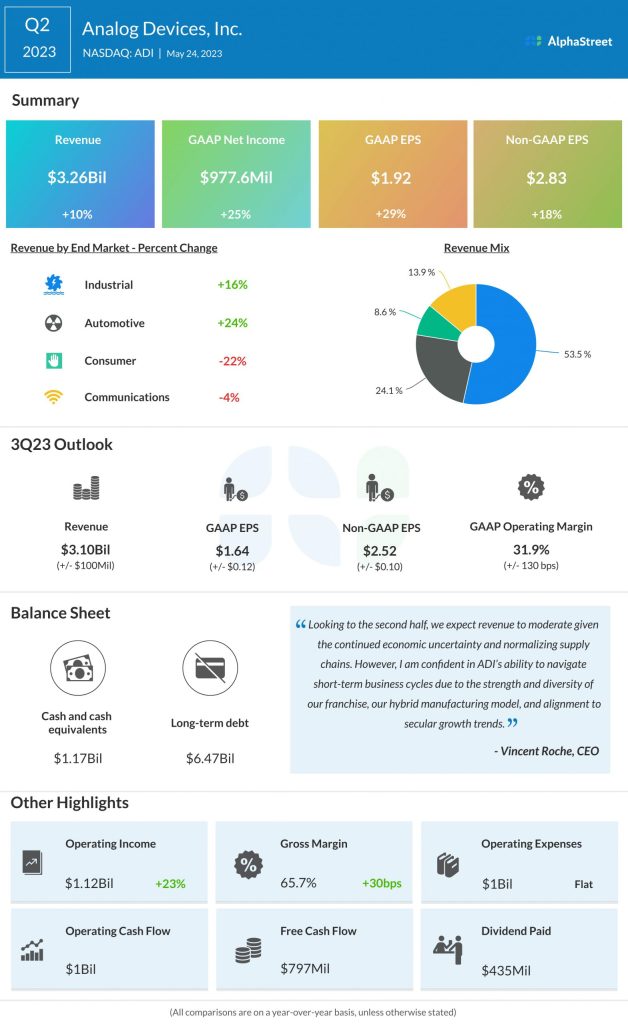

In the April quarter, continued strong performance by the core Industrial and Automotive segments pushed up total revenues to $3.26 billion, up 10% from last year. Both unadjusted and adjusted earnings per share grew in double digits to $1.92 and $2.83 respectively. Analog has delivered stronger-than-expected quarterly earnings and revenues consistently for about three years, and the latest quarter was no different.

Gross margin increased by 30 basis points, reflecting flat operating expenses that remained unchanged year-over-year. The company ended the quarter with an impressive operating cash flow of around $1 billion.

“Looking to the second half, we expect revenue to moderate given the continued economic uncertainty and normalizing supply chains. However, I am confident in ADI’s ability to navigate short-term business cycles due to the strength and diversity of our franchise, our hybrid manufacturing model, and alignment to secular growth trends,” said Analog’s chief executive officer Vincent Roche.

Outlook

For the current quarter, the management expects revenues to be around $3.10 billion. At the mid-point of the estimate, unadjusted operating margin is expected to be around 31.9% and adjusted operating margin approximately 48.5%. The earnings per share forecast, including special items, is around $1.64, while adjusted profit is expected to be about $2.52. The guidance is below analysts’ estimates.

Analog’s shares traded down 8% in the early hours of Wednesday’s session. Still, the stock is up 6% from the levels seen at the beginning of the year.