Firearms manufacturer American Outdoor Brands (AOBC) reported a plunge in top and bottom line results for the third quarter of 2018. The dismal results were impacted by lower shipments in the company’s firearms business which in turn was driven by a reduction in wholesaler and retailer orders versus the prior year.

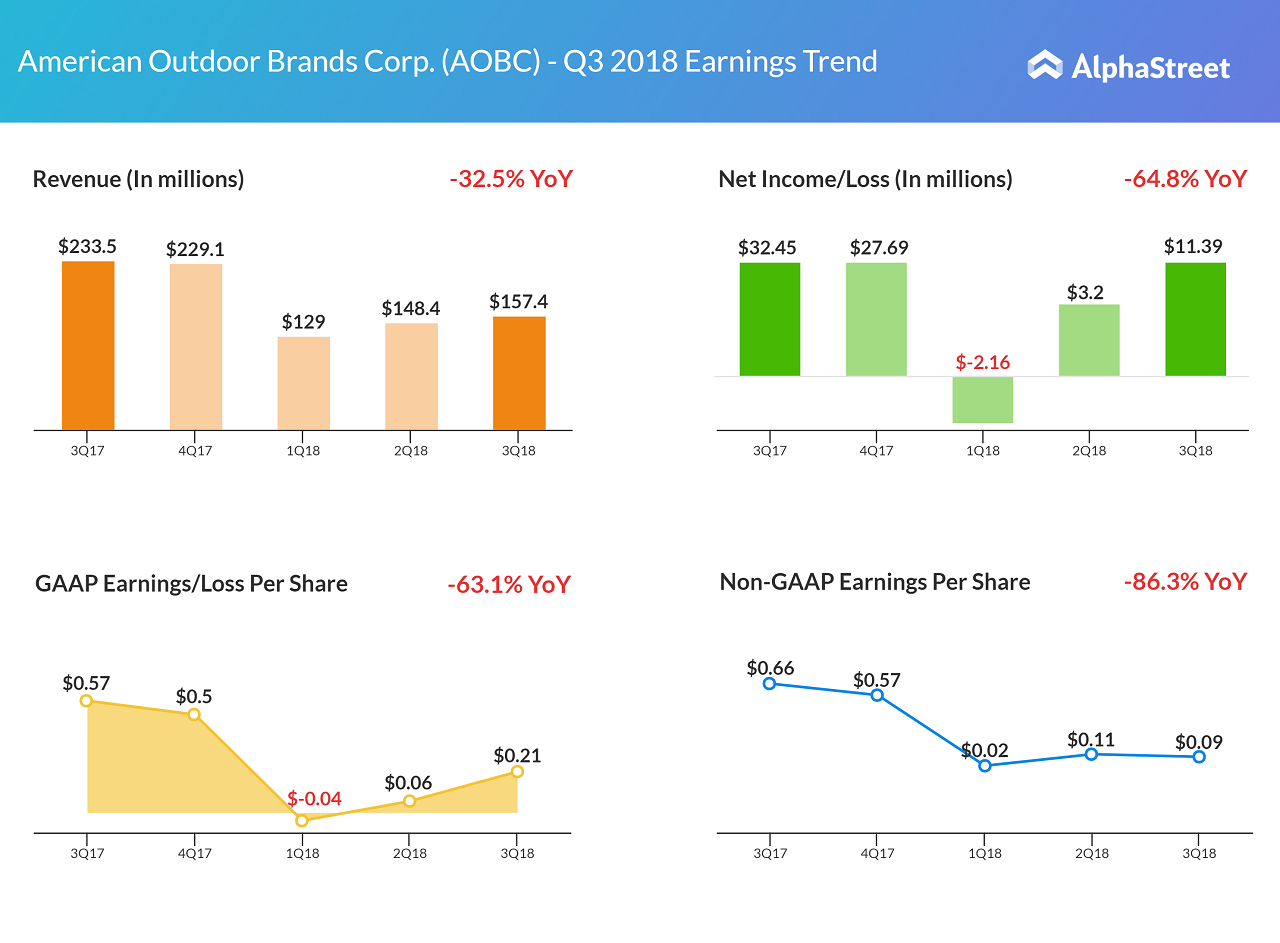

Revenue sunk 32.5% to $157.4 million from $233.5 million a year earlier. Profit for the quarter slumped 64.8% to $11.39 million while GAAP earnings per share declined 63.1% to $0.21. Adjusted earnings per share slumped even higher by 86.3% to $0.09.

The bright spot for the quarter was a double-digit revenue growth within the company’s Outdoor Products and Accessories segment.

Outlook

For 4Q18, American Outdoor Brands expects net sales in the range of $162 million to $166 million. GAAP earnings per share is anticipated in the range of $0.01 to $0.03, while non-GAAP earnings per share is expected in the range of $0.09 to $0.11.

For full-year 2018, American Outdoor Brands expects net sales to come in the range of $597 million to $601 million. GAAP and non-GAAP earnings per share are targeted to be in the range of $0.24 to $0.26, and $0.31 to $0.33, respectively.

The company believes that the new, lower levels of consumer firearm demand reflected in the January NICS results may continue for some time.