If there is one stock that hasn’t allowed its growth in size to hamper its rally, it’s Apple (AAPL). Since hitting $1 trillion in valuation on August 2 this year, the stock has gained 4%, even as the other trillion dollar company Amazon (AMZN) tumbled last week to around $800 billion market cap following earnings results.

Looking into the fourth quarter results of Apple, scheduled to be published on November 1, the stock looks rock steady on the back of the latest set of iPhone launches. However, since the results won’t comprise sales data of the new iPhone XR, and will contain only about 10 days of sales of iPhone XS and XS Max, investors will be looking forward to management comments on the initial response and the projections for the holiday quarter.

During the upcoming holiday-quarter, analysts expect iPhone unit sales to touch 100 million, a million higher than the same period last year.

Apple shares will be primarily driven by how the management sees sales to take off during the upcoming quarter, rather than the fundamental earnings figures. However, there will be one figure that investors will be keen to find out – Average selling price (ASP) of iPhones.

Thanks to the organic increase in the cost of the latest version of iPhone every year, the company regularly enjoys double-digit increases in ASP. This quarter, Bernstein analyst Toni Sacconaghi has projected a 29% jump in iPhone ASP to $800, driven by the fully loaded iPhone XS Max, which costs $1,449.

Another important aspect that could shake product sales is the impact of trade tension with China. While the $749-priced iPhone XR is likely to offer good competition to cheaper local smartphone models in China, investors will be looking at how much it can offer resistance to the demand dent caused by the macro tensions.

Another important aspect that could shake product sales is the impact of trade tension with China. While the $749-priced iPhone XR is likely to offer good competition to cheaper local smartphone models in China, investors will be looking at how much it can offer resistance to the demand dent caused by the macro tensions.

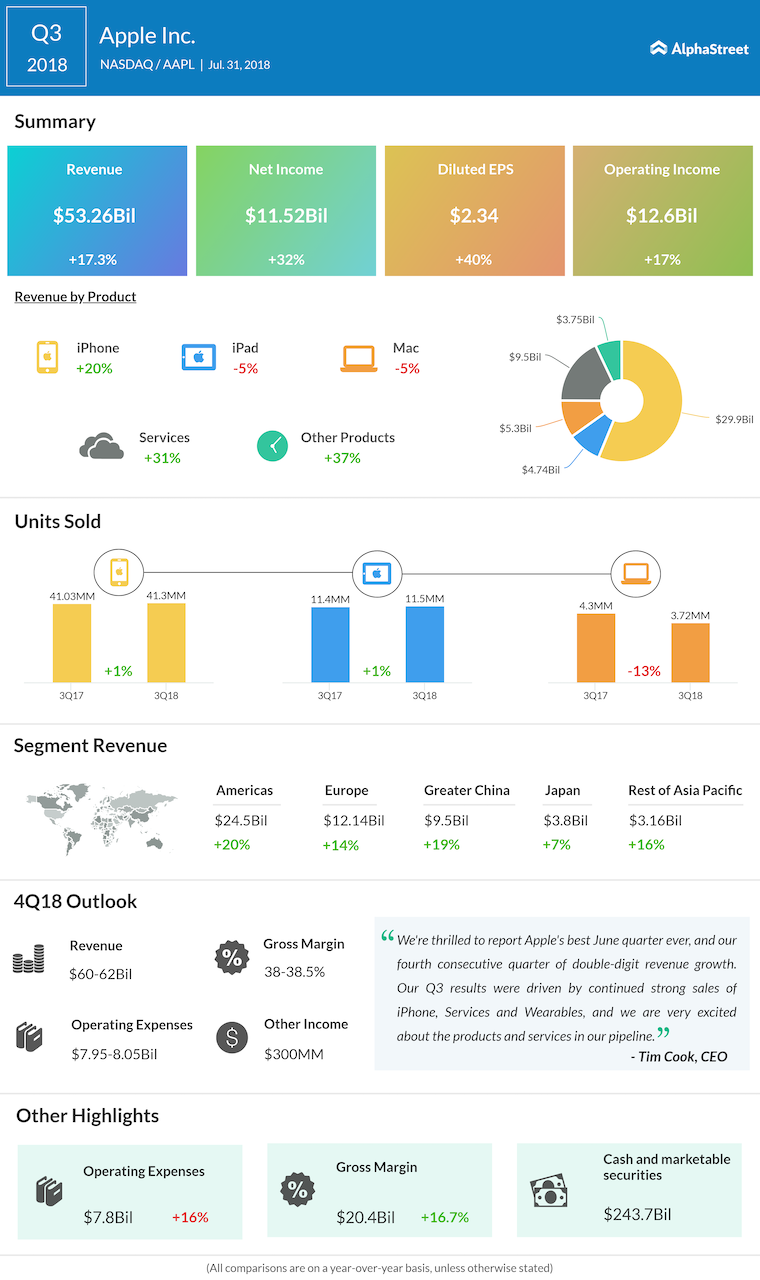

During the fourth quarter, revenue is projected to grow 16% to $61.41 billion. Net income will grow 34% to $2.78 per share, according to street consensus.

The stock has an average price target of $239.75. The shares were trading up 1% at $218.43 during the morning trading session on Monday.