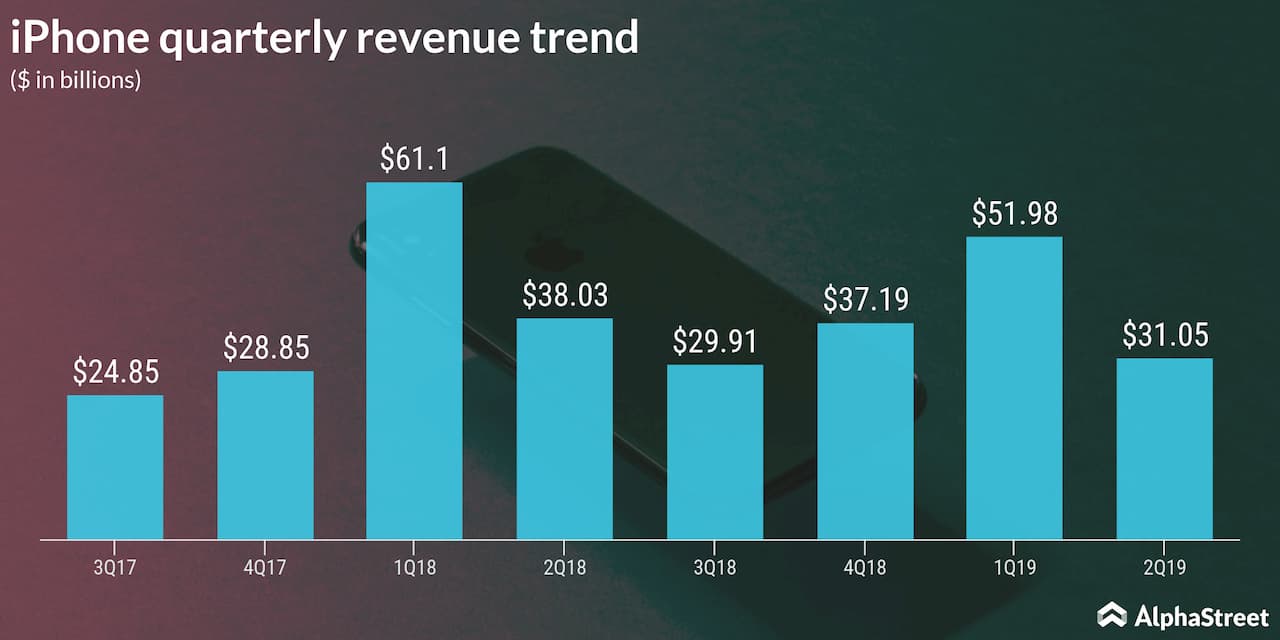

Since iPhone accounts for more than half of its total revenues, investors would continue to focus on its sales trend, no matter how much the management tries to highlight the company’s strong growth elsewhere.

The first and foremost hurdle for Apple would be proving that iPhone growth has not stagnated. The street has very modest targets for this quarter, so for a strong company that Apple is, this should be an advantage.

The street projects Q3 revenues to be $53.4 billion, compared to $53.27 billion last year. This represents a pretty narrow growth, or in another perspective, a borderline against a third straight year-over-year decline. Beating this hurdle won’t be easy, given the fact that this is Apple’s weakest cyclical quarter historically. Tough one!

Weakness in iPhone sales will dent the bottom-line as well in the third quarter, which analysts peg at $2.10 per share. During the same quarter last year, the Cupertino, California-based firm had reported earnings of $2.34 per share. Apple has a remarkable history of beating earnings estimates, and has done so in all four of the trailing quarters.

Up next is the line of potential regulatory probes that could

take place any time, at all major tech companies including Apple. Though the

services segment has been showing tremendous growth for Apple, quickly adopting

the role of a revenue driver, an anti-trust lawsuit could deeply hamper this

rally.

All eyes on guidance and iPhone

updates

Investors will be closely watching the guidance as the tech giant generally releases the latest version of iPhone in the month of September. The guidance will give the initial hints about how the company sees sales picking up following its product release.

The guidance will also give a cue on the potential impact of tariffs on the Mac Pro parts to be shipped from China, on which President Donald Trump had earlier refused a waiver.

READ: What Alphabet executives discussed during Q2 2019 earnings call

ADVERTISEMENT

As per the hitherto leaks, the upcoming iPhone, now lovingly called iPhone 11, does not have any pathbreaking features, except for a third camera, for ultra-wide photographs. According to market observers, 5G adaptability is still a far-fetched idea.

It is unlikely that the management would divulge any further

details about the product; they hardly do.

Still, investors and analysts will be trying to read between the lines during the earning conference calls, to carve out any tiny bit of detail that could possibly hint any what the upcoming handset would feel like.

Listen to on-demand

earnings calls and hear how management responds to analysts’ questions