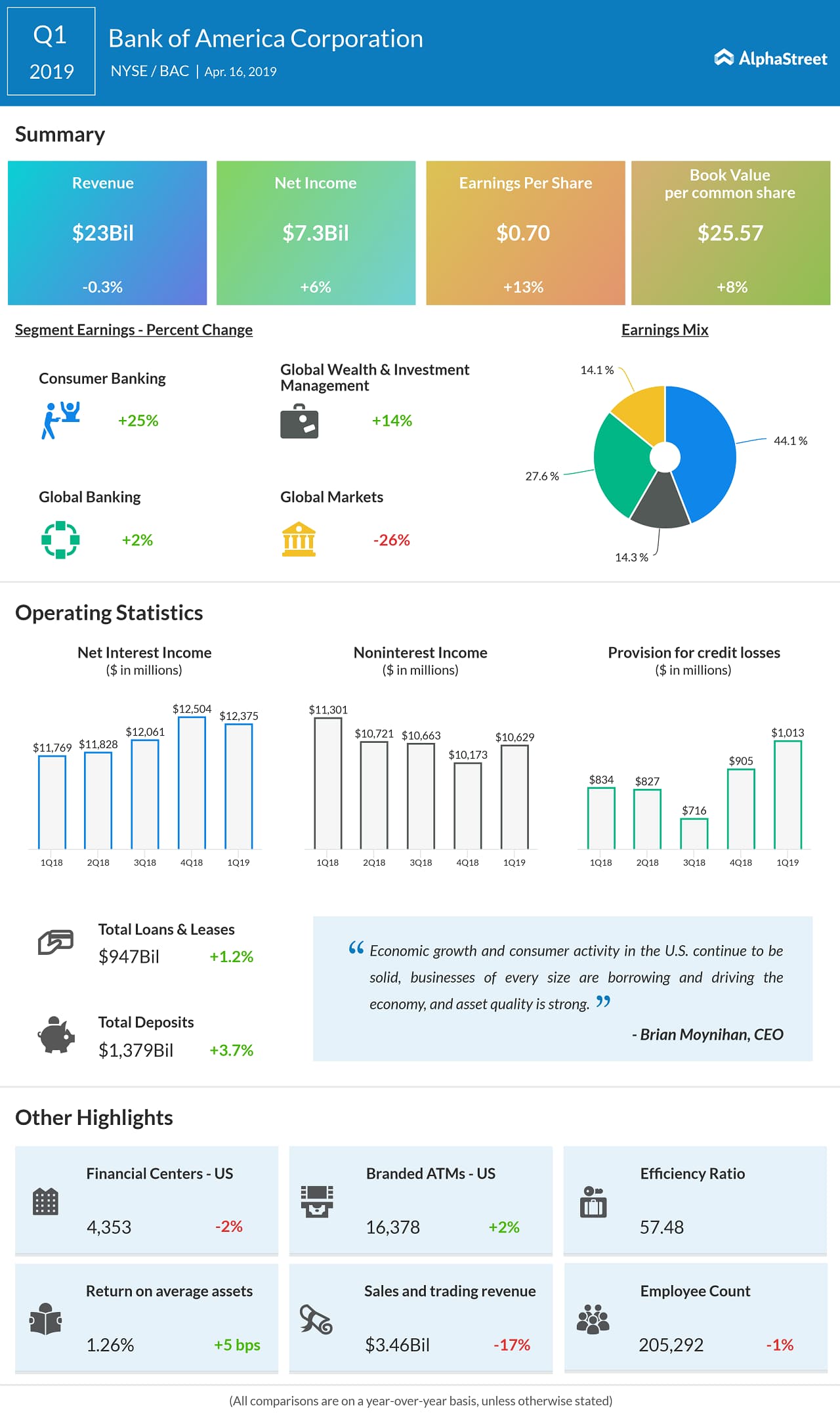

The 5% increase in the net interest income was driven by the interest rate hikes in 2018 and growth in loans and deposits. Average loan and lease balances in business segments rose 4% and average deposit balances rose 5%. Provision for credit losses increased $179 million to $1 billion.

“Economic growth and consumer activity in the U.S. continue to be solid, businesses of every size are borrowing and driving the economy, and asset quality is strong,” said CEO Brian Moynihan. He added, “We reduced expenses by four percent from the first quarter of 2018, contributing to the seventeenth consecutive quarter of positive operating leverage.”

Last Friday, peers JPMorgan Chase (JPM) and Wells Fargo (WFC) reported their quarterly results. On Monday, Citigroup (C) and Goldman Sachs (GS) reported their Q1 results. Except JPMorgan, other banking firms’ revenue declined year-over-year for the recently ended quarter. Today, BlackRock (BLK) also reported a decline in Q1 revenue.

Shares of BoFA, which closed down 1.09% at $29.84 on Monday, have gained 21% since the beginning of 2019.