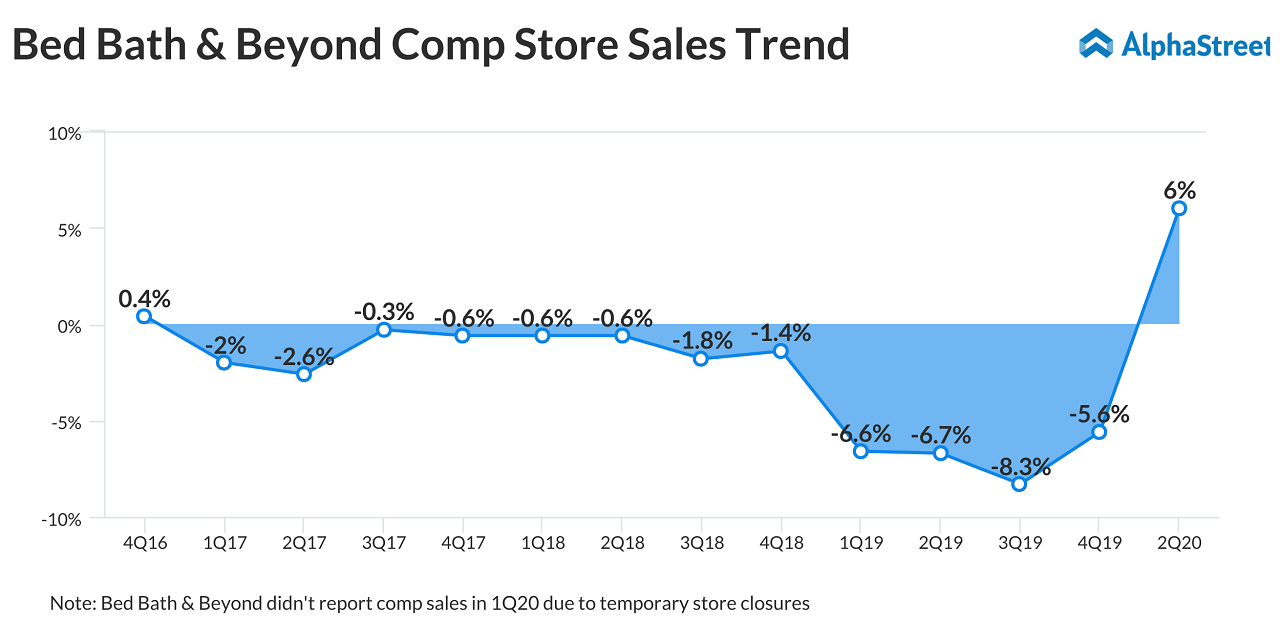

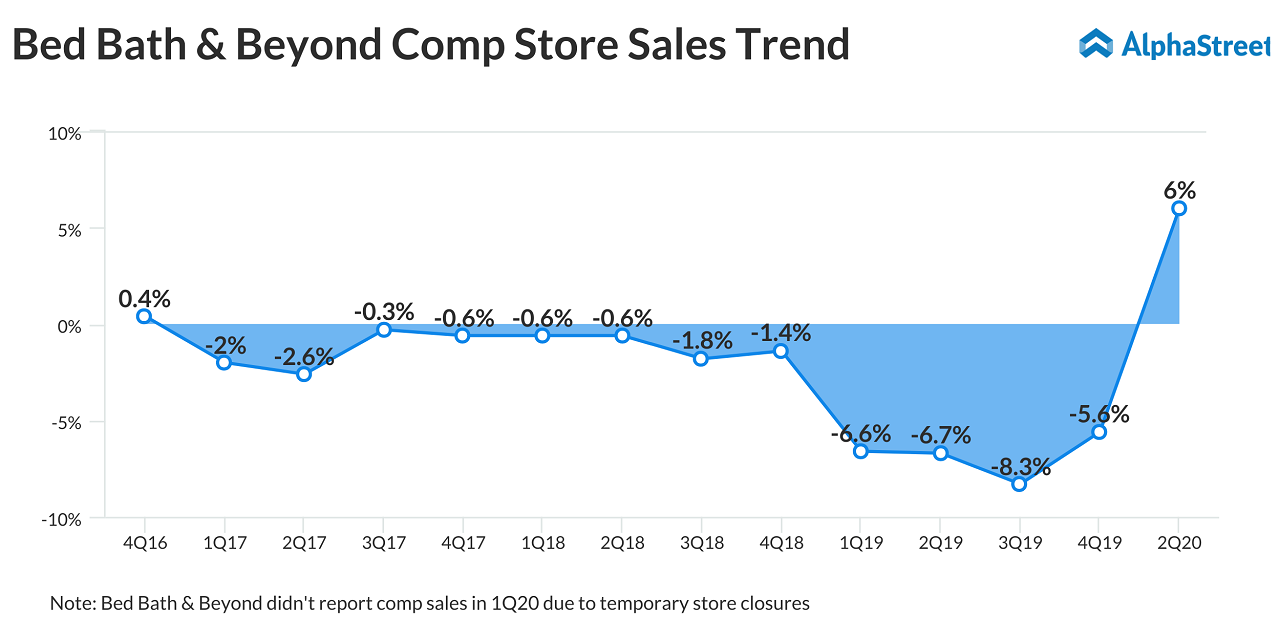

Home goods retailer Bed Bath & Beyond’s (NASDAQ: BBBY) unexpected comparable sales growth of 6% in the second quarter of 2020 made the stock hit a new 52-week high ($20.37) today. BBBY stock ended up 25% today with a trading volume of 79.3 million shares.

Q2 results

Sales declined 1% to $2.7 billion due to the divestiture of One Kings Lane business. Total comparable sales grew 6%. Before this, the company had reported positive comp sales growth in Q4 of fiscal 2016. Digital comp sales surged 89%, driven by the expansion of BOPIS and Curbside Pickup services. BOPIS-generated sales represented 15% of total digital sales in the quarter.

On an adjusted basis, profit per share increased 47% year-over-to $0.50. On a GAAP basis, Bed Bath & Beyond swung to a profit of $1.75 per share from a net loss of $1.12 per share in the prior year quarter.

Changing customer trends

When presenting the Q2 results, CEO Mark Tritton said,

“During this unprecedented time when our homes have become the center of our lives, we are well placed as customer spend more on their home and lifestyle. We see this trend continuing, and we’ve been responding with agility the changing needs of our customers, both in terms of our merchandise and service offerings.”

ADVERTISEMENT

Bed Bath & Beyond gained two million new online customers in Q2, of which 800,000 were completely new to the company. With a successful back-to-college season, Bed Bath & Beyond achieved 21% sales growth in college product sales. For the holiday season, the company expects customers to shop earlier.

Looking forward

In August, the New Jersey-based company implemented a workforce reduction of approximately 2,800 employees as part of its previously announced restructuring plan. This action is estimated to generate future annual pre-tax savings of approximately $150 million. The next phase of the company’s restructuring plan includes a store optimization project. The company recently confirmed that the first one-third of the 200 Bed, Bath & Beyond store closures will occur by the end of the calendar 2020.

Bed Bath & Beyond plans to accelerate its restructuring program to drive profit improvement over the next two-to-three years. The company anticipates to reinvest $150 million to $200 million of the expected cost savings into future growth initiatives. Bed Bath & Beyond maintained its stance of not providing fiscal 2020 guidance due to the uncertainty developed by COVID-19.

Also read: Bed Bath & Beyond (BBBY) Q2 2020 Earnings Call Transcript