Best Buy Co., Inc. (NYSE: BBY), a leading retailer of consumer electronics and related merchandise, reported higher profit for the first quarter of 2025, despite a decline in revenues.

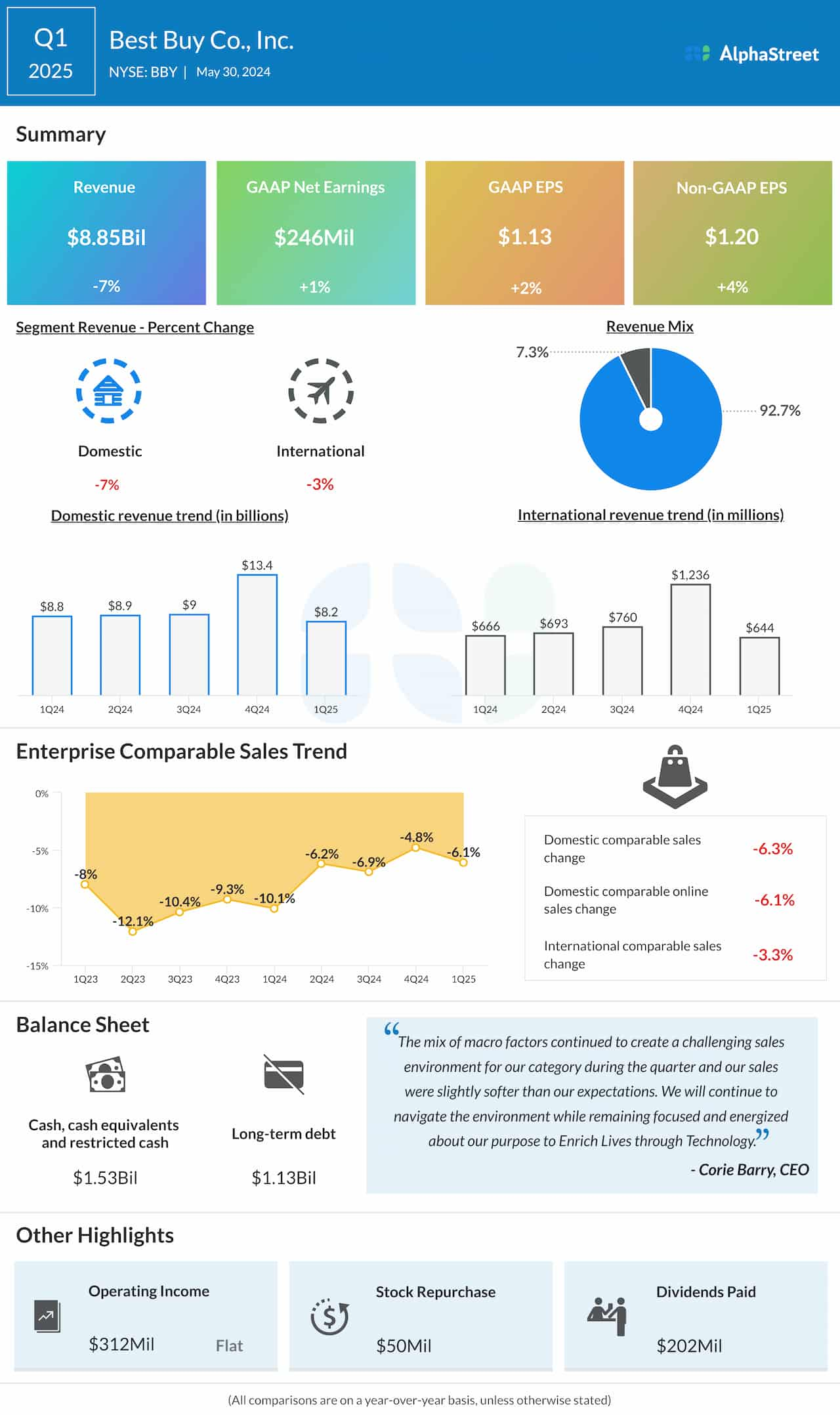

First-quarter revenues decreased to $8.85 billion from $9.47 billion in the corresponding period of 2024. Total comparable sales declined 6.1%, continuing the recent trend.

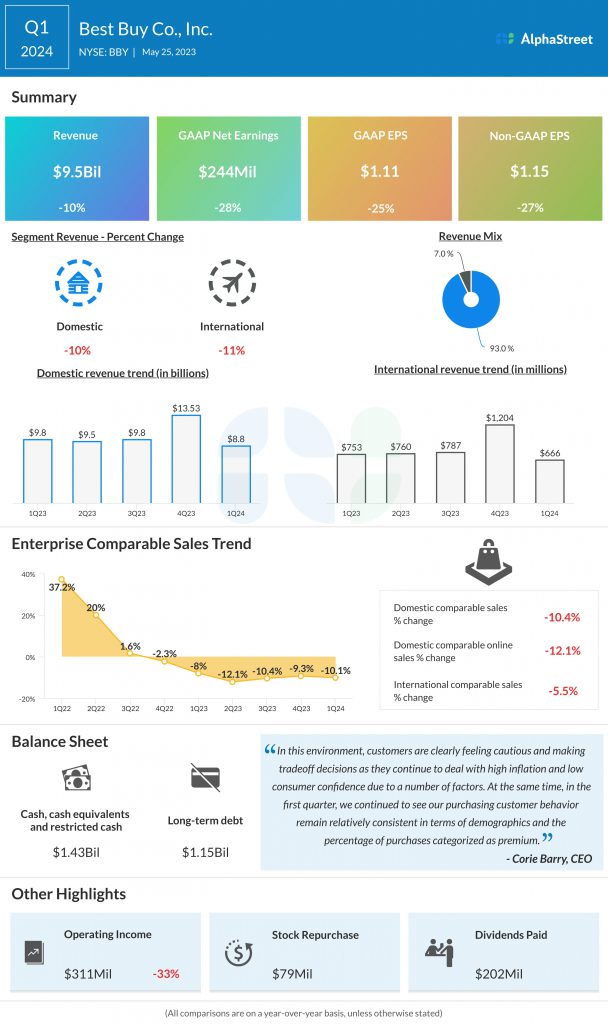

The company reported earnings of $1.20 per share for the April quarter, on an adjusted basis, which is up 4% from the $1.15 per share profit it earned in the year-ago quarter. Net income, including special items, was $246 million or $1.13 per share in Q1, compared to $244 million or $1.11 per share a year earlier.

Corie Barry, Best Buy’s CEO, said, “Through strong execution, we continued to manage our profitability while at the same time preparing for future growth. We made progress on our FY25 priorities, grew our paid membership base, and drove improvements in our customer experiences.”