Best Buy Co. Inc. (NYSE: BBY) topped market expectations for both revenue and earnings in the fourth quarter of 2020. After gaining briefly in premarket hours on Thursday, the stock dipped and is now down by 0.71%.

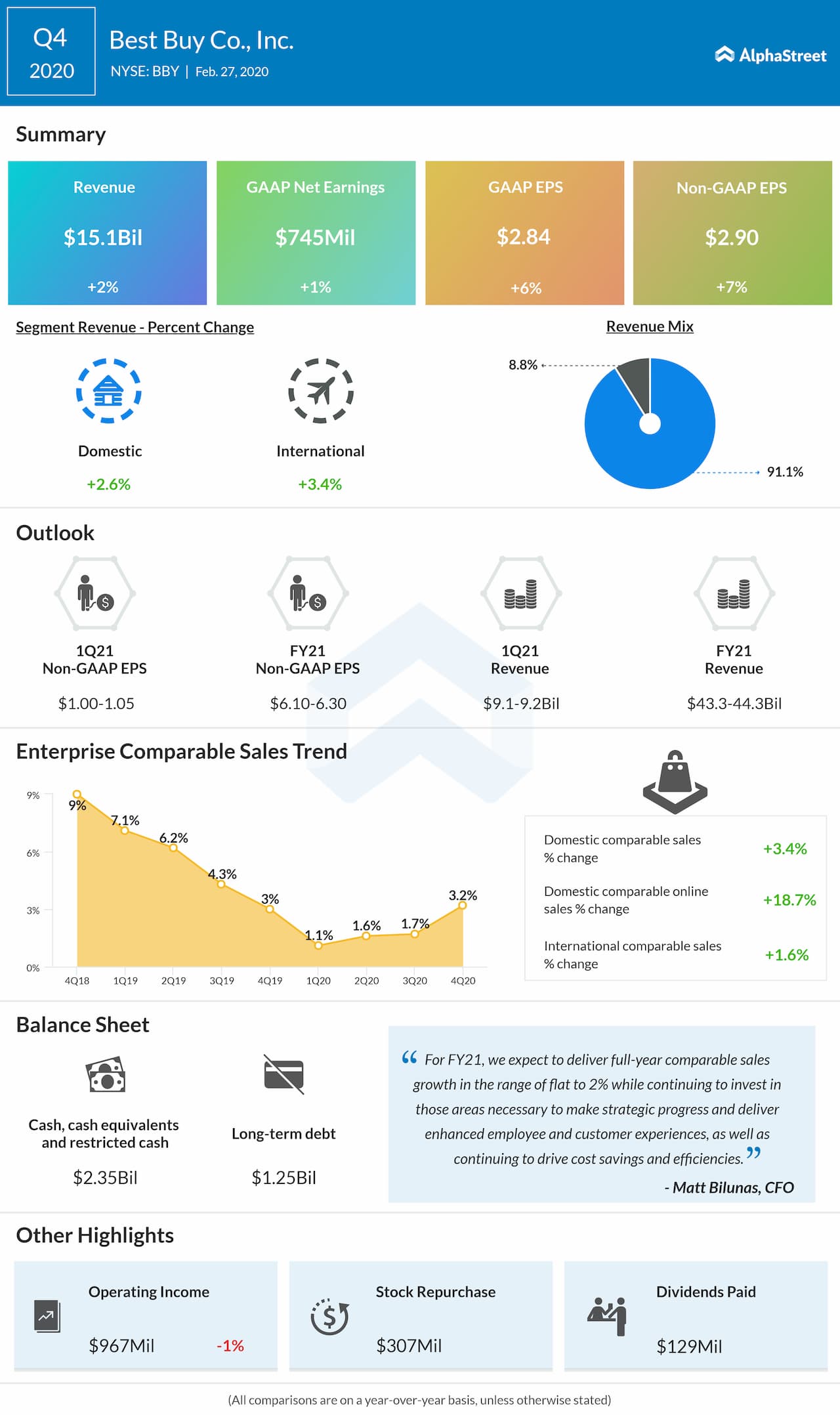

Enterprise revenue grew to $15.1 billion from $14.8 billion in the same period last year, and came ahead of estimates of $15.05 billion. Enterprise comparable sales rose 3.2%.

GAAP net income was $745 million, or $2.84 per share, compared to $735 million, or $2.69 per share, last year. Adjusted EPS totaled $2.90, beating forecasts of $2.75.

The company’s quarterly results benefited from compelling

holiday deals as well as improved inventory management and delivery services. Domestic

revenue increased 2.6% year-over-year, driven by comparable sales growth of

3.4%. This was partially offset by revenue loss from store closures over the

past year.

In the domestic segment, comparable sales growth was driven mainly by headphones, computing, appliances, mobile phones and tablets, offset partly by declines in gaming. Domestic online revenue grew 18.7% helped by higher average order values, traffic and conversion rates.

International revenue rose 3.4%, helped by comp sales growth of 1.6% and favorable foreign currency exchange rates.

Looking into 2021, Best Buy said it is monitoring the

developments related to the coronavirus outbreak and it is currently difficult

to ascertain the exact financial impacts from supply chain disruptions. The

majority of impacts are expected to occur in the first half of the year and are

not likely to affect the company’s long-term strategy and initiatives. Best Buy’s

guidance reflects its best estimates of the impacts at present.

For the first quarter of 2021, Best Buy expects revenue of $9.1-9.2 billion and adjusted EPS of $1.00-1.05. Comparable sales is expected to be flat to up 1%. For the full year of 2021, the company expects revenue of $43.3 billion to $44.3 billion and adjusted EPS of $6.10-6.30. Comparable sales is expected to be flat to up 2%.

Best Buy declared a 10% increase in its quarterly dividend to $0.55 per share. The dividend is payable on April 9 to shareholders of record as of March 19, 2020.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.