China operations

Through the facility, Beyond Meat plans to provide unique product offerings, like Beyond Pork, which was created to cater to the Chinese market in particular. A year ago, the company entered China through a partnership with Starbucks China. Since then, Beyond Meat has expanded its menu offerings at Starbucks China and has partnered with other brands such as Pizza Hut, KFC, Hema and others.

Sales and distribution

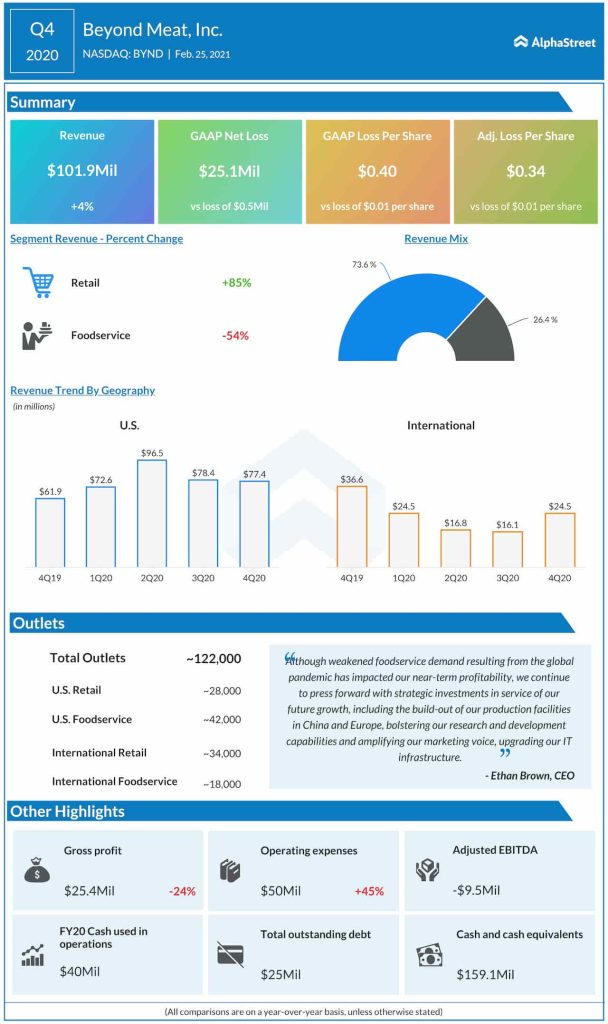

In fiscal year 2020, Beyond Meat’s net revenues increased nearly 37% to approx. $407 million versus the prior year. Revenue in the US was up nearly 63% while international revenue fell 16.5%. During the year, the company’s foodservice business remained challenged due to the COVID-19 pandemic but the retail channel saw strong triple-digit growth both in the domestic and international markets.

Beyond Meat’s products are available at 122,000 outlets worldwide, which is up 294% from the time of its IPO. Its top line has grown at a compound annual growth rate of 132% over the past four years. Revenues were $32.6 million in 2017.

The company’s products are stocked at Walmart (NYSE: WMT), Kroger (NYSE: KR), Target (NYSE: TGT), Costco (NYSE: COST) and Whole Foods. Beyond Meat recently announced it was expanding its product offerings at Walmart stores.

Beyond Meat has partnered with Yum Brands (NYSE: YUM) and McDonald’s Corporation (NYSE: MCD) to offer its products on their menus and the company also entered into a partnership with PepsiCo (NASDAQ: PEP) to produce plant-based snacks and beverages.

After China, Beyond Meat plans to open its first manufacturing facility in Europe this year to increase its production capability and drive growth.

Profitability and expenses

Despite these achievements, there are concerns over the company’s lack of profitability and rising expenses. In FY2020, Beyond Meat reported a loss of $52.8 million. This was wider than the $12 million reported in FY2019.

Gross margins declined to 30.1% in 2020 from 33.5% in the previous year due to a lower net price per pound caused by strategic investments in promotional activity and product mix shifts.

Total operating expenses increased to $171.6 million in 2020 from $100 million in 2019. This was driven by the company’s investments in long-term growth initiatives such as research and development efforts, international expansion initiatives and IT investments.

When the pandemic subsides and the foodservice channel begins to recover, Beyond Meat is likely to see more demand and the new facilities will help in meeting this need. At the same time, it remains to be seen how this will impact expenses and margins.