Mixed Outlook

That said, BA is not entirely risk-free as the troubles of the company and the aviation industry as a whole are far from over. While projecting solid growth for the twelve-month period, which would take the stock slightly above $270, analysts following the stock have assigned moderate buy rating.

Read management/analysts’ comments on Boeing’s Q2 results

Going forward, Boeing’s recovery would depend on the rate of COIVD-19 infections, the effectiveness of the vaccination drive, and global trade. Interestingly, new orders for 737 MAX jets have been quite encouraging ever since the Federal Aviation Administration gave the green signal for the controversial aircraft to resume operations last year – to the extent that the company is forced to raise production considerably to meet the high demand.

737 Woes Linger

However, costs related to the twin crashes and prolonged grounding would continue to eat into the company’s profit, in the form of customer concessions and compensations. Also, delays in the 797 project do not bode well for it, given the competitive disadvantage and financial loss associated with it.

We’re currently producing 16 airplanes per month and continue to expect to gradually increase the rate to 31 a month in early ’22 with further gradual increases to correspond with market demand and, importantly, supply chain capacity. We will continue to assess the production rate plan as we monitor the market environment and engage in customer discussions.

David Calhoun, chief executive officer of The Boeing Company

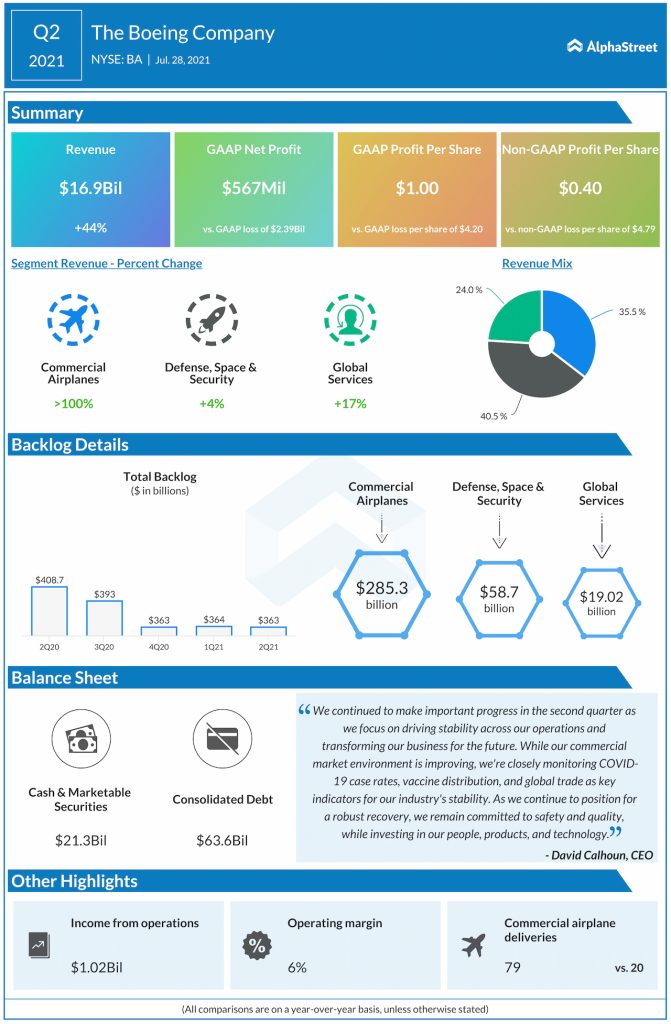

In a sign that the aviation industry has finally started shedding the COVID blues, Boeing last month reported positive results for the second quarter, recording profit for the first time in one-and-half years, defying experts’ prediction for yet another loss. Earnings had mostly missed estimates ever since trouble started for the company in early 2019.

Q2 Rebound

When compared to the historic lows seen a year ago, second-quarter revenue advanced 44% to about $17 billion and exceeded the forecast. That translated into a profit of $0.40 per share, which marks an improvement from the year-ago quarter when the company reported a loss of $4.79 per share. All the three business units registered growth, led by the core commercial airplanes segment.

Helped by a decline in expenses as a percentage of revenue and the managements’ aggressive efforts to preserve cash, the company ended the quarter with a cash balance of around $8 billion. The impressive liquidity position would give it the much-needed leeway to take forward the recovery process and reduce the relatively high debt.

LUV, AAL, UAL, ALK: How did Q2 turn out for the airline industry?

Boeing’s stock closed the last trading session higher, after gaining around 8% in the past six months. The stock has mostly traded above its long-term average this year.