Blessing in Disguise

With demand conditions improving, Box seems to be coming out of a period of volatility and starting to improve profitability. If the strong cash position is maintained going forward, the company would be able to meet its capital spending goals, with the primary focus being the expansion of the customer base and product portfolio.

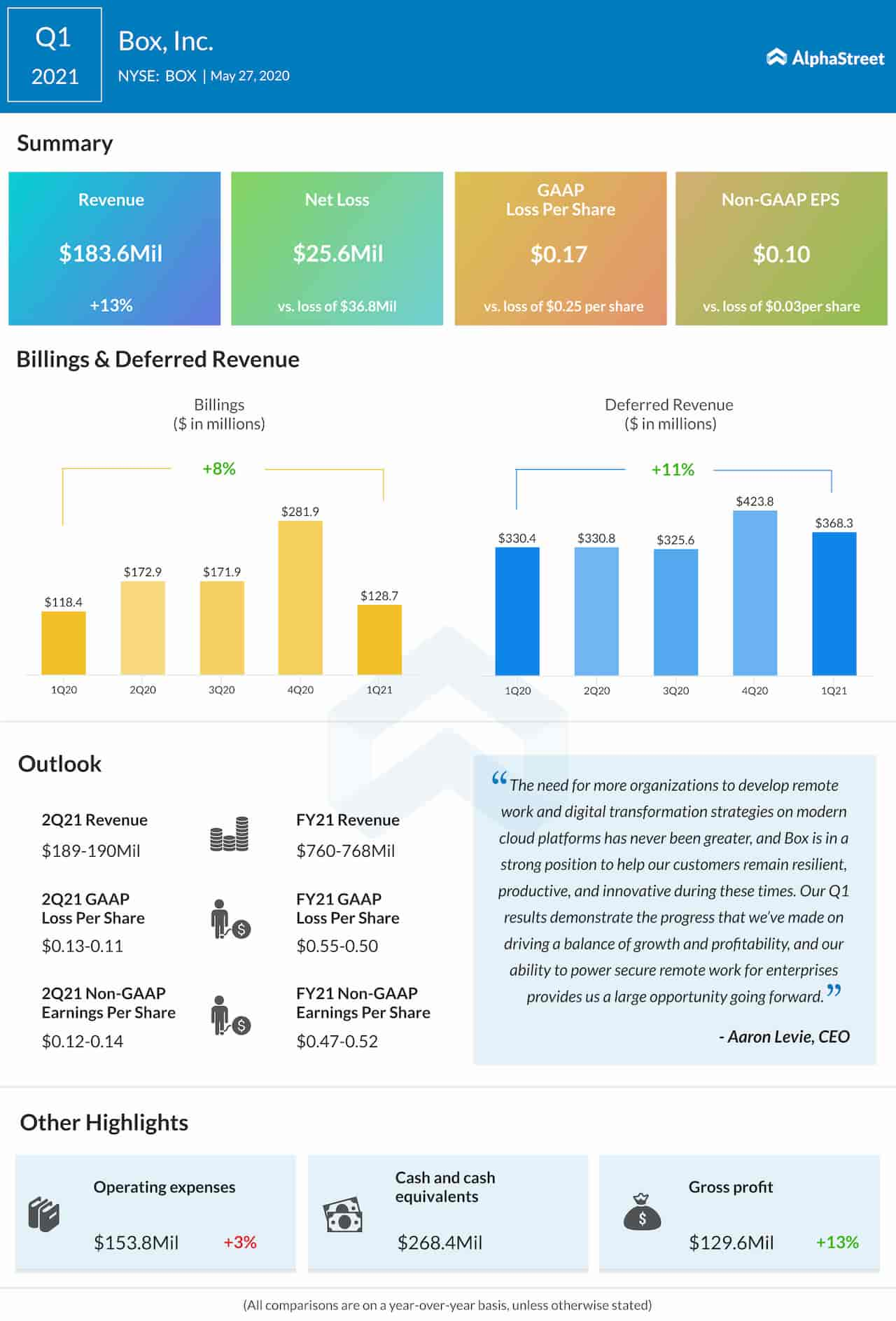

Outlook

In a sign that Box might not stay fully insulated from the crisis, the executives last month predicted slower sales growth and negative earnings for the second quarter, which marks a reversal of the recovery witnessed in recent quarters. The prediction, at a time when the other tech firms are finding it difficult to assess the situation, reflects Box’s relatively better visibility despite the uncertainties.

“While the future macroeconomic impact of COVID-19 on the market remains uncertain, we believe we are in a strong position to achieve a long-term healthy growth rate with the increased profitability. To drive efficient and consistent revenue growth, we will continue to execute on our multi-product strategy and drive more efficiency into our go-to-market motion,” said Box’s chief executive officer Aaron Levie during his interaction with market watchers last month.

Stock Shines

Box’s shares are probably headed towards a new peak, continuing the recovery from the recent selloff. Anticipating the value to grow further in the coming months, though modestly, analysts see good investment potential at least until the next earnings release, which is expected on August 26. With the stock outperforming the market in the recent rally, most investors would find the favorable valuation and the company’s strong fundamentals attractive.

Strong Start to FY21

In the early months of fiscal 2021, earnings recovery gathered momentum — after returning to the positive territory in the fourth quarter from a losing streak. At $0.10 per share, earnings came in above the market’s prediction. The improvement can be attributed to a 13% growth in revenues to $184 million, with recurring revenues accounting for most it.

[irp posts=”62879″]

Like most of its peers in the tech space, Box regained market value in recent weeks. Earlier, the stock had fallen to a multi-year low when the market was battered by the pandemic. It closed the last trading session just above $22, the highest in more than two years. The shares have gained 28% so far this year and 25% in the past twelve months.