Investing in AVGO

Moreover, Broadcom’s dividend policy is attractive, characterized by distribution of half of its cash flows among shareholders. After regular hikes over the years, the dividend yield currently hovers near 3%. AGVO is a safe investment that can bring good shareholder returns.

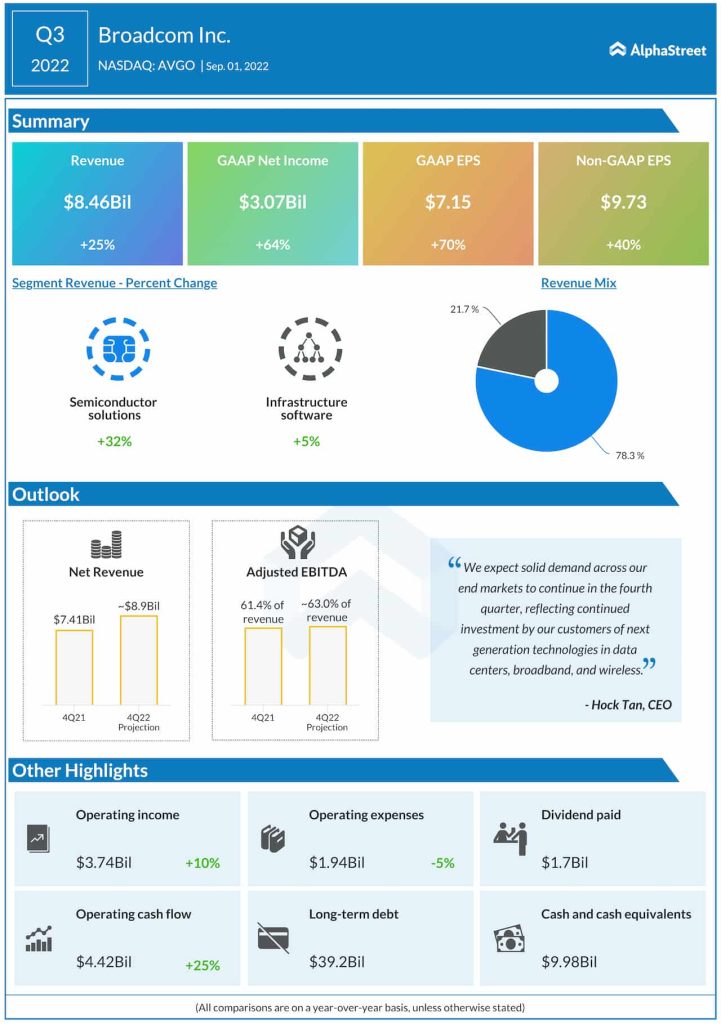

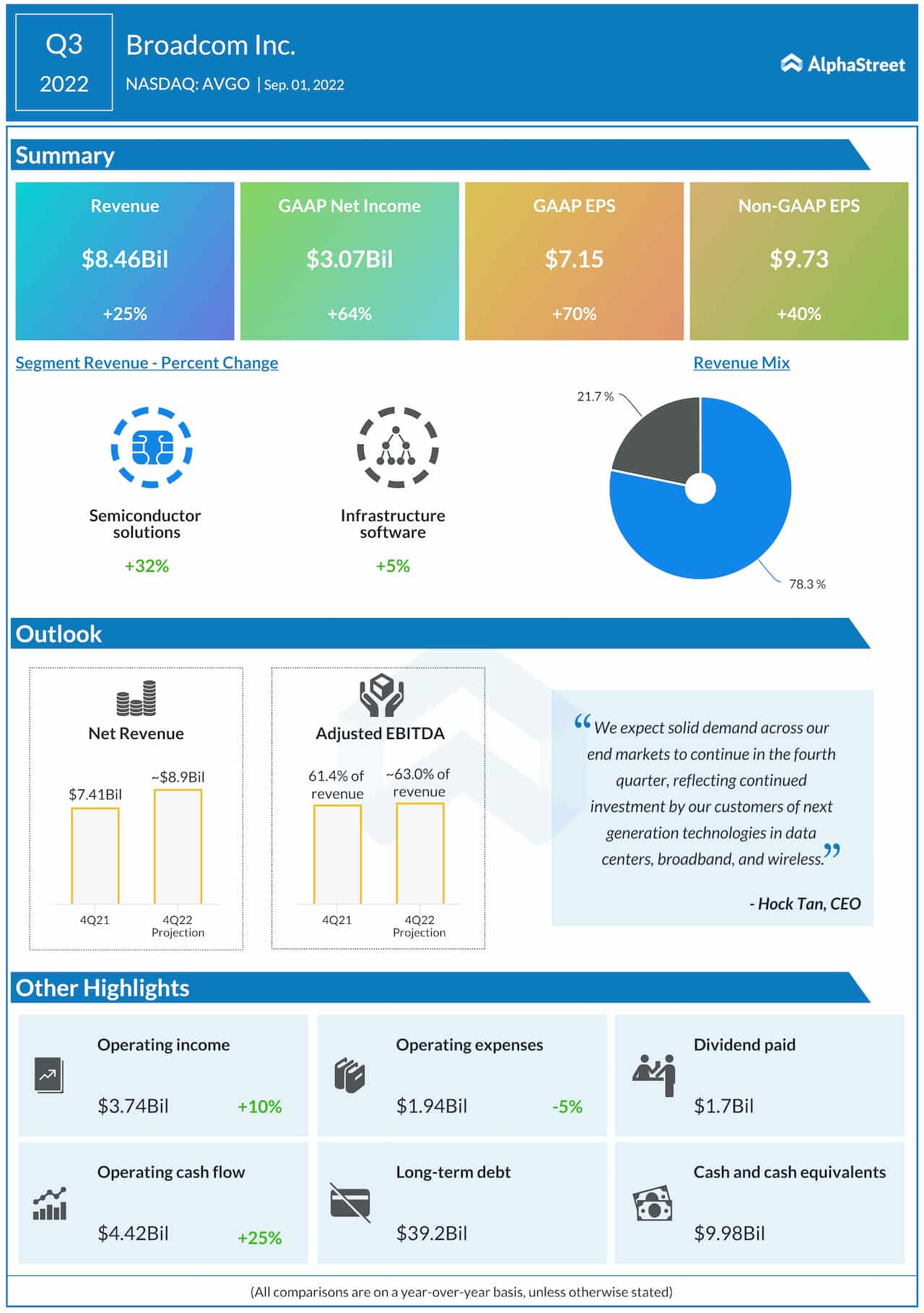

Earnings: Highlights of Intel’s Q3 2022 financial results

The fact that the company is doing well despite the challenging business environment justifies the market’s bullish view. But growth will likely slow down next year, in line with the general industry trend. Unlike some of the leading chipmakers, Broadcom mainly serves manufacturers of communication devices, broadband receivers, and mobile phones – industries that tend to stay unaffected by fluctuations in the economy in the current scenario. The relatively high demand for chips used in such products gives the company an edge as far as long-term sales are concerned.

Q4 Results Due

The company is expected to report fourth-quarter earnings of $10.28 per share, up 32% year-over-year, when it announces the results on December 8 after regular trading hours. The top line is estimated to have increased by 20% to $8.9 billion. Interestingly, earnings either exceeded or matched estimates in each of the trailing ten quarters.

By adding VMware to its fold, Broadcom looks to boost its software business significantly. The $61-billion deal has been approved by the stakeholders of both companies and is expected to close early next year. Post-buyout, the Broadcom Software Group will rebrand and operate as VMware.

“We remain excited about our acquisition of VMware and continue to be impressed by their world-class engineering talent, as well as strong customer and channel partnerships. We have tremendous respect for what VMware has built, and together, we will enable enterprises to accelerate innovation and expand choice by addressing the most complex technology challenges in this multi-cloud era,” said Broadcom’s CEO Hock Tan at the post-earnings conference call.

Key Numbers

Broadcom’s semiconductor solutions business, which accounts for more than three-fourths of total revenues, grew sharply in the September quarter. That translated into a 25% increase in net revenues to $8.5 billion and a 40% growth in adjusted earnings to $9.73 per share.

Read management/analysts’ comments on Broadcom’s Q3 results

After ending the last trading session lower, AVGO made modest gains early Tuesday. It has been maintaining the uptrend ahead of earnings since recovering from a near-two-year low earlier this month.