Of late, the growth initiatives of Cal-Maine Foods, Inc. (NASDAQ: CALM) have been centered around a recent legislation requiring food service providers to transition to cage-free eggs. With its business being impacted by the virus crisis, the company is looking to tap such opportunities while also optimizing its investments with focus on the high-margin Specialty segment.

Read management/analysts’ comments on quarterly reports

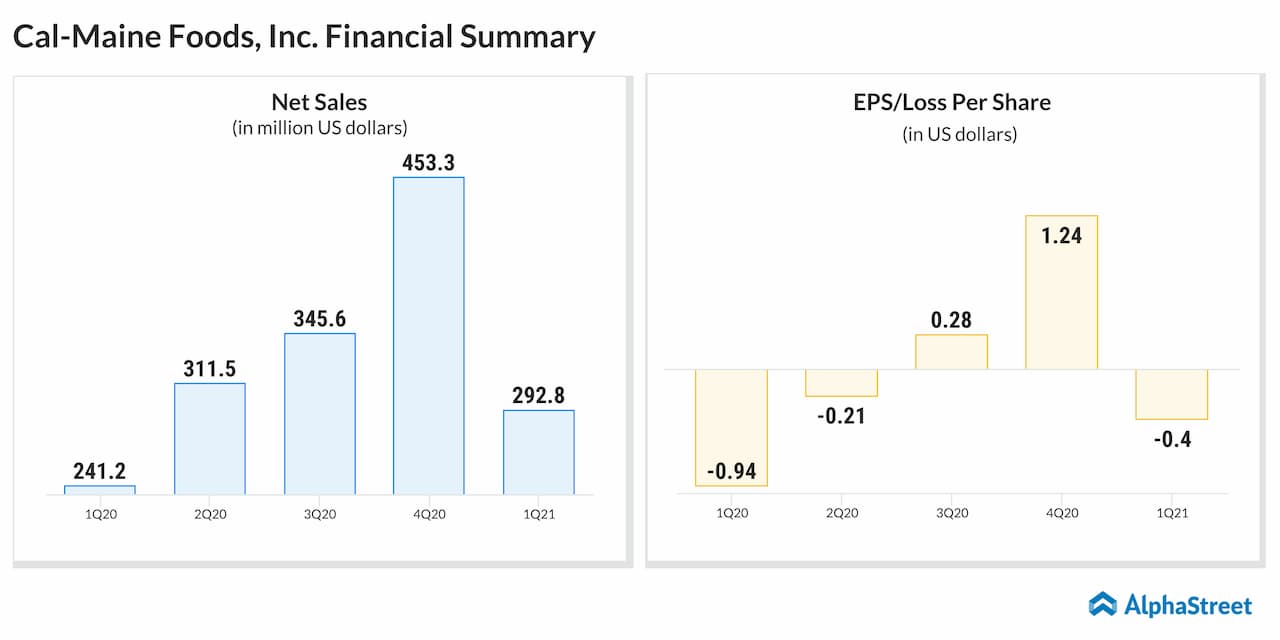

The company, a leading producer of fresh eggs, entered the new fiscal year on a mixed note in terms of financial performance, recording solid sales growth and incurring a loss in the first quarter after staying profitable in the previous two quarters. The outcome elicited a mixed response from investors, with the stock making modest gains soon after the announcement and retreating to the pre-earnings levels later.

Buy It?

The current valuation looks suitable for long-term investment, an opportunity worth considering. However, the company might disappoint those looking for immediate gains, given the relatively weak return on equity and the stock’s flat performance. Despite the volatility, the stock is trading much above its long-term average and analysts recommend buying it.

Being part of an industry that is highly competitive, Cal-Maine faces growth challenges — something that doesn’t bode well for the company and its stakeholders in these times of market uncertainty. Also, profitability has been under pressure for quite some time as the unfavorable pricing environment continued to offset the benefits of higher sales volumes.

Call for Caution

It is estimated that supply-demand imbalance and the resultant drop in selling prices would weigh on margins in the near future. It is worth noting that the volatility in prices has been affecting earnings. In addition to the COVID-related supply chain disruption, macroeconomic issues like the US-China trade dispute might add to the pricing woes. Recently, the management suspended dividends yet again, citing poor bottom-line performance, which will make the stock less attractive to some investors.

The Highs

On the positive side, it looks like things are changing in the company’s favor. In many states, restaurants have resumed operations, signaling a further uptick in demand during the remainder of the year.

At the same time, feed costs moderated at the beginning of the fiscal year. There has been an improvement in the prices of specialty eggs — which account for more than a third of the total revenue — mainly due to the steady rise in conventional egg prices. Also, demand has picked up from the levels seen at the onset of the pandemic, as more people started cooking food at home due to the shelter-in-place orders.

Q1 Loss Narrows

After a short-lived recovery, the company slipped into the negative territory in the first quarter of 2021, incurring a loss of $0.40 per share. The bottom-line number, which was narrower than the estimated loss, marked an improvement from last year’s loss of $0.94 per share. It benefitted from a 21% growth in sales, which was partially offset by higher operating costs. At $293 million, the top-line also exceeded the consensus forecast.

Cal-Maine’s chief executive officer Dolph Baker sounded optimistic in his remarks. “An important competitive advantage for Cal-Maine Foods is our ability to offer our customers choice, by providing a favorable product mix in a sustainable manner, including conventional, cage-free, organic, and other specialty eggs. In recent years, a significant number of large restaurant chains, food service companies, and grocery chains, including our largest customers, announced goals to transition to an exclusively cage-free egg supply chain by specified future dates,” he said.

Also read: McDonald’s vs. Yum Brands

Cal-Maine’s stock, which has remained volatile in recent months, opened Tuesday’s trading slightly below the levels seen at the beginning of the year and maintained the downtrend throughout the session. Since mid-August, it has lost about 14%.