Q4 results

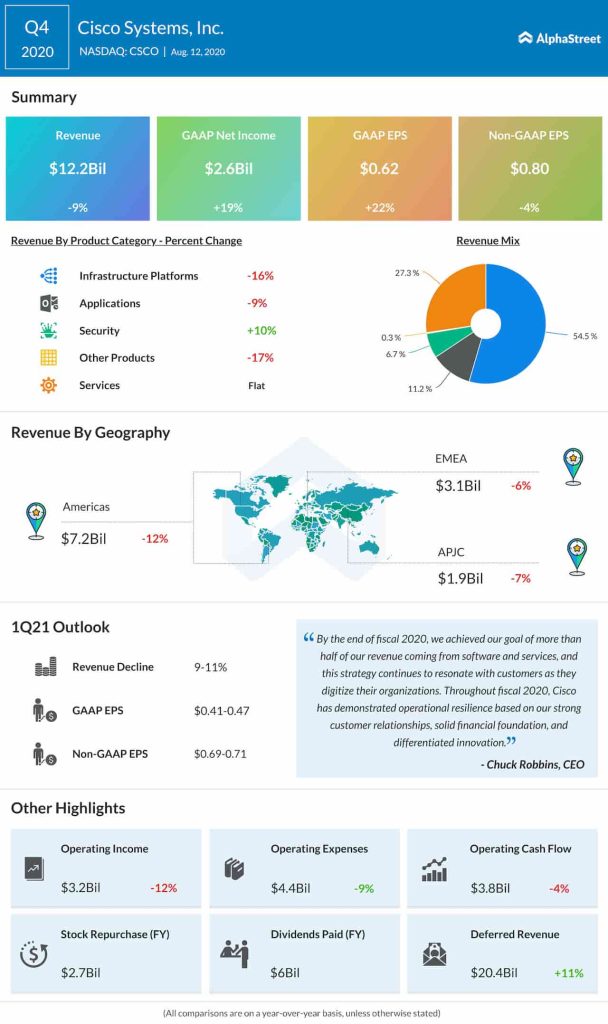

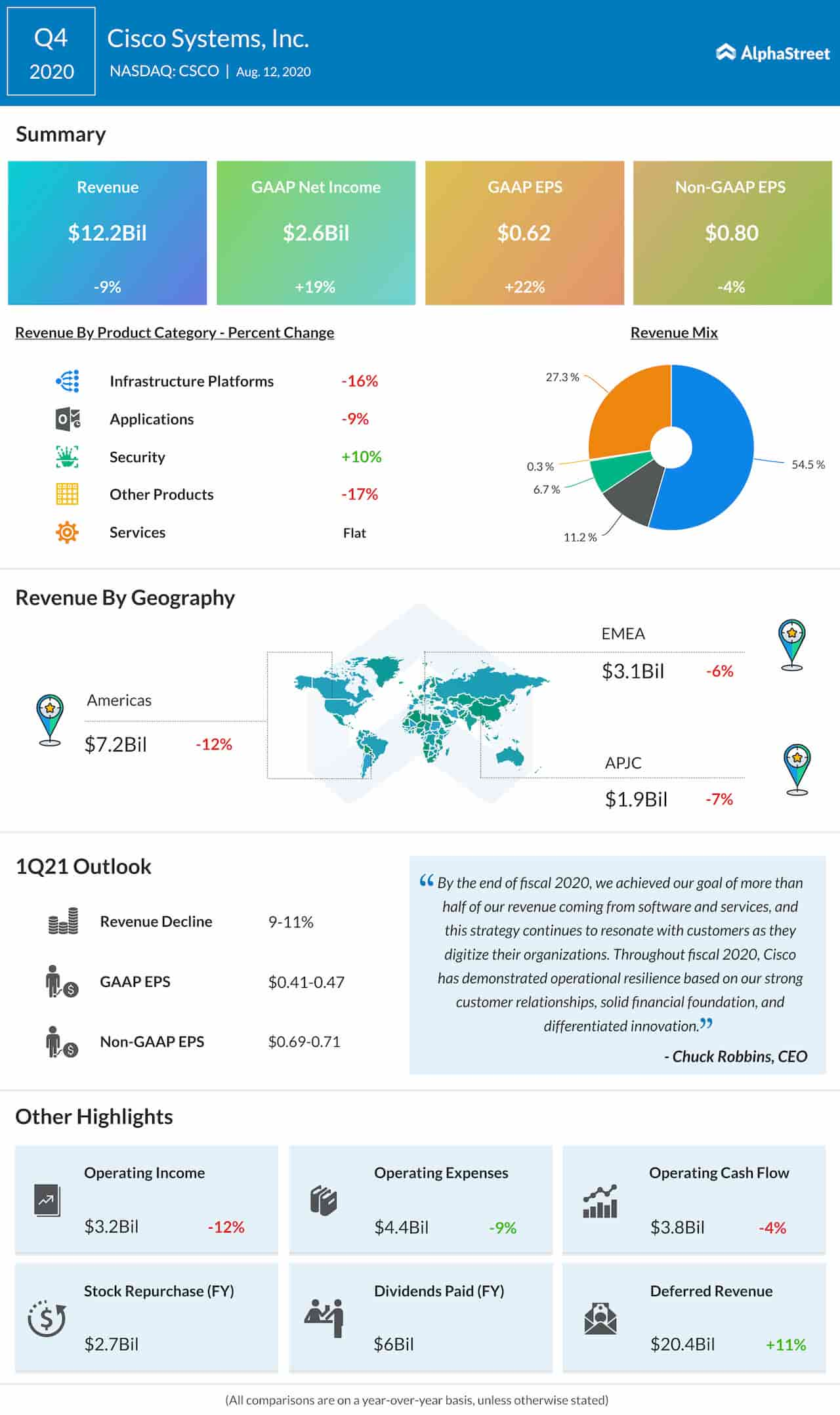

In the Infrastructure Platforms product category, sales declined across switching, routing, data center and wireless driven products as COVID-19 induced weakness was seen in the commercial and enterprise markets. The bright spot in the quarter was Security, which was up 10% with a strong performance in network security, identity and access, advanced threat and unified threat management.

In terms of orders in Q4, total product orders were down 10%. In the customer segments, the public sector, enterprise, commercial and service provider were down 1%, 7%, 23%, and 5%, respectively.

Change in focus

Like many other organizations, Cisco had re-examined its business and had planned to change its focus. The company now plans to accelerate the transition of the majority of its portfolio to be delivered as a service.

Investments will also be accelerated in the following areas: cloud security, cloud collaboration, key enhancements for education, health care and other industries, increased automation in the enterprise, the future of work and application insights and analytics.

The other areas of focus that have been accelerated by the pandemic will be multi-cloud investment, 5G and WiFi 6, 400-gig, optical networking, next generation silicon and AI.

Weak guidance

Cisco had projected first quarter 2021 revenue to decline 9-11%, which represents a fourth quarter of revenue decline in a row. Non-GAAP earnings per share is expected to range from $0.69 to $0.71.

When answering about a question on Q1 2021 revenue outlook, CEO Chuck Robbins said,

“I wouldn’t say that we’re coming out of the coronavirus right now. I think that it feels to me very much like it felt 90 days ago. And clearly in the U.S., we have not seen — we’ve seen some areas that have gotten better, and obviously, some that have not.”

ADVERTISEMENT

Also, CFO Kelly Kramer, whose retirement was announced during the earnings announcement, pointed out that Q1 2020 was a strong quarter comparing to Q1 2021, which has an impact of COVID-19.

Cost cuts

In order to reduce the cost structure, Cisco had planned to cut over $1 billion on an annualized basis over the next few quarters. The company also plans to re-balance its R&D investments to focus on key areas that will position it well for the future.

CFO Kelly Kramer clarified that majority (80%) of this cut would be in operating expenses and a certain portion in the cost of goods sold.

Looking ahead

Investors weren’t happy with the softer-than-expected Q1 outlook. Market watchers felt that cut in R&D investments might affect the revenue from Cisco’s products further in the future. The fierce competition in the software as a service area will continue to affect Cisco in the future, which had planned to mainly focus on SaaS now.

Read Cisco Systems Q4 2020 earnings call transcript