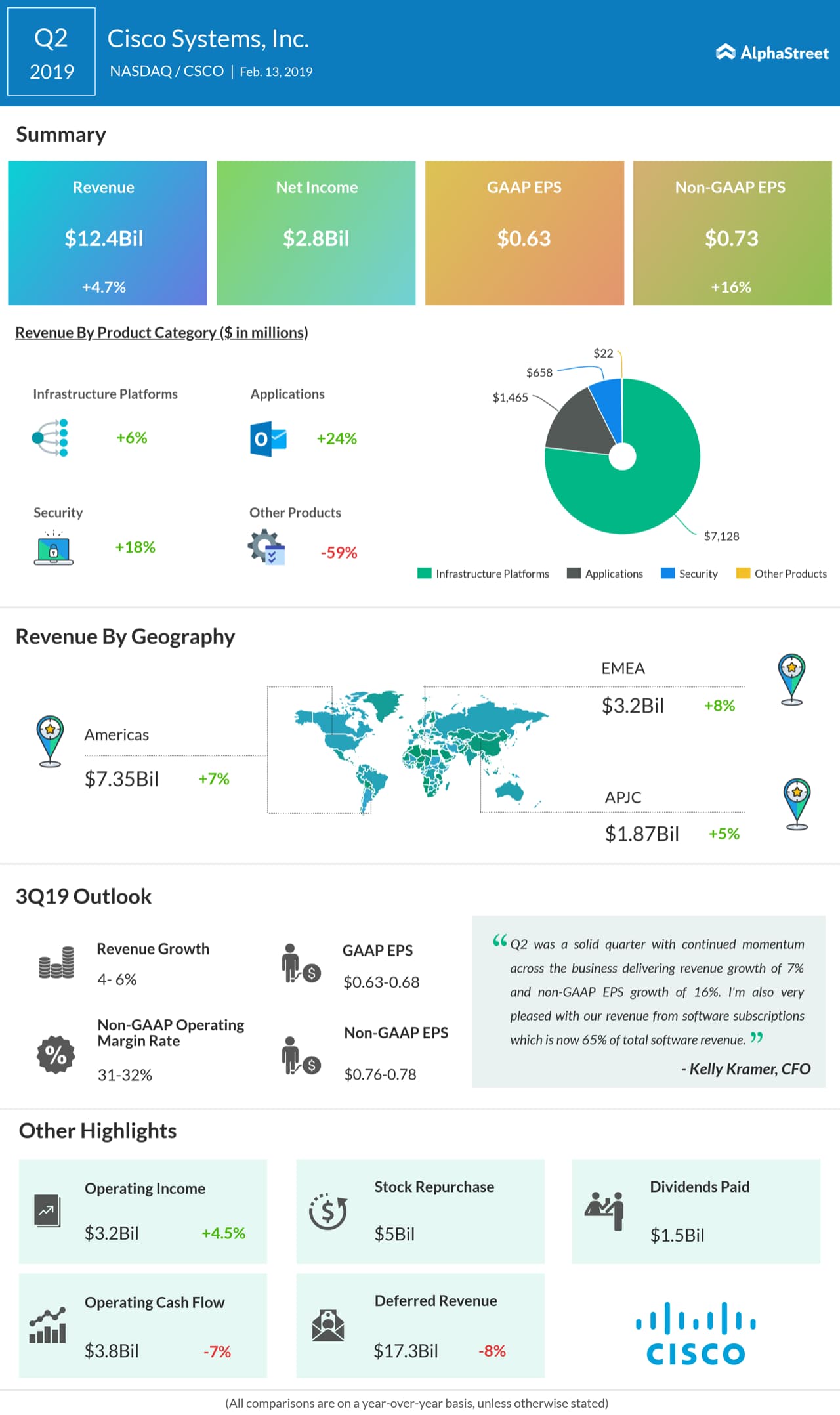

Revenues inched up 7% to $12.45 billion driven by a 9% increase in product revenue and a 1% rise in service revenue. On geographical wise, revenue from the Americas increased by 7%, that from EMEA inched up 8% and APJC revenue moved up 5%. Product revenue performance was broad-based with Applications gaining by 24%, Security increasing by 18%, and Infrastructure Platforms rising by 6%.

Looking ahead into the third quarter, the company expects revenue growth in the range of 4% to 6% and earnings in the range of $0.63 to $0.68 per share. Adjusted earnings are anticipated to be in the range of $0.76 to $0.78 per share.

Adjusted gross margin is predicted to be in the range of 64% to 65% and the adjusted operating margin is projected to be 31% to 32% for the third quarter. The forecast has been normalized to exclude the divested SPVSS business. Revenue for the divested SPVSS business for the third quarter of fiscal 2018 was $219 million.

For the second quarter, deferred revenue declined by 8% to $17.3 billion due to a 23% dip in deferred product revenue. Deferred service revenue was up 3%.

Cisco has declared a quarterly dividend of $0.35 per common share, a 2-cent increase or up 6% over the previous quarter’s dividend. The dividend will be paid on April 24, 2019, to all shareholders of record as of April 5, 2019.

The company’s board of directors also approved a $15 billion increase to the authorization of the stock repurchase program. There is no fixed termination date for the repurchase program. The remaining authorized amount for stock repurchases including the additional authorization is about $24 billion.

On December 18, 2018, the company announced its intent to buy Luxtera, a privately-held semiconductor company. On January 30, 2019, Cisco announced its intent to purchase Singularity Networks, a privately-held network infrastructure analytics company. Both acquisitions closed in the third quarter of fiscal 2019.

Shares of Cisco ended Wednesday’s regular session down 0.81% at $47.50 on the Nasdaq. The stock has risen over 7% in the past year and over 5% in the past three months.