For long, the Coca-Cola Company (NYSE: KO) has effectively leveraged its strong portfolio of brands and well-aligned operating model, while working to drive long-term growth. The beverage giant is expected to deliver higher sales and bottom-line numbers when it announces fourth-quarter results next week.

After reaching a record high nearly two years ago, the company’s stock has gone through a series of ups and downs but remained stable. KO picked up strength in recent months and is once again hovering near the peak. Being a dividend aristocrat, Coca-Cola remains a favorite among long-term investors – offers a bigger-than-average yield of 3% currently.

Estimates

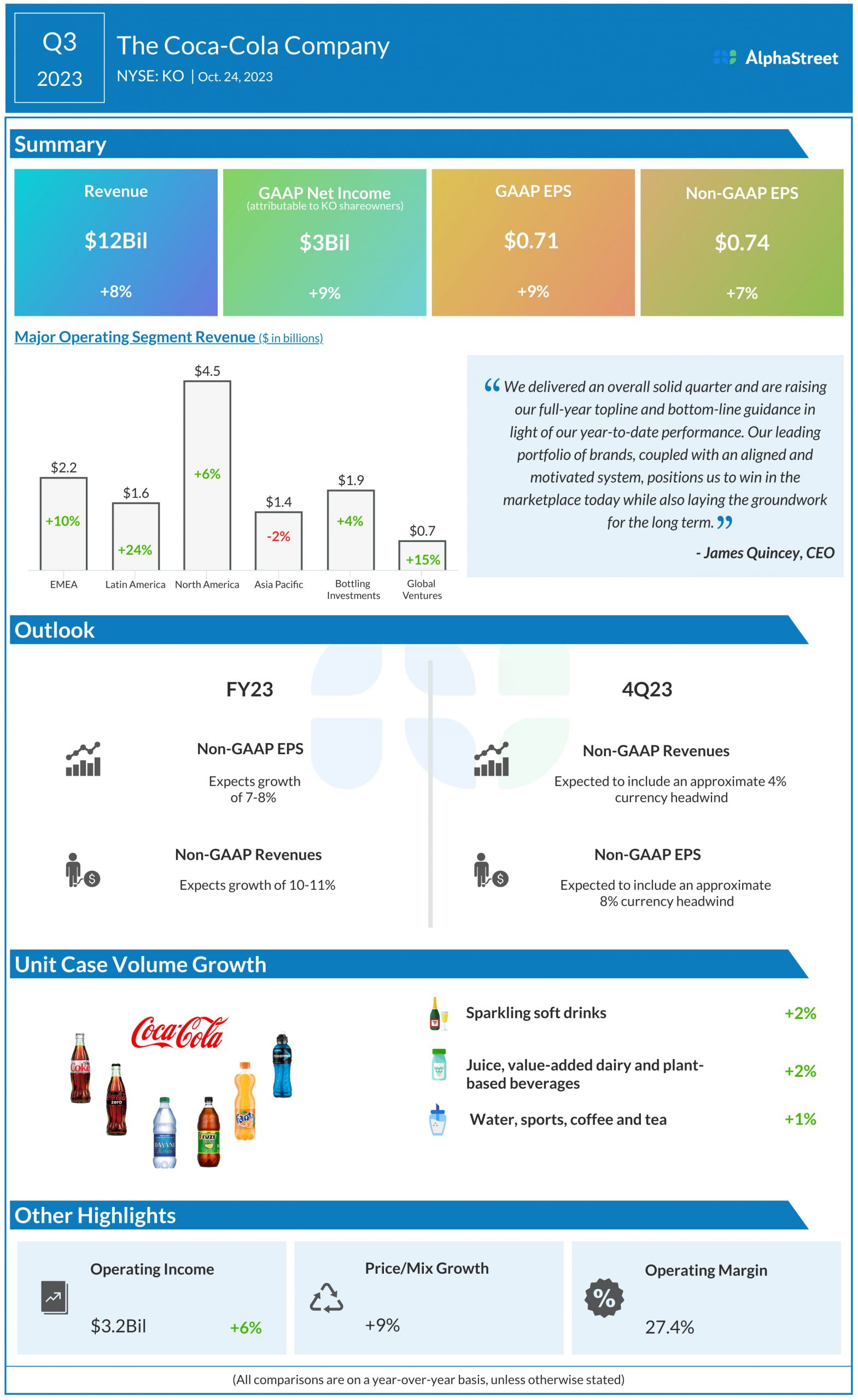

The soft drink company is preparing to report fourth-quarter numbers on February 13, at 6:55 a.m. ET. Market watchers are looking for adjusted earnings of $0.49 per share for the December quarter, compared to $0.45 per share in Q4 2022. It is estimated that earnings benefited from a projected 5% increase in revenues to $10.67 billion. Recently, the company’s leadership cautioned that Q4 adjusted earnings would include an 8% currency headwind.

As far as short-term volume growth is concerned, the company bets on the moderation in inflation and improving consumer sentiment, a trend that also gives it flexibility in pricing actions. An initiative is underway to incorporate generative AI in key areas of the business including the creation of new flavors, with plans to scale up the same for mass customer engagement.

On Track

Overall, the company looks well-positioned to tap into the growing momentum in areas like hospitality, amusement, and travel, after the post-pandemic recovery. A couple of years ago, the business was affected by COVID-related disruptions. As the market reopening revived sales, the company discontinued many of its underperforming brands to revitalize the business, which in turn catalyzed the recovery. Complementing that, the company is re-franchising its bottling operations in certain markets for better efficiency and to streamline the supply chain.

Coca-Cola’s CEO James Quincey said at the Q3 earnings call, “We’re seeing broadly consumer strength across Latin America, India, and in parts of Central and Southeast Asia. On the other hand, consumer confidence in spending has yet to fully recover in Africa and China. Our revenue growth management execution capabilities give us a distinct advantage, and we are leveraging these capabilities to ensure we have the right product in the right package in the right channel and at the right price points to meet consumers where they are.”

Key Numbers

The company has a good track record of delivering better-than-expected quarterly earnings and revenues, with only a few misses in the past decade. The trend continued in the third quarter when adjusted profit rose 7% year-over-year to $0.74 per share. It was driven mainly by an 8% increase in revenues to $12 billion. Sales grew across all major geographical regions, except Asia Pacific. Taking a cue from the positive Q3 outcome, Coca-Cola executives raised their full-year guidance for net income and sales.

Shares of Coca-Cola opened Thursday’s session lower and traded broadly in line with the 12-month average price. They have gained 13% in the past three months.