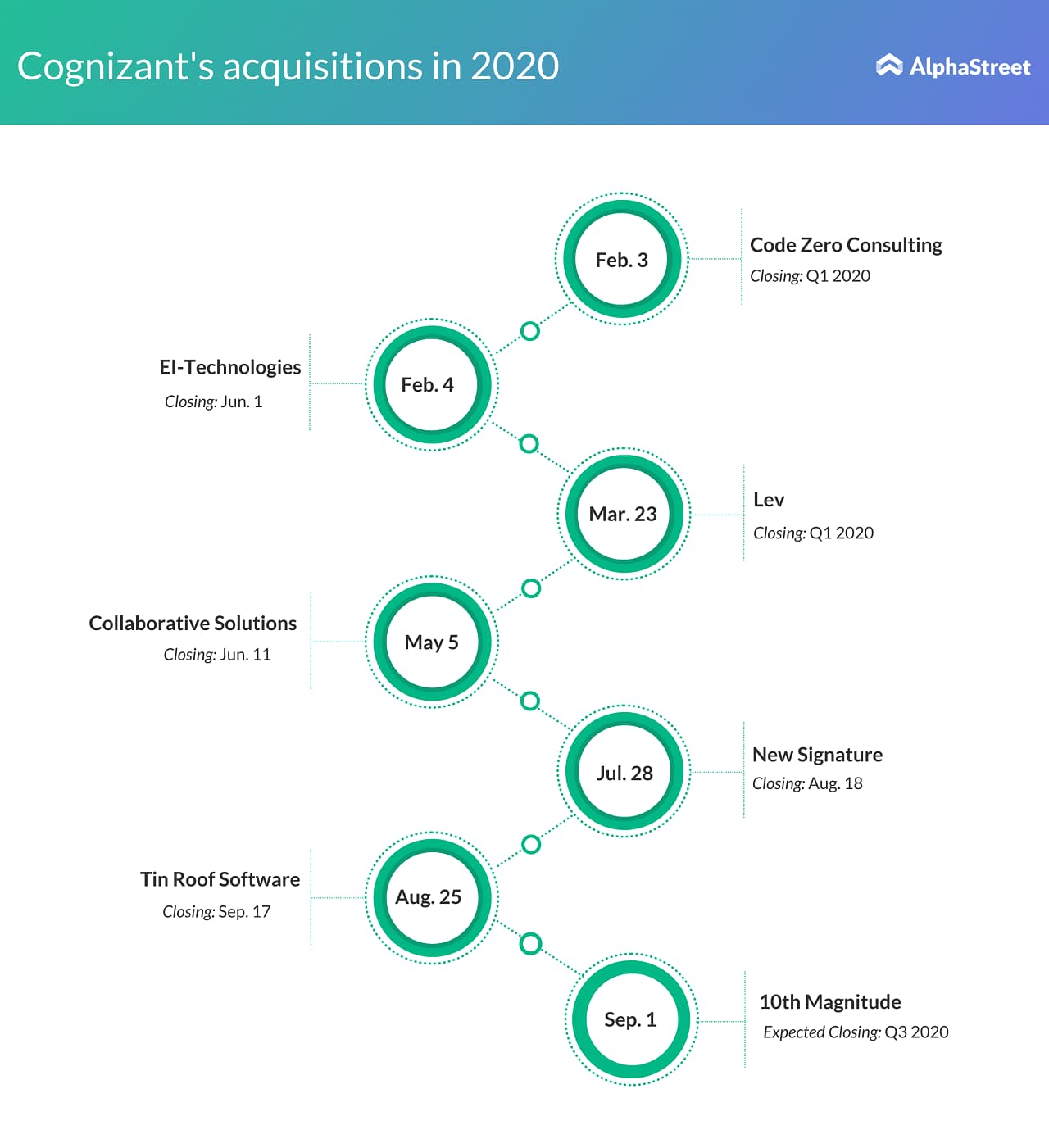

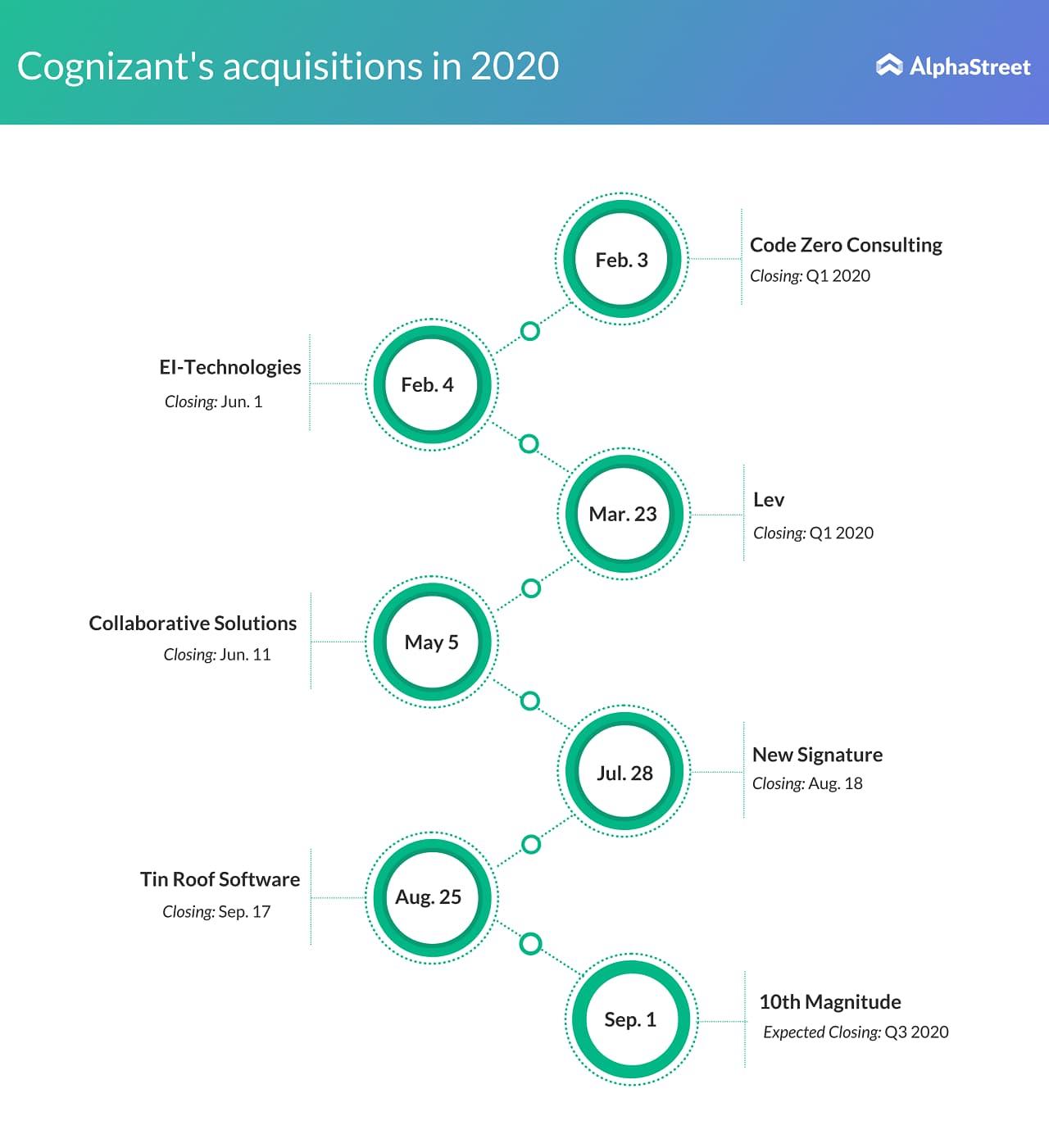

Cognizant Technology Solutions (NASDAQ: CTSH) has been on a buying spree in 2020. The portfolio of the acquisitions that Cognizant made this year is expected to help the company in its legacy offerings and new offerings and were focused on expanding its cloud capabilities. Cognizant had made seven acquisitions so far this year. The financial details of these deals were not revealed by the company.

1) Code Zero Consulting

Code Zero Consulting was the first company acquired by Cognizant in this year. Code Zero, which is a Salesforce Platinum Partner, helps companies digitally transform by providing strategy, implementation and migration capabilities. This acquisition helped in strengthening Cognizant’s cloud solutions portfolio.

2) EI-Technologies

On Feb. 4, Cognizant acquired the Paris-based EI-Technologies, a privately-held digital technology consulting firm, to complement its global Salesforce practice. This deal expanded Cognizant’s client resources in Europe. The 2008-founded firm’s 345 employees in France got added to Cognizant through this acquisition.

3) Lev

In March, the Teaneck, New Jersey-based company entered into an agreement to acquire Indianapolis-based Lev, a privately-held digital marketing consultancy firm. Lev helped companies in simplifying and modernizing their marketing campaigns using Salesforce Marketing Cloud to provide data-driven insight and personalization across the customer journey, and drive revenue.

4) Collaborative Solutions

Cognizant acquired Collaborative Solutions in May, which specialized in Workday enterprise cloud applications for finance and human resources. The acquisition of Collaborative Solutions added new finance and HR advisory and implementation services to Cognizant’s cloud offerings.

Also read: Cognizant (CTSH) Earnings: Key numbers from Q2 2020 results

5) New Signature

During the second quarter earnings call, CEO Brian Humphries stated, “New signature, one of the world’s largest independent Microsoft public cloud transformation specialists that serves all three Microsoft clouds. This will provide the foundation for a dedicated Microsoft business group within Cognizant”. New Signature, an award-winning Microsoft Partner, is exclusively focused on Microsoft technologies, with an integrated offering across all three of Microsoft’s business clouds: Azure, Microsoft 365, and Dynamics 365.

6) Tin Roof Software

Last month, Cognizant acquired Tin Roof Software, privately-held custom software and digital product development services company headquartered in Atlanta, Georgia. This acquisition will expand Cognizant’s software product engineering footprint in the US and connect Tin Roof’s experts with Cognizant’s broader global software development capabilities.

7) 10th Magnitude

Early this month, Cognizant acquired Chicago-based 10th Magnitude, a cloud specialist focused exclusively on the Microsoft Azure cloud computing platform. This acquisition will expand the Microsoft Azure expertise within Cognizant’s new Microsoft Business Group, adding development and managed services hubs in major cities throughout the US. 10th Magnitude is Cognizant’s sixth cloud-related acquisition in 2020, highlighting the company’s continued acceleration and execution of its cloud strategy.

Related: Cognizant (CTSH) Q2 2020 Earnings Call Transcript