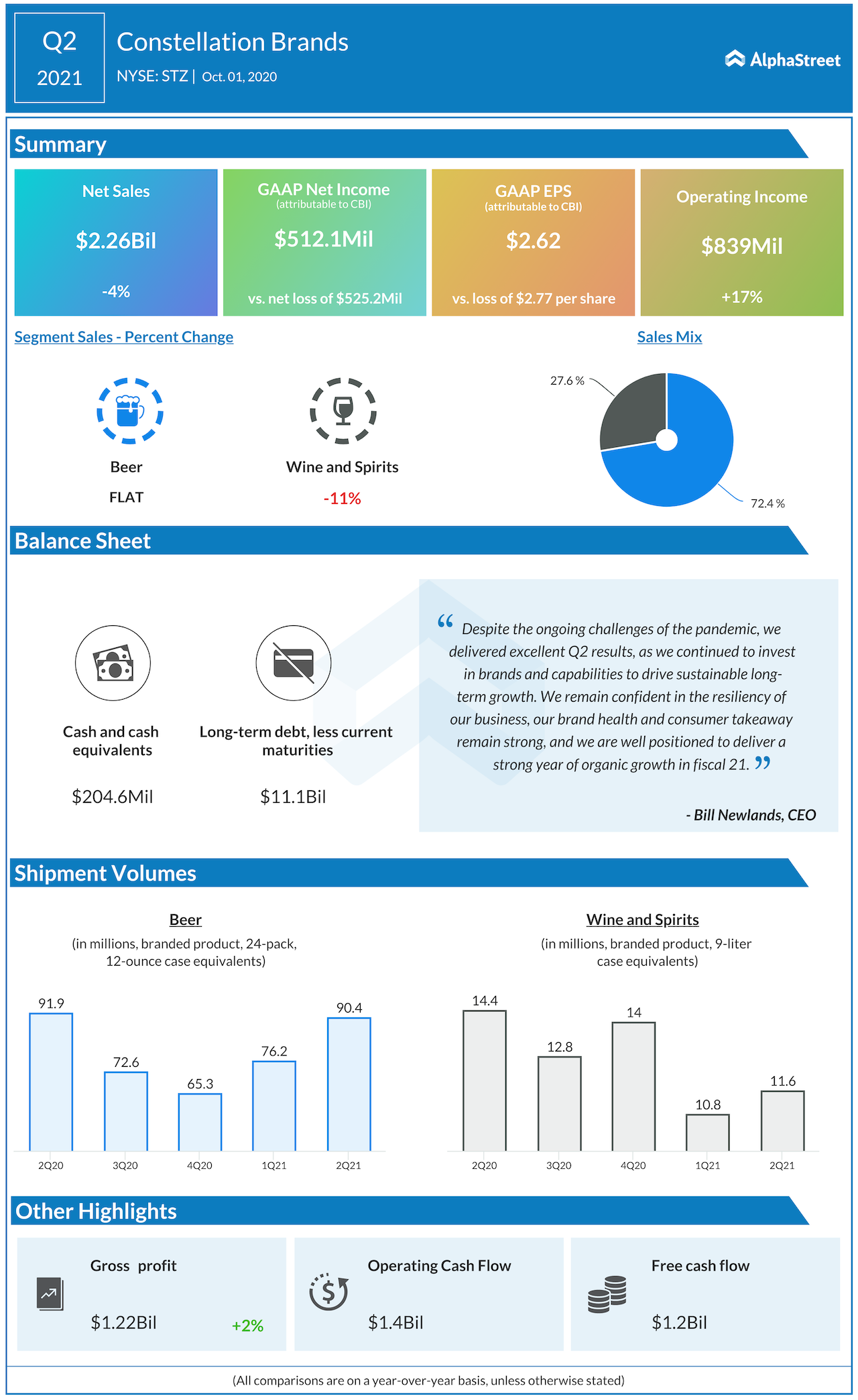

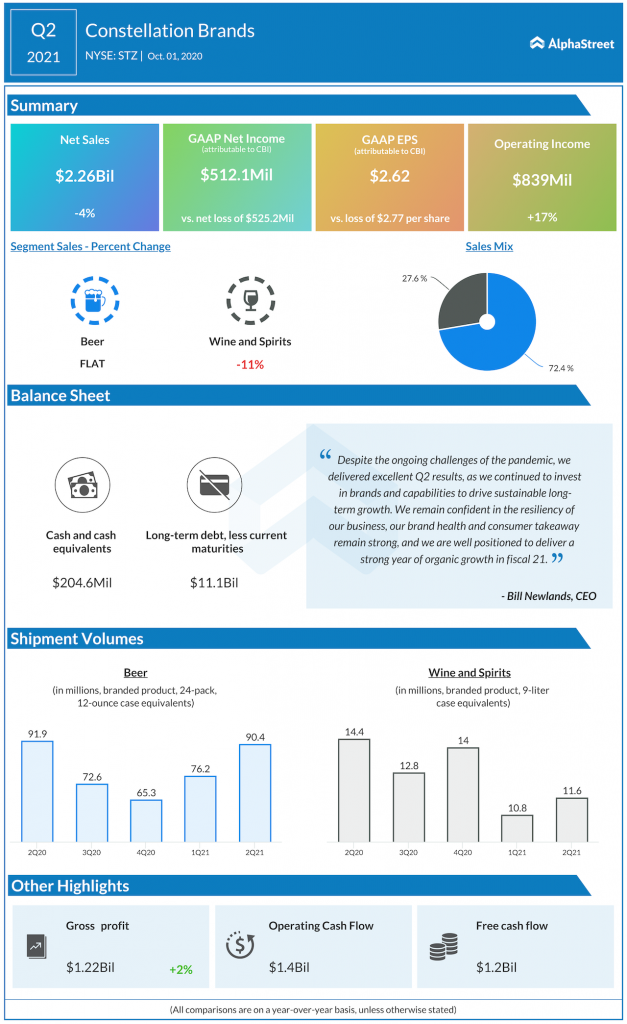

Shares of Constellation Brands Inc. (NYSE: STZ) stayed in green territory on Friday, a day after the company reported second quarter 2021 earnings results. Despite falling 4% year-over-year, the company’s second quarter sales were better than market expectations. Constellation also reported earnings of $2.62 per share for the quarter versus a loss of $2.77 per share last year. Comparable EPS was $2.76.

Category performance

Net sales in the beer segment remained flat while shipment volume dropped 1.6%. However, the company saw depletion growth of almost 5% helped by strength in the off-premise channel which offset a decline of almost 50% in the on-premise channel caused by the COVID-19 pandemic.

The beer business grew 11% in IRI channels overall and over 15% for priority SKUs. The segment saw strong performance from the Corona and Modelo Especial brands. The Corona brand family witnessed double-digit growth from IRI channels fueled by Corona Hard Seltzer, Corona Premier and Corona Extra. Modelo Especial saw depletion growth of 9% in the second quarter.

Corona Hard Seltzer is witnessing rapid growth, with 6% IRI market share in the US hard seltzer category and growth in distribution to almost 70% ACV in IRI channels. Going forward, Constellation plans on further expansion in the hard seltzer category with new flavors and packages.

In wine and spirits, net sales dropped 11% while shipment volume fell over 19%. Depletion volume was also down 3.3%. However, the higher-end wine Power Brands outpaced the US high-end wine category in IRI channels, driven by double-digit growth for Kim Crawford, Meiomi and The Prisoner Brand Family.

Portfolio

Constellation is looking to roll out new products in its wine and spirits business in the third quarter of 2021. These include The Prisoner cabernet sauvignon and chardonnay varietals, SVEDKA and High West ready-to-drink cocktails and Meiomi cabernet sauvignon.

Constellation has acquired a minority stake in the Booker Vineyard’s business, a direct-to-consumer wine portfolio, as part of its efforts to tailor its wine and spirits business to suit shifts in consumer preferences. The company expects this deal to boost its fine wine portfolio as well as its DTC and 3-tier ecommerce initiatives.

Constellation also acquired the remaining interest in craft spirits producer Copper & Kings and expects this transaction to allow it to expand into the fast-growing craft spirits market.

Ecommerce

On its quarterly conference call, Constellation stated that ecommerce for beverage alcohol has exploded due to the pandemic, growing 3-4 times in volume versus the prior year. The company sees key growth drivers in ecommerce and DTC and is shifting a significant portion of its resources and marketing dollars towards growing its digital commerce channels.

Canopy investment

Constellation’s share of Canopy Growth Corporation’s (NYSE: CGC) equity earnings for the second quarter totaled a loss of $31 million on a reported basis and $34 million on a comparable basis. The company recorded a $48 million decrease in the fair value of Canopy investments for Q2. Constellation has recognized a $64 million unrealized net gain since its initial investment in Canopy in 2017.

Despite this, Constellation remains bullish on Canopy’s growth prospects and is pleased with the cannabis company’s strategic plan and its progress in reducing expenses and cash burn. Canopy has rolled out the Rec 2.0 cannabis beverage products in the cannabis market in Canada where it has a 75% market share and it has shipped more than 1.6 million cans since launch in March.

Canopy is also planning to bring its line of cannabis beverages to the US next summer through an agreement with Acreage Holdings. Constellation believes Canopy is well-positioned to benefit from the opportunity in the emerging cannabis space over the long term.

Click here to read the full transcript of Constellation Brands Q2 2021 earnings call