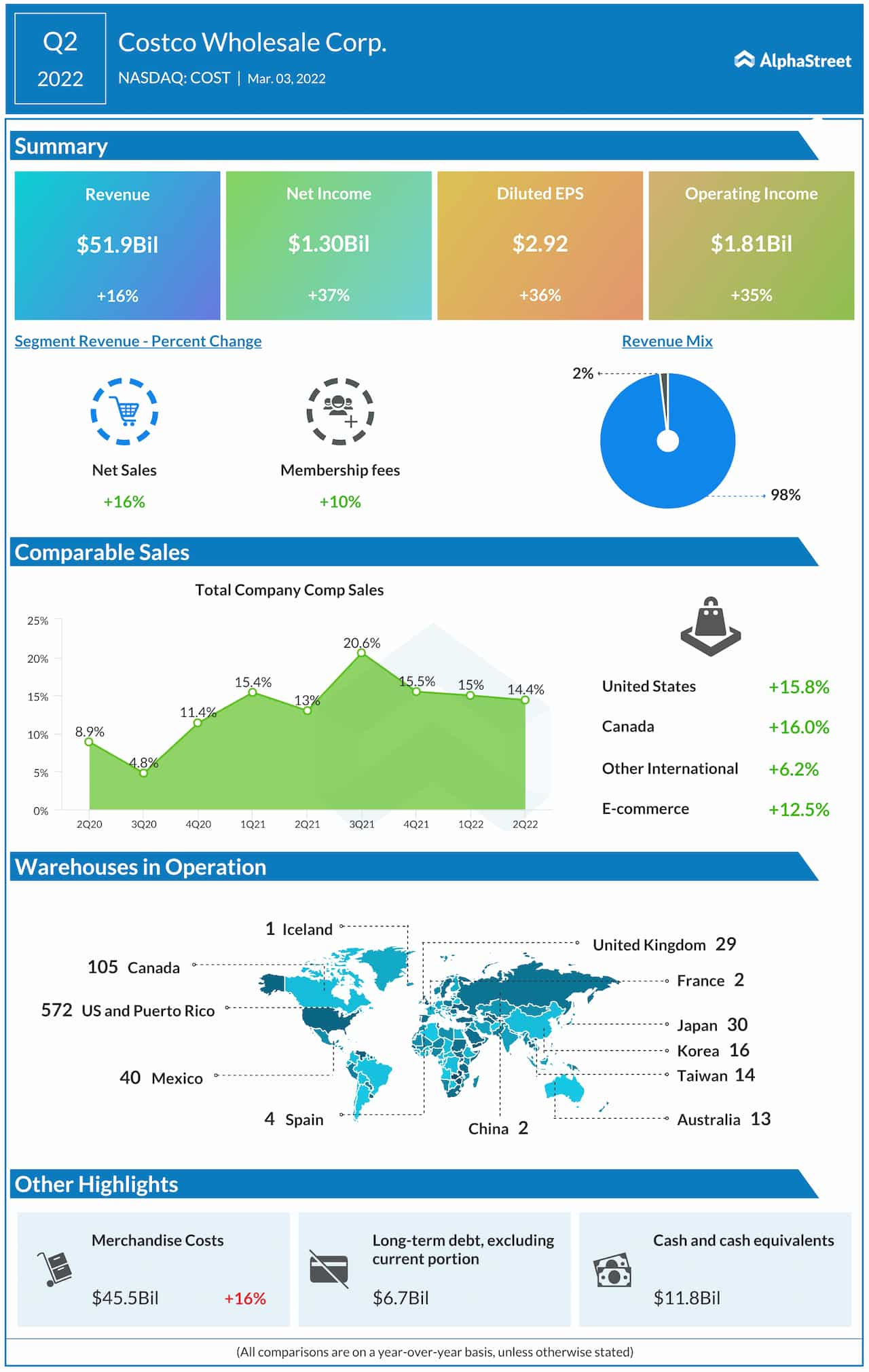

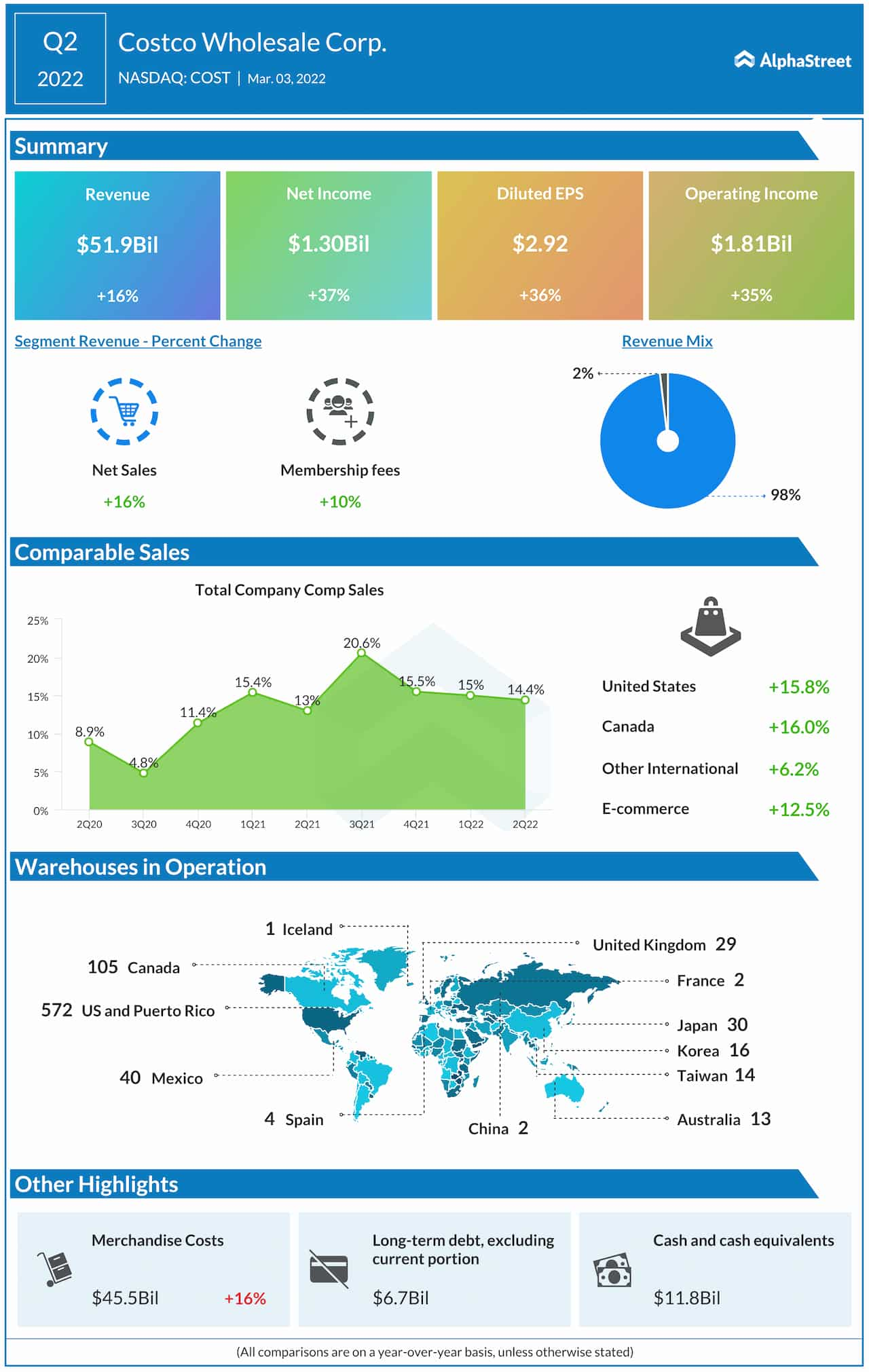

Costco Wholesale Corporation (NASDAQ: COST) became a sought-after shopping destination during the lockdown as the warehouse behemoth’s unique business model allowed customers to buy in bulk at affordable prices. Despite sales fluctuating due to pandemic-related uncertainties, the company maintained its subscriber base intact by getting members to renew their yearly memberships.

Read management/analysts’ comments on Costco’s Q2 results

In a sign that virus-related challenges are easing, shopping frequency and average transaction value increased year-over-year in the latter part of the first half. The uptick in memberships shows the company continues to attract customers despite the mass shift to eCommerce platforms. Encouraged by strong customer loyalty — with a retention rate of more than 90% — the management is reportedly considering a fee hike.

The Stock

The Issaquah, Washington-based company’s performance at the stock market has been impressive, with the stock gaining steadily over the years. Though COST had a positive start to 2022, it experienced weakness in the early weeks of the year before regaining some momentum later. The majority of analysts following Costco recommend investing in the company as they expect the stock to gain about 10% in the next twelve months. Meanwhile, there is speculation that the positive sentiment from the sales boom has already been priced into the stock.

Costco’s spacious outlets allowed customers to effectively practice social distancing when restrictions were imposed in the early days of the pandemic. That, combined with competitive prices and an uninterrupted supply of merchandise, attracted people to the stores. Interestingly, the sales momentum remained strong even after the COVID situation improved and economies started reopening. Moreover, the retailer is aggressively ramping up its eCommerce capabilities to better align the business with changing market conditions, which is in line with the management’s strategy of constantly innovating and enhancing customer experience.

Comps Rise 14.4%

In the second quarter, comparable-store sales rose 14.4%, broadly matching the growth registered in the trailing two quarters. Consequently, net sales increased 16% annually to $52 billion and topped expectations. At $2.92 per share, earnings were up 36% year-over-year and above the consensus forecast. Selling, general and administrative expenses decreased from last year.

From Costco’s Q2 2022 earnings conference call:

“There was a period during the mid-2020-year lockouts — COVID lockouts, where we had negative — we had lost money in the business and had negative revenues because you’re getting more cancellations and no new orders and that fluctuated. It is come back. It fell a little bit with Delta, it came back after that, it fell a little bit with Omicron. Although now we seem to be upon the upward trend and it is profitable. Not as profitable as it was two years ago, but continuing in that direction.”

Supply Chain Woes

Unfavorable foreign exchange rates and elevated inflation, mainly related to high fuel costs, could remain a drag on Costco’s profitability going forward. Though the company has managed to tackle the supply chain issues – through measures like chartering of vessels to move merchandise — uncertainties in container movement and labor shortage might affect sales to some extent.

WMT Earnings: All you need to know about Walmart’s Q4 2022 earnings results

Costco’s shares peaked in the final weeks of last year, but soon entered a volatile phase and lost about 7% since then. The stock closed Monday’s regular session slightly higher.