Shake Shack Inc. (NYSE: SHAK) took a

meaningful hit to its operations from the coronavirus outbreak. The company missed

the topline estimates for the first quarter of 2020 despite an 8% increase in

total revenue and a 7% increase in Shack sales.

From mid-March, Shake Shack closed all its dining rooms and

shifted to a to-go only operating model across all its Shacks, as shutdowns were

imposed across the country. This reduced sales levels drastically.

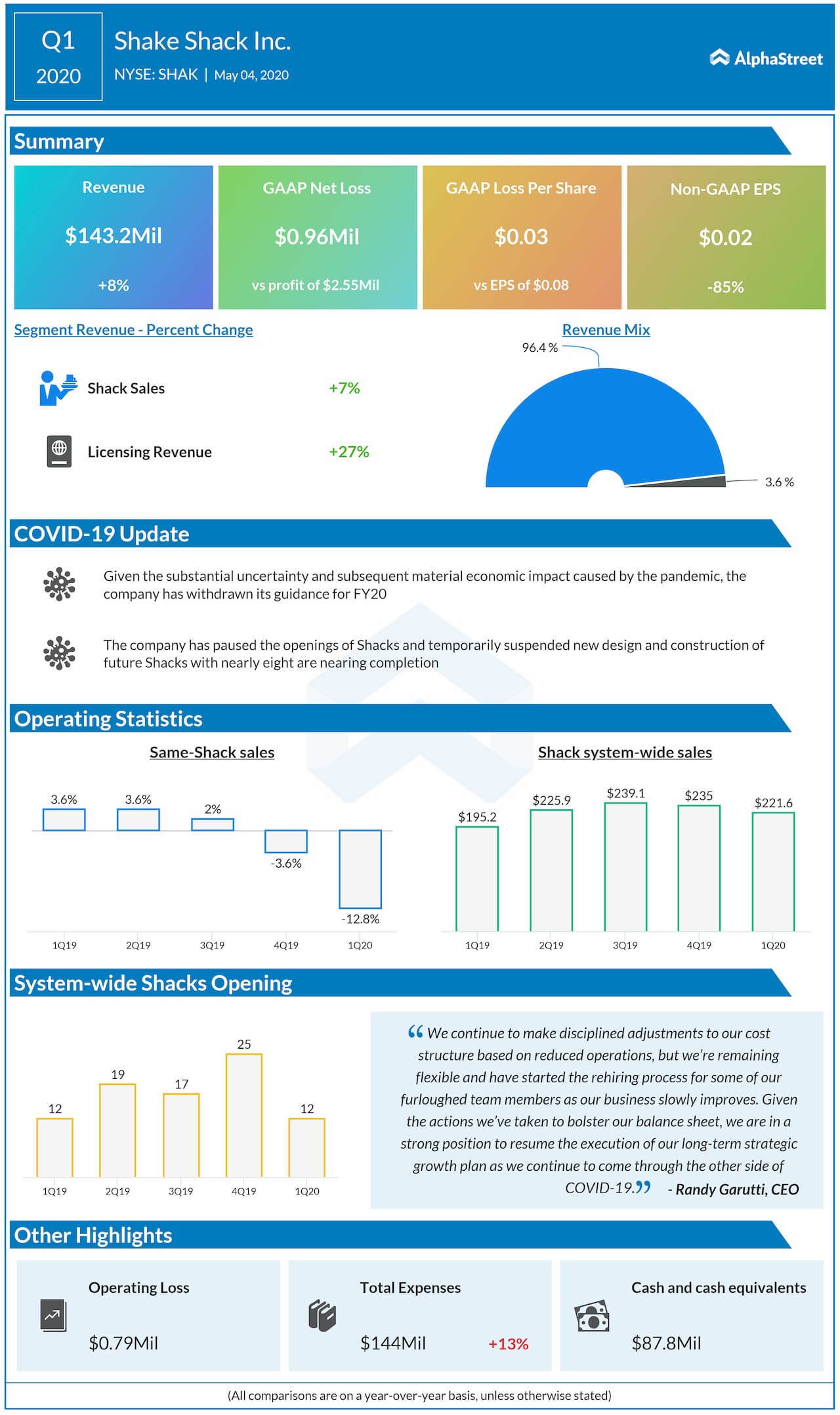

Same-Shack sales decreased 12.8% for the quarter. During the week ended March 25, same-Shack sales hit the lowest point with a year-over-year decline of 73%. Since then, however, the company has seen a pickup in both same-Shack sales and total sales with the decline in same-Shack sales narrowing to 45% in the week ended April 29.

Shake Shack Q1 2020 Earnings Infographic

This pickup in sales was driven by growth in digital

channels, changes to the operating models and the expansion of delivery

partnerships. Importantly, the current difficult situation brought a change to

the company’s strategy and focus.

Shake Shack brought about several changes such as curb-side

pickup, digital pre-ordering and makeshift drive-thrus in order to provide services

to customers amid the health crisis. The company is now focusing on its digital

innovation strategy and the investments it has made over the past few years are

beginning to pay off in this tough environment.

The company stated in its quarterly conference call that

quarter-to-date, through the week ending April 29, digital channels represented

approx. 80% of total Shack sales with the Shack app and web channel growing nearly

three times higher than last year. The number of first-time customers on its

digital channels more than doubled over the last eight weeks.

Shake Shack is mainly focused on its own channels as part of

its long-term digital strategy and believes these provide the best opportunity

to drive frequency and loyalty with customers. To improve its delivery

capabilities, the company has partnered with services like UberEats, DoorDash,

Postmates and Caviar. This is in addition to its existing partnership with

Grubhub.

Going forward, Shake Shack expects to continue these

partnerships in order to provide its customers with maximum access to its

services. The company also rolled out ready-to-cook boxes with all the necessary

ingredients to make a Shack burger at home. This has received positive

responses with over 12,000 kits being sold thus far.

In terms of its reopening plans, the company believes its

dining rooms will operate with significantly limited seating capacity once

operations resume. Shake Shack plans to move more customers to mobile and

contactless pre-ordering as it reduces its capacity for cashiers and kiosks.

Shake Shack is also looking to add a new feature called Shack Track to its locations. This involves interior and exterior pickup windows or new pickup areas to improve flow and encourage digital pre-order. The company is assessing its current locations to determine where this feature can be quickly adopted.

In short, Shake Shack’s new strategy focuses on improving its digital capabilities and to increase ordering through its mobile and online platforms as well as on expanding its delivery services and introducing new features that help in providing better service to customers.