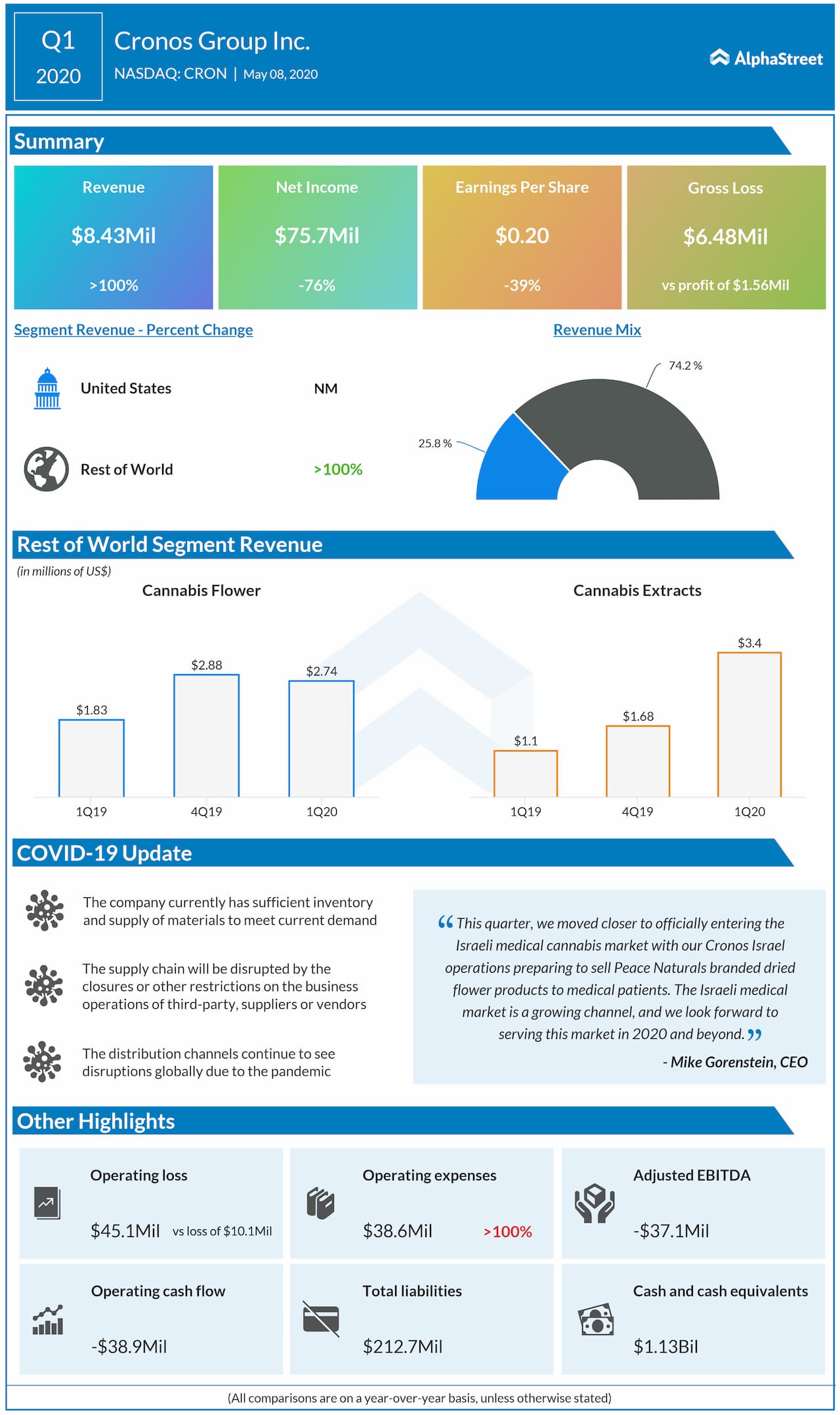

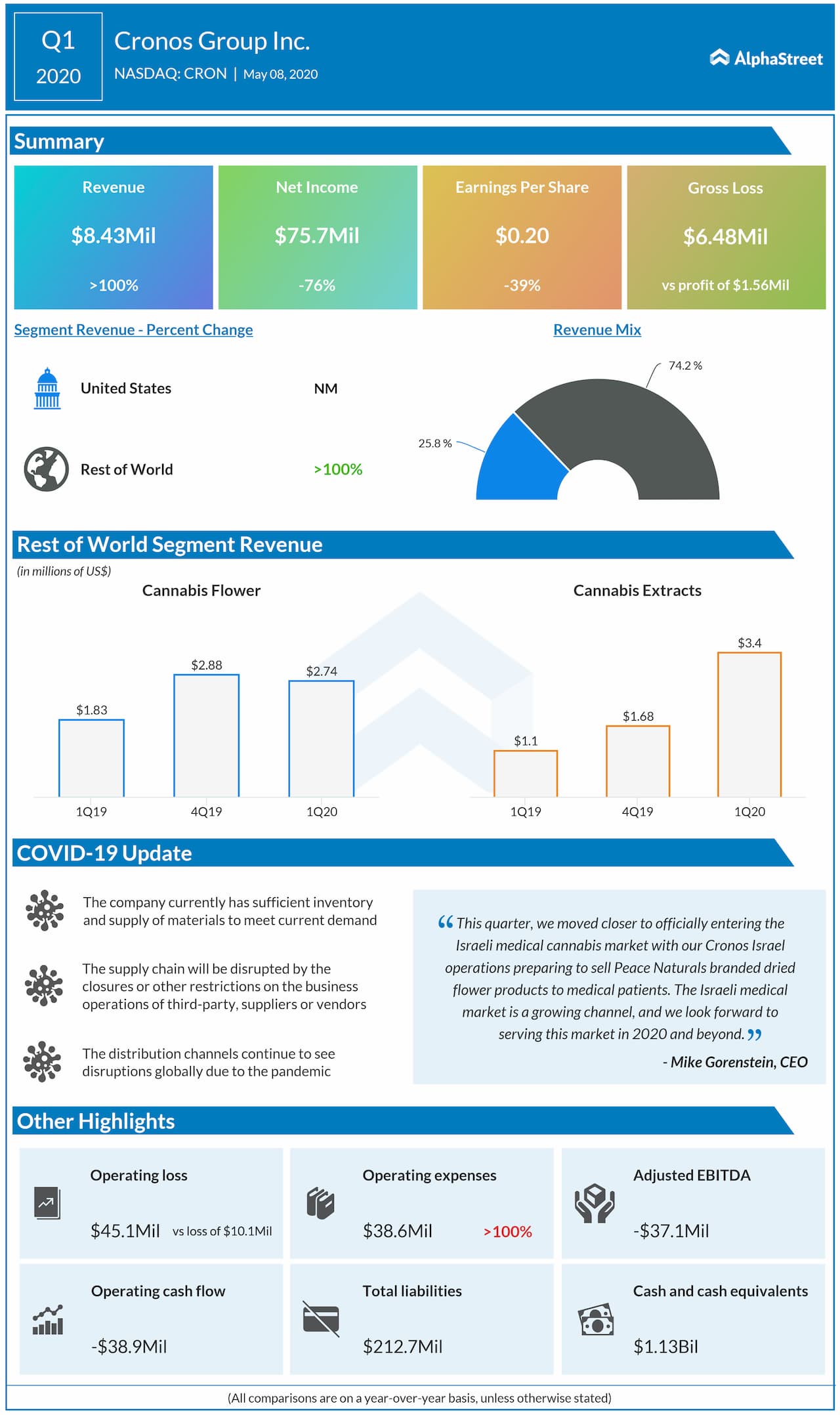

Cronos Group Inc. (NASDAQ: CRON) reported a 76% dip in earnings for the first quarter of 2020 due to higher operating expenses as well as lesser gain on revaluation of derivative liabilities.

Revenue soared by 181% primarily driven by continued growth in the adult-use Canadian cannabis market, sales resulting from the launch of cannabis vaporizers to the Canadian market, including both adult-use and direct-to-consumer, and the inclusion of the Redwood acquisition in our financial results.

The company incurred an inventory write-down of $8 million, on dried cannabis and cannabis extracts, primarily driven by fixed-price contracts negotiated prior to cannabis product price compression due to broader trends of oversupply in the Canadian market. Cronos anticipates further inventory write-downs in the short-term due to pricing pressures in the marketplace and the impact of its operational repurposing of the Peace Naturals Campus.

The company’s manufacturing sites have adjusted in order to comply with the current COVID-19 guidelines provided by local and federal governments. The Company has reduced the number of personnel working on-site at its production facilities in the US, Canada, and Israel to essential employees, and implemented work-from-home policies where appropriate.

Cronos Group’s distribution channels continue to see disruptions globally due to the COVID-19 pandemic. Online cannabis stores throughout Canada have remained operational.