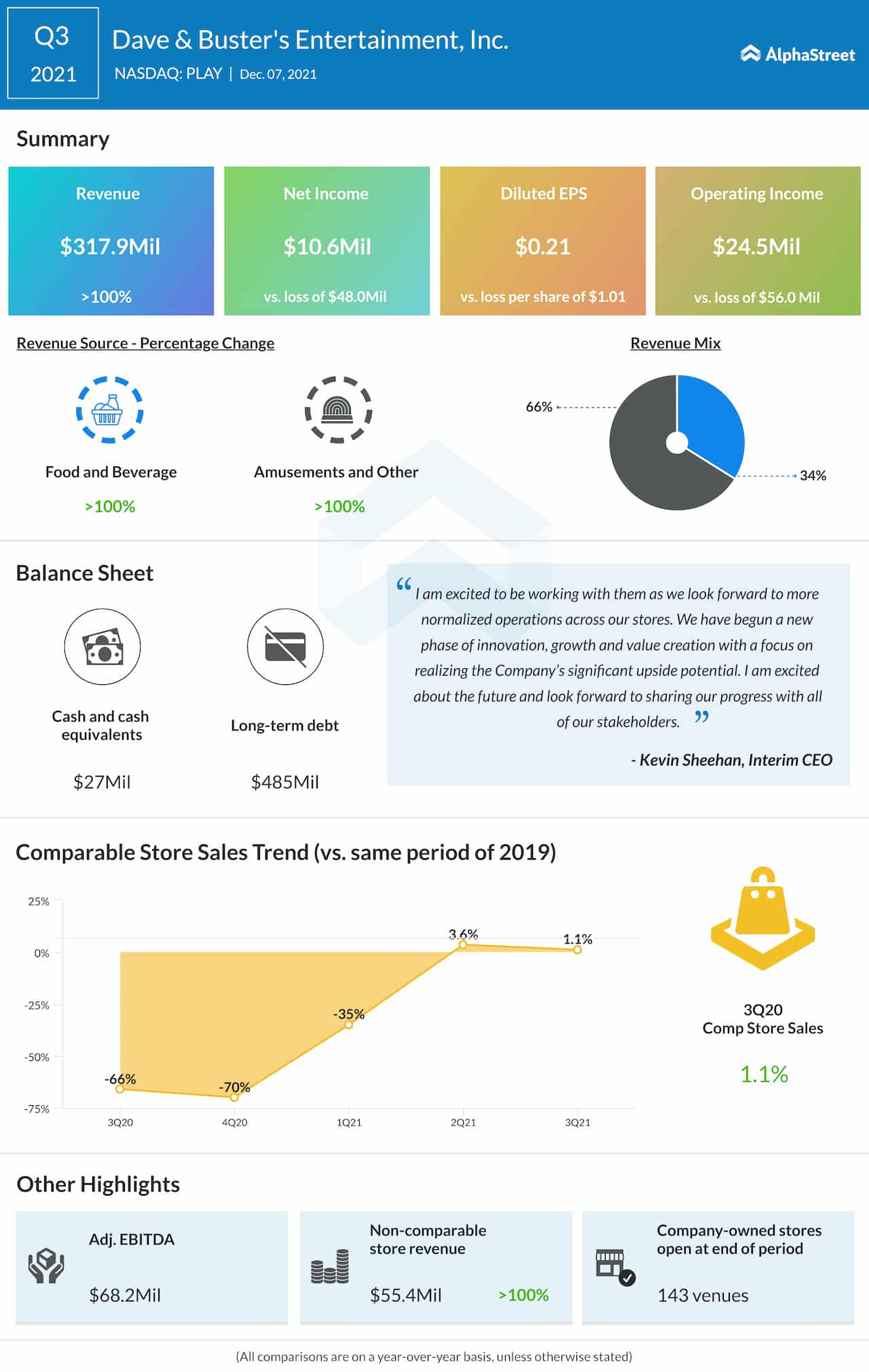

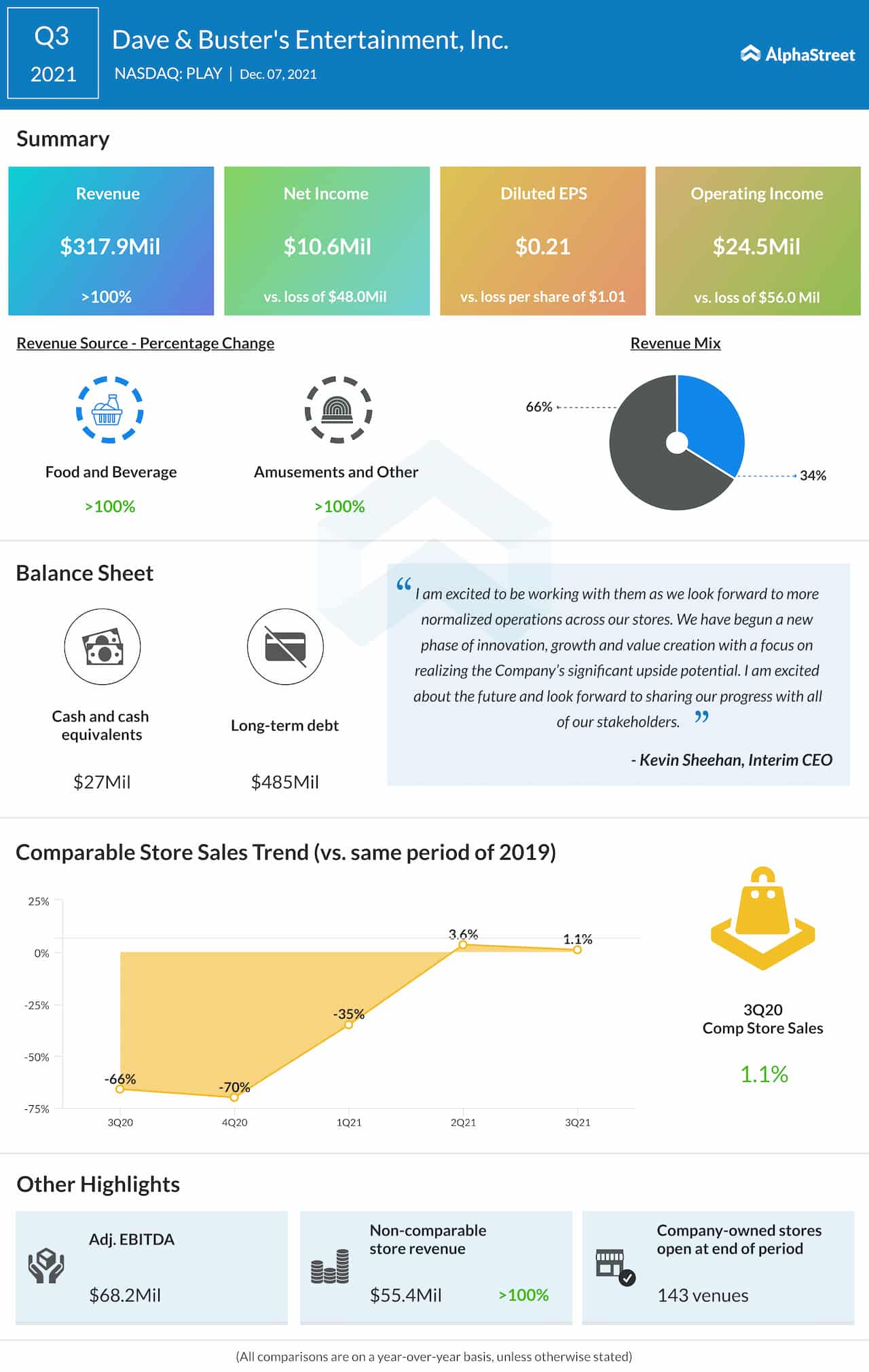

Dave & Buster’s Entertainment, Inc. (NASDAQ: PLAY), which operates a chain of casual dining and leisure facilities, reported net profit for the third quarter of 2021 compared to a loss last year, supported by strong revenue growth. The results also beat Wall Street’s expectations.

The Dallas-based company reported a net income of $10.6 million or $0.21 per share for the October quarter, which marked an improvement from the prior-year period when it incurred a loss of $48.04 million or $1.01 per share. The latest number is also above the consensus forecast.

The positive bottom-line performance reflects a sharp increase in revenues to $317.9 million amid positive comparable store performance. The top-line also beat analysts’ estimates.

“With respect to organic growth, we will broaden our entertainment offering to include more immersive sports viewing experiences, including improvements to the watch environment and the addition of fantasy sports and in sports betting option as permitted. We also see significant opportunity to drive traffic in our off-peak days and dayparts, and we are evaluating a variety of initiatives to extract more value out of our existing stores,” said Kevin Sheehan, chief executive officer of Dave & Buster’s Entertainment, at the post-earnings conference call.

Read management/analysts’ comments on Dave & Buster’s Q3 results

Shares of Dave & Buster’s have lost more than 28% in the past six months. The stock traded higher during Wednesday’s pre-market session after closing the previous session at $32.66