Mixed results

Operating performance and trends

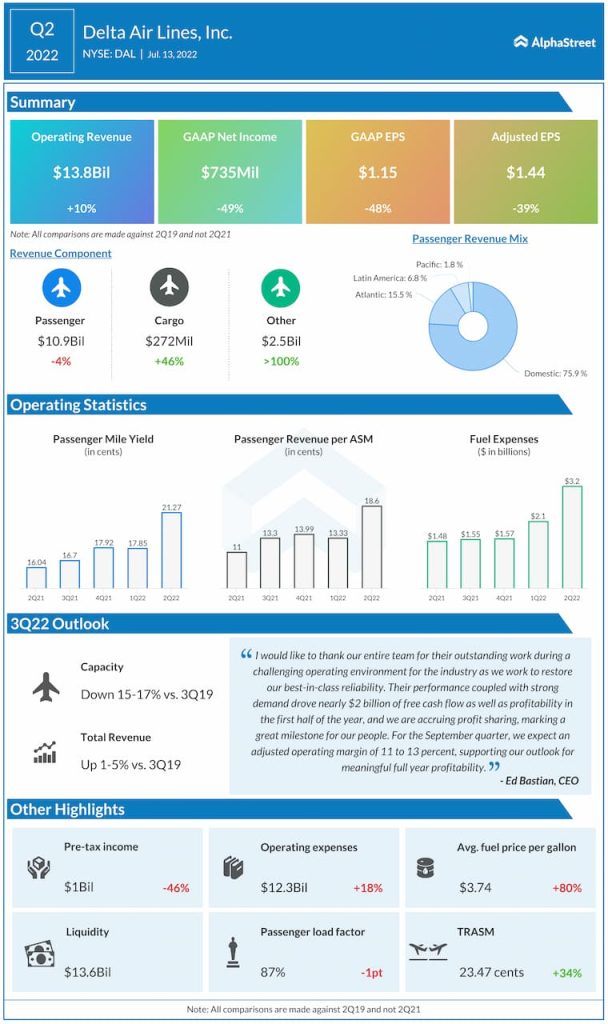

In Q2 2022, capacity was down 18% from the same period in 2019. Passenger load factor dipped slightly to 87%. Total revenue per available seat miles (TRASM) increased 34% to 23.47 cents while cost per available seat mile (CASM) rose 44% to 20.89 cents. Non-fuel unit cost was up 22% to 12.76 cents. Average fuel price per gallon increased 80% to $3.74 and total fuel expense rose 41% to $3.2 billion.

Domestic passenger revenue was up 3% compared to Q2 2019 while international passenger revenue saw an 81% recovery versus the same period. However, total passenger revenue for the quarter dropped 4% to $10.9 billion compared to the 2019 period.

Delta continued to see recovery in business travel during Q2. Domestic corporate sales were around 80% recovered versus 2019 while international corporate sales were around 65% recovered. The international recovery was driven by outsized improvement in Transatlantic. Results from a recent corporate survey indicate a bullish outlook for business travel in the third quarter along with optimism around international travel.

Cargo revenue rose 46% to $272 million compared to Q2 2019. Delta’s co-branded credit card with American Express yielded $1.4 billion in remuneration for the quarter, up 35% compared to the same period in 2019, and on track to exceed $5 billion for the full year.

Outlook

For the third quarter of 2022, Delta expects total revenue to increase 1-5% compared to the third quarter of 2019. Capacity is expected to be down 15-17% from Q3 2019. Operating margin is expected to range between 11-13% while CASM-Ex is projected to be up around 22% versus Q3 2019.

Click here to access the full transcripts of the latest earnings conference calls