Quarterly performance

Trends

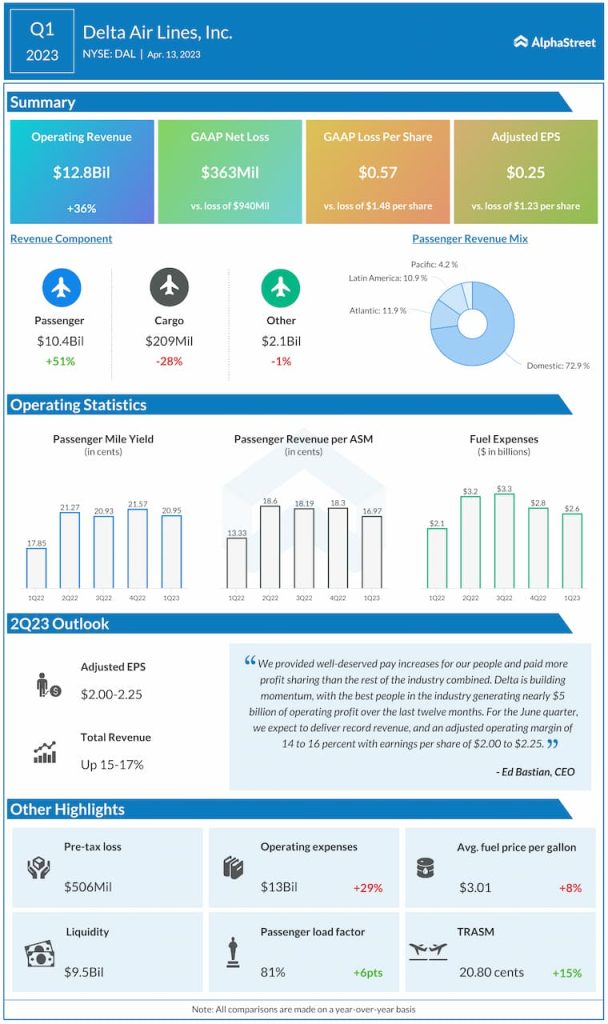

Delta continued to see strength in unit revenue during the first quarter. Total revenue per available seat mile (TRASM) increased 15% on a reported basis and 23% on an adjusted basis compared to the year-ago quarter. Passenger revenue per available seat mile (PRASM) increased 27% YoY in Q1. Capacity was up 18% in the first quarter while passenger load factor was 81% versus 75% last year.

Passenger revenue increased 51% YoY to $10.4 billion in Q1. Delta saw a pick-up in business travel, which was led by small and medium-sized business demand as well as growth in international business travel. Small and medium business bookings in the first quarter were fully recovered compared to 2019 levels.

International corporate sales in Q1 were around 90% recovered to 2019 levels while domestic corporate sales were around 85% recovered to 2019 levels. In its earnings report, Delta said that based on recent corporate survey results, 96% of companies expect their travel to increase or stay the same sequentially in the second quarter of 2023.

In Q1, operating expenses increased 29% YoY to $13 billion. Non-fuel unit cost (CASM-ex) increased 4.7%. Reported average fuel price per gallon was $3.01, up 8% from the year-ago period.

Outlook

For the second quarter of 2023, total revenue is expected to increase 15-17% year-over-year. Adjusted EPS is estimated to be $2.00-2.25 while operating margin is expected to be 14-16%. For the full year of 2023, total revenue is expected to grow 15-20% YoY while operating margin is estimated to be 10-12%. Adjusted EPS is expected to be $5-6 for the year.