While the pickup in demand and subsequent recovery in revenue is dependent on several factors that may or may not play out as expected, Delta is focusing on the areas that it can control and the company expects the actions it is taking will position it well when demand finally rebounds.

Path to recovery

Demand can pick up at a meaningful pace only if lockdowns and restrictions come to an end and business travel sees an improvement. This is not expected to roll out fully until the first half of 2021. Revenues will see an improvement only if demand returns at scale.

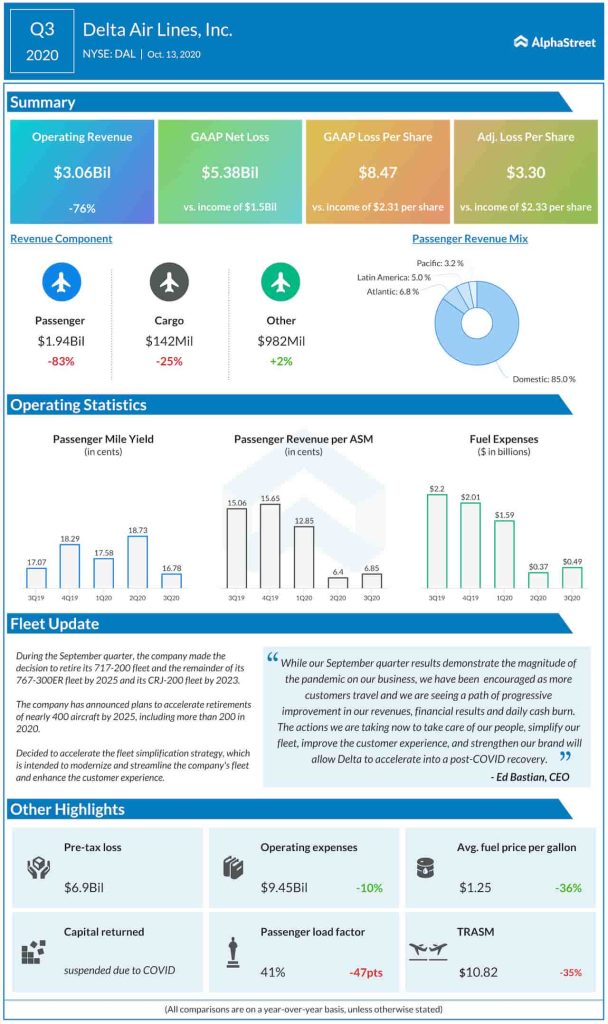

Delta is currently running at a fraction of its normal capacity despite a slight pickup in air travel. In the third quarter, revenues were at 21% of prior-year levels and for the fourth quarter, revenues are expected to be at 30-35% of the year-ago levels.

Although fourth-quarter revenues are expected to triple from the level seen in the second quarter, the company still feels it has a long way to go before it gets to normal. Delta believes it could take two years or more to reach a normalized revenue environment.

Delta is seeing a slight improvement in corporate travel and although volumes stood at 15% of last year’s levels, they are showing an upward trend across all industries and this is expected to continue till next year. International demand remains weak in general due to restrictions in key markets while domestic demand has recovered to 35-40% of pre-pandemic levels.

Streamlining efforts

Delta has resized itself by 20% since the beginning of the year by reducing its fleet, headcount and expenses. The company scaled down its non-pilot workforce by 20% which helped lower labor costs by over 40% in the past six months.

The company retired over 200 aircraft this year and it is looking to retire another 400, or around 30% of its fleet, by 2025. Delta will retire its CRJ-200 fleet by 2023 and its 717 and 767-300ER fleets by 2025. This will take out four fleet families reducing costs meaningfully.

Delta will also restructure its order book with Airbus, reducing its aircraft purchase commitments by more than $2 billion this year and by over $5 billion through 2022.

The company is increasing capacity during the peak holiday season of Thanksgiving and Christmas and reducing it during the off-peak season such as Halloween and election week. This will reduce Q4 capacity by 40-45% year-over-year. Delta expects Q4 revenues to drop by 65-70% from last year.

Cost performance and cash burn

These actions helped Delta reduce costs significantly and bring down its cash burn. In the third quarter, operating expenses fell by 52% despite an increase in capacity. For the fourth quarter, operating expenses are expected to be down around 50% year-over-year and CASM is estimated to be flat to down on 40-45% lower capacity.

Delta managed to bring down its daily cash burn from $27 million per day in June to $18 million per day in September. This is expected to improve further to a range of $10-12 million for the fourth quarter.

These efforts are expected to help Delta slowly increase capacity going forward while keeping costs low thereby providing opportunities for margin expansion.

Click here to read the full transcript of Delta Air Lines Q3 2020 earnings conference call