Revenue and profitability

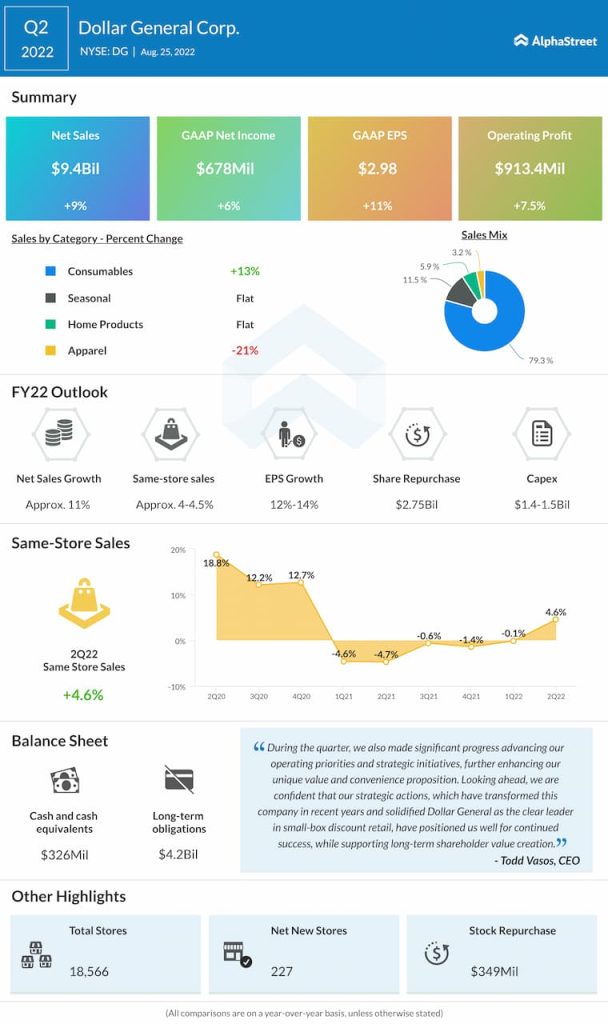

Same-store sales rose 4.6% helped by increases in average transaction amount and customer traffic. EPS grew 10.8% to $2.98. Gross margin increased by 69 basis points to 32.3%. Operating profit increased 7.5% to $913.4 million.

Customer preferences and category performances

Amid the ongoing inflation and economic uncertainty, Dollar General saw higher demand for consumables, which led to stronger-than-expected sales in this category, while the non-consumable categories witnessed declines.

The discount retailer saw a slight pickup in customer traffic during the second quarter along with an increase in the number of higher-income shoppers who are looking for more value in the current environment.

Average basket size also increased in Q2, driven mainly by inflation. As long as the inflationary environment persists, discount retailers like Dollar General stand to benefit as customers look for more affordable options to meet their daily needs. However, profits could be impacted as consumables make up more of sales as it is a low-margin category.

Store fleet and strategy

Dollar General changed its plans for its store fleet due to delays in the receipt of construction materials. The company now plans to open 1,010-1,060 new stores as opposed to the 1,110 planned earlier. The number of remodels and relocations have been increased to 1,795 remodels and 125 relocations from 1,750 and 120 respectively.

Dollar General has various strategic initiatives in place to drive growth. The company is seeing strong sales and margins in stores where it has rolled out its non-consumables initiative (NCI). It expects these benefits to continue throughout this year. NCI is currently available in around 15,000 stores and DG expects to complete the rollout across nearly the entire chain by year-end.

The pOpshelf concept is doing well and the company plans to triple the number of pOpshelf stores this year. It also expects to open a total of 15 store-within-a-store concepts, which involves a smaller pOpshelf store within a larger Dollar General store. Over the long term, the company anticipates the average gross margin rate from these stores to exceed 40%.

Outlook

Dollar General raised its sales outlook for FY2022. The company expects net sales to grow around 11% and same-store sales to grow 4-4.5% versus the previous expectations of a 10-10.5% net sales growth and 3-3.5% same-store sales growth. EPS is estimated to grow 12-14% for the year.

Click here to read the full transcript of Dollar General Q2 2022 earnings conference call