Sales

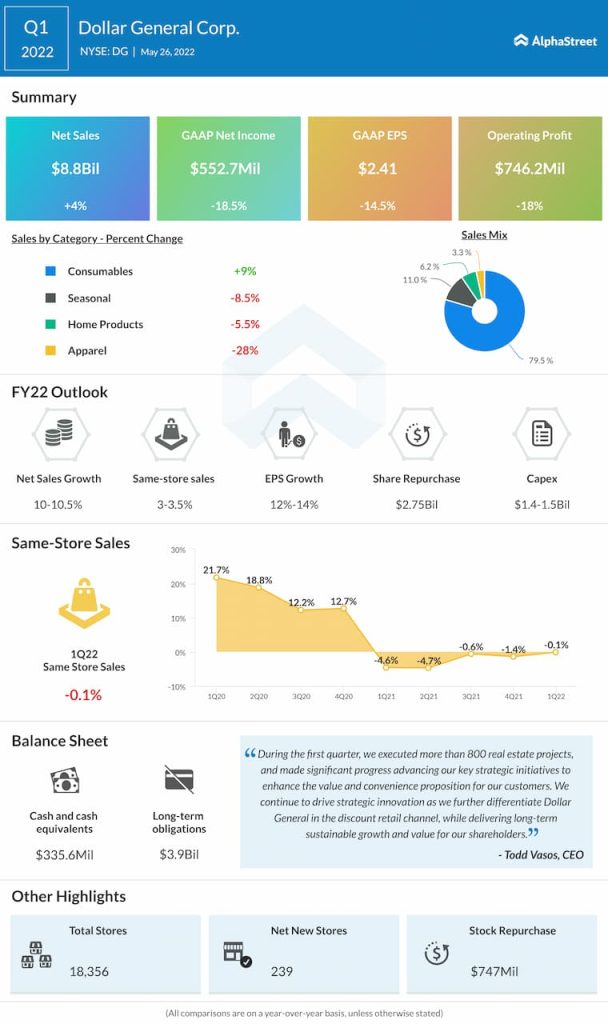

Same-store sales fell 0.1% in the quarter due to a drop in customer traffic. This decline was offset by an increase in average basket size driven by inflation. The consumables category delivered comp sales growth of 4.6% during the quarter but this was offset by a 15% decline in the non-consumable categories.

Dollar General raised its sales guidance for fiscal year 2022 and now expects net sales growth to range between 10-10.5% versus the earlier guidance of approx. 10%. Same-store sales are now expected to grow around 3-3.5% versus the prior expectation of 2.5%. Comp sales growth is expected to be stronger in the latter half of the year than the first half.

Profitability

Net income in Q1 decreased 18.5% YoY to $552.7 million while EPS fell 14.5% to $2.41. Despite the decline, EPS came ahead of expectations. Gross profit, as a percentage of net sales, decreased 151 basis points to 31.3% versus the prior-year quarter. The drop in gross profit rate was due to a larger portion of sales coming from the low-margin consumables category. Gross profit was also impacted by an increase in markdowns as well as higher transportation and distribution costs.

For the year, Dollar General expects EPS growth in the range of approx. 12-14%. Like comp sales, EPS growth is also anticipated to be stronger in the back half of the year versus the first. In terms of margins, the company expects to realize benefits from its growth initiatives as well as distribution and transportation efficiencies. However, supply chain pressures and product cost inflation are expected to act as headwinds in 2022.

Store fleet

In Q1, Dollar General opened 239 new stores, remodeled 532 stores, and relocated 32 stores thereby executing more than 800 real estate projects. In FY2022, the company plans to execute 2,980 real estate projects including 1,110 new store openings, 1,750 remodels, and 120 store relocations.

Dollar General expects around 800 of its new stores in 2022 to be in the larger 8,500 square foot store format as it works to accommodate a wider product selection. The company plans to open up to 10 new stores in Mexico by the end of the year as part of its international expansion efforts. With a robust real estate pipeline, DG is optimistic about its future growth opportunities.