Domino’s Pizza Inc. (NYSE: DPZ) reported a 16% increase in earnings for the fourth quarter of 2019 as higher store count and same-store sales growth drove the top line higher. The results exceeded analysts’ expectations.

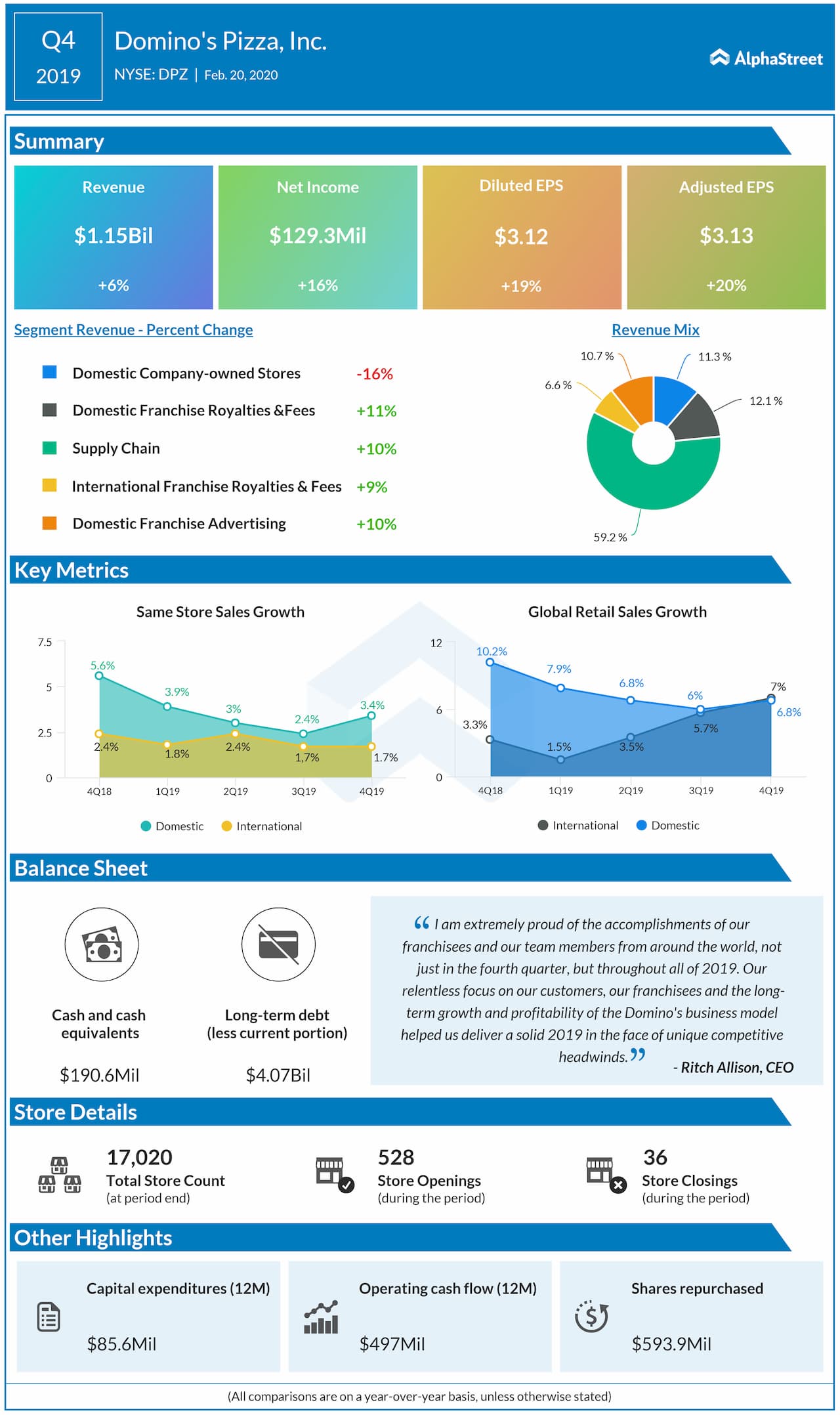

Net income increased by 16% to $129.3 million or $3.12 per share. Adjusted EPS jumped by 20% to $3.13. Revenue grew by 6.3% to $1.15 billion. Analysts had expected EPS of $2.98 on revenue of $1.12 billion for the fourth quarter.

The bottom line was driven by higher royalty revenues from the US and international franchised stores and higher supply chain volumes as well as lower general and administrative expenses.

Global retail sales rose 6.9% during the quarter or 7.6% excluding foreign currency impact. The US same-store sales increased by 3.4% while international same-store sales were up 1.7%.

For the fourth quarter, the same-store sales continued the positive sales momentum in the US stores business. The company had fourth-quarter global net store growth of 492 stores, comprised of 141 net new US stores and 351 net new international stores.

The top-line growth was impacted by lower US company-owned store revenues resulting from the previously disclosed sale of 59 US company-owned stores to certain of its existing US franchisees during the second quarter of 2019. A rise in effective tax rate and higher net interest expense as a result of its November 2019 recapitalization reduced the bottom-line growth.

On February 19, 2020, the board of directors declared a quarterly dividend of $0.78 per share. The dividend will be paid on March 30, 2020, to shareholders of record as of March 13, 2020. This represents an increase of 20% over the previous quarterly dividend amount.

Looking ahead, the company reaffirmed a 2-3 year outlook for global retail sales growth of 7-10%, US same-store sales growth of 2-5%, international same-store sales growth of 1-4%, and global net unit growth of 6-8%.

As of December 29, 2019, the company had about $190.6 million of unrestricted cash and cash equivalents, while the total debt stood at $4.11 billion.