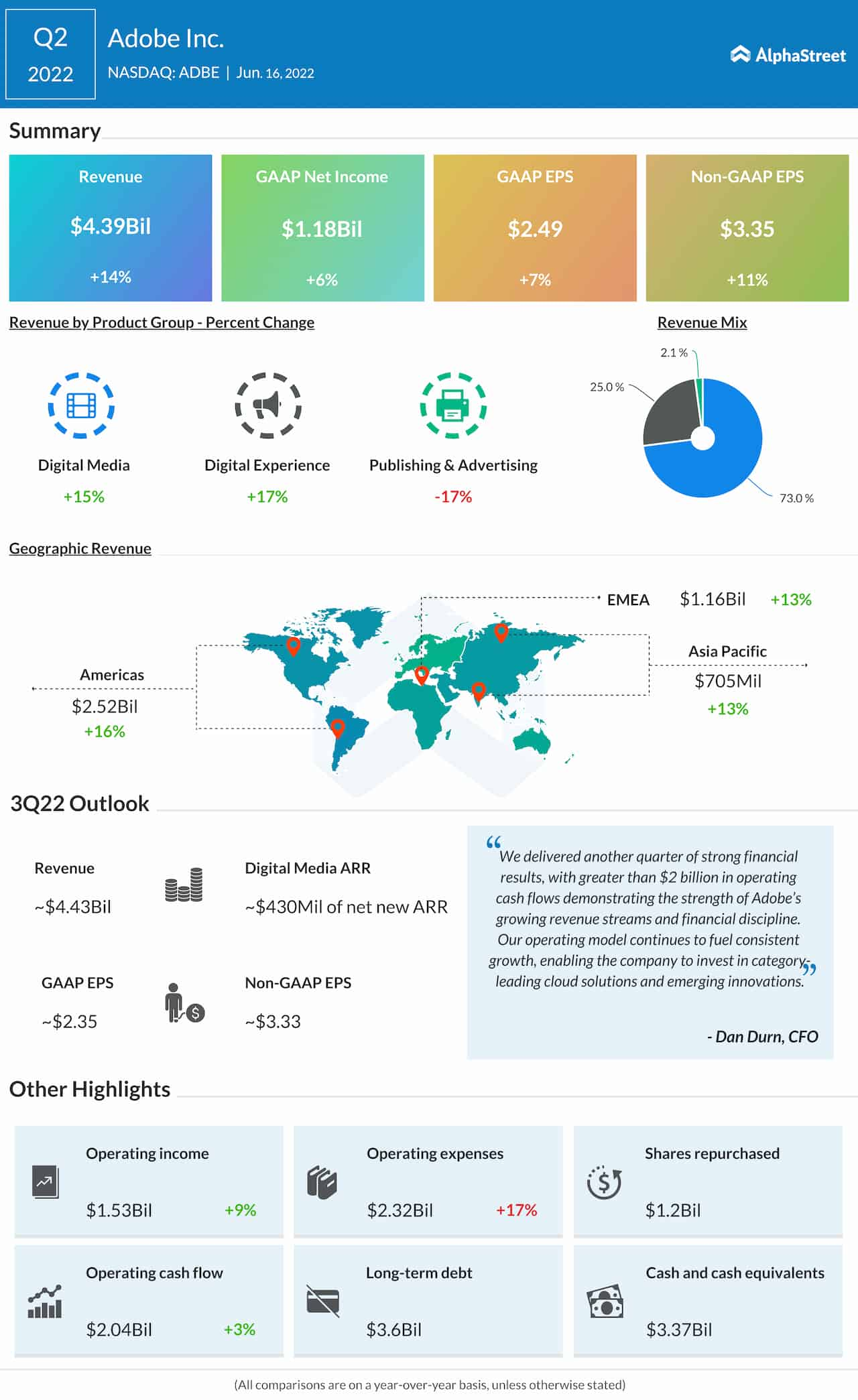

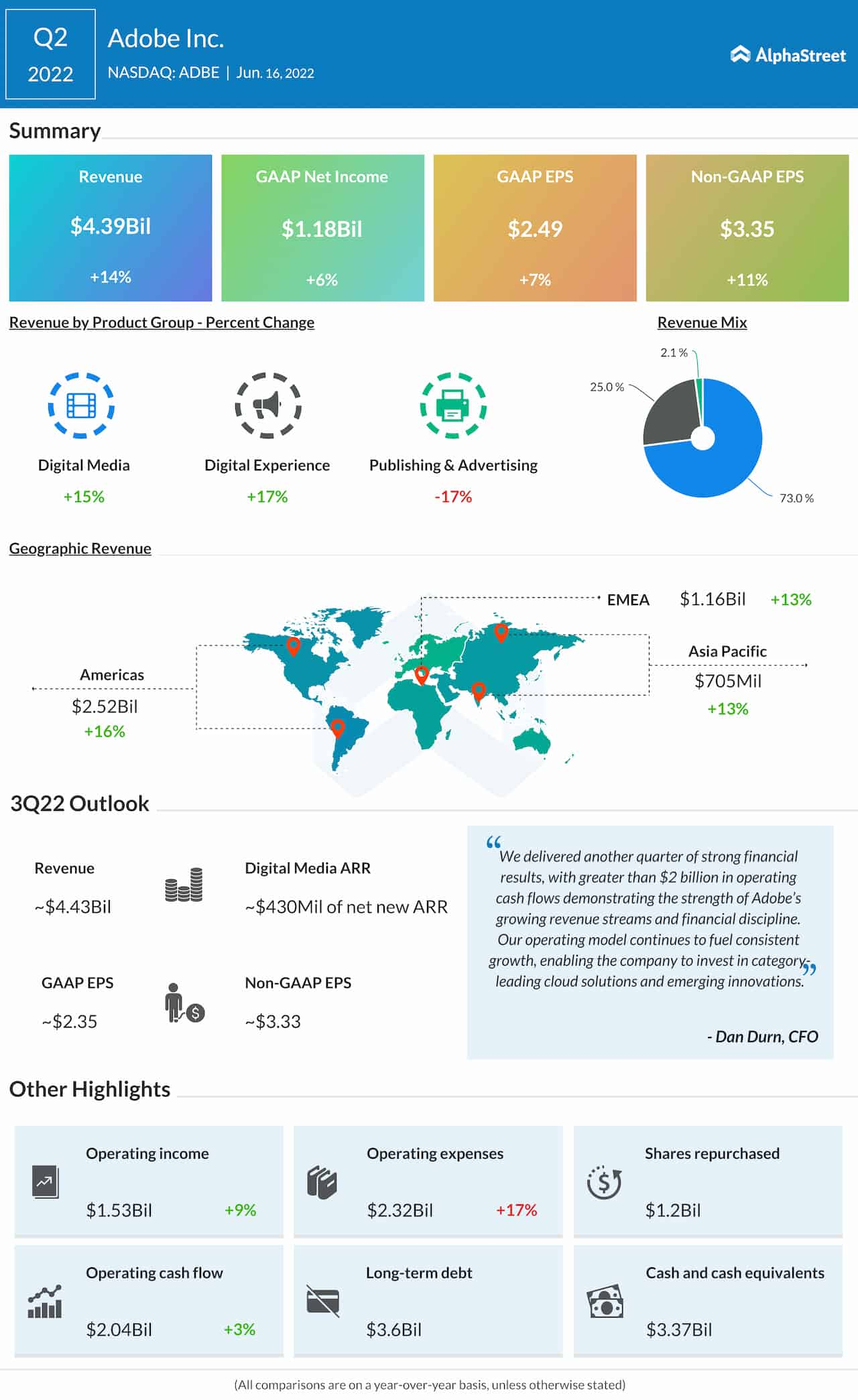

Design software maker Adobe Inc. (NASDAQ: ADBE) on Thursday announced second-quarter results, reporting revenues and earnings that increased year-over-year and topped expectations.

At $4.39 billion, second-quarter revenues were up 14% from the prior-year period and above the market’s projection. The top line benefited from strong growth in the core operating segments.

Net profit, excluding special items, rose to $3.35 per share from $3.03 per share last year and came in above the consensus forecast. Unadjusted net income was $1.18 billion or $2.49 per share, compared to $1.12 billion or $2.32 per share in the second quarter of 2021.

Check this space to read management/analysts’ comments on Adobe’s Q2 results

“We are winning in our established businesses and seeing significant momentum in new categories from content authoring for a broad base of creators to PDF functionality on the web to the leading real-time customer data platform for global enterprises,” said Adobe’s CEO Shantanu Narayen.