After a relatively quiet period, consolidations seem to be making a comeback. Continuing its acquisition spree, Accenture clinched at least four deals this week, with the buyout of UK-based talent consultancy Cirrus Logic topping the list.

The professional services firm also agreed to buy Brazil-based robotics solutions provider Pollux and Australian logistics consultancy GRA. The other business that joined the Accenture fold is technology solutions provider REPL Group.

Agilent Technologies agreed to acquire Resolution Bioscience for $695 million, while Taco Bell owner Yum! Brands bought artificial intelligence provider Kvantum. The other key deals include Digital Turbine’s purchase of Israel-based mobile advertising company Triapodi Ltd, and the $1.45-billion acquisition of UK-based Capco by Indian software giant Wipro.

Once again, retailers dominated the earnings scene, with department store operators Kohl’s and Target Corp. publishing their latest statistics on Tuesday, followed by discount chain Dollar Tree on Wednesday. The next day, Kroger Company and warehouse giant Costco Corp. delivered mixed results for their most recent quarters amid tough-year-over comparison.

Chipmaker Broadcom’s first-quarter report was the other major announcement of the week. As Wall Street approaches the fag end of the earnings season, Oracle’s third-quarter financial report is probably the most-awaited announcement next week — scheduled for March 10.

Prior to that, H&R Block and Dick’s Sporting Goods are expected to report on March 9. As the week progresses, Ulta Beauty will be unveiling fourth-quarter numbers on March 11.

Key Earnings to Watch

Monday: Niu Technologies, Del Taco Restaurants, Avid Bioservices, and Stitch Fix

Tuesday: Children’s Place, Casey’s General Stores, Barnes & Noble Education, Vertex Energy, Dick’s Sporting Goods, Avid Technology, and MongoDB

Wednesday: Campbell Soup Company, Tupperware Brands, LendingClub Corp, Cloudera, and Oracle Corp.

Thursday: JD.com, 22nd Century Group, Goodrich Petroleum, DocuSign, Tilly’s, AutoWeb, Ulta Beauty, and Vail Resorts

Friday: Kirkland’s, Information Services Group, Buckle, and Saga Communications

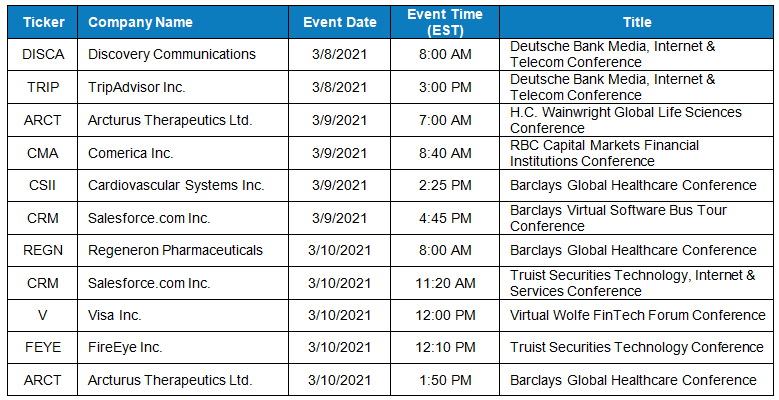

Key Corporate Conferences to Watch

Key Investor Days/AGMs to Watch

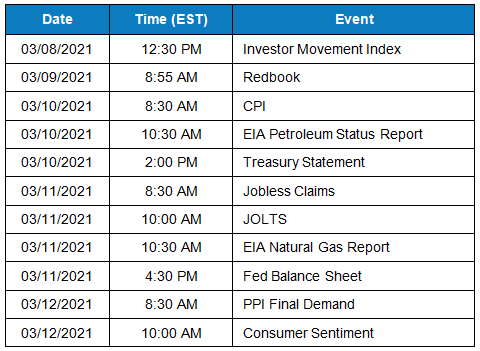

Key US Economic Events

Notable Transcripts

The following are notable companies which have reported their earnings last week. In case if you have missed catching up on their performance, click the respective links to skim through the transcripts to glean more insights.

Zoom Video Q4 2021 Earnings Transcript

Novavax Q4 2020 Earnings Transcript

NIO Q4 2020 Earnings Transcript

Kohl’s Q4 2020 Earnings Transcript

Autozone Q2 2021 Earnings Transcript

Box Q4 2021 Earnings Transcript

Target Q4 2020 Earnings Transcript

HP Enterprise Q1 2021 Earnings Transcript

Dollar Tree Q4 2020 Earnings Transcript

Snowflake Q4 2021 Earnings Transcript

Broadcom Q1 2021 Earnings Transcript

Costco Wholesale Q2 2021 Earnings Transcript

Gap Q4 2020 Earnings Transcript

If you want to listen to how management responds to analyst questions and the tone they use, you can head over to our YouTube channel to listen to conference calls on the go.