KB Home (NYSE: KBH) will be publishing fourth-quarter earnings on January 10, after markets close. Of late, the homebuilder has been facing headwinds from inflation and high mortgage rates, but it looks poised to deliver better performance in fiscal 2024 amid steady improvement in orders.

The company’s stock made impressive gains in the final weeks of 2023, after experiencing weakness since mid-year. The value has increased by more than 75% in the past twelve months.

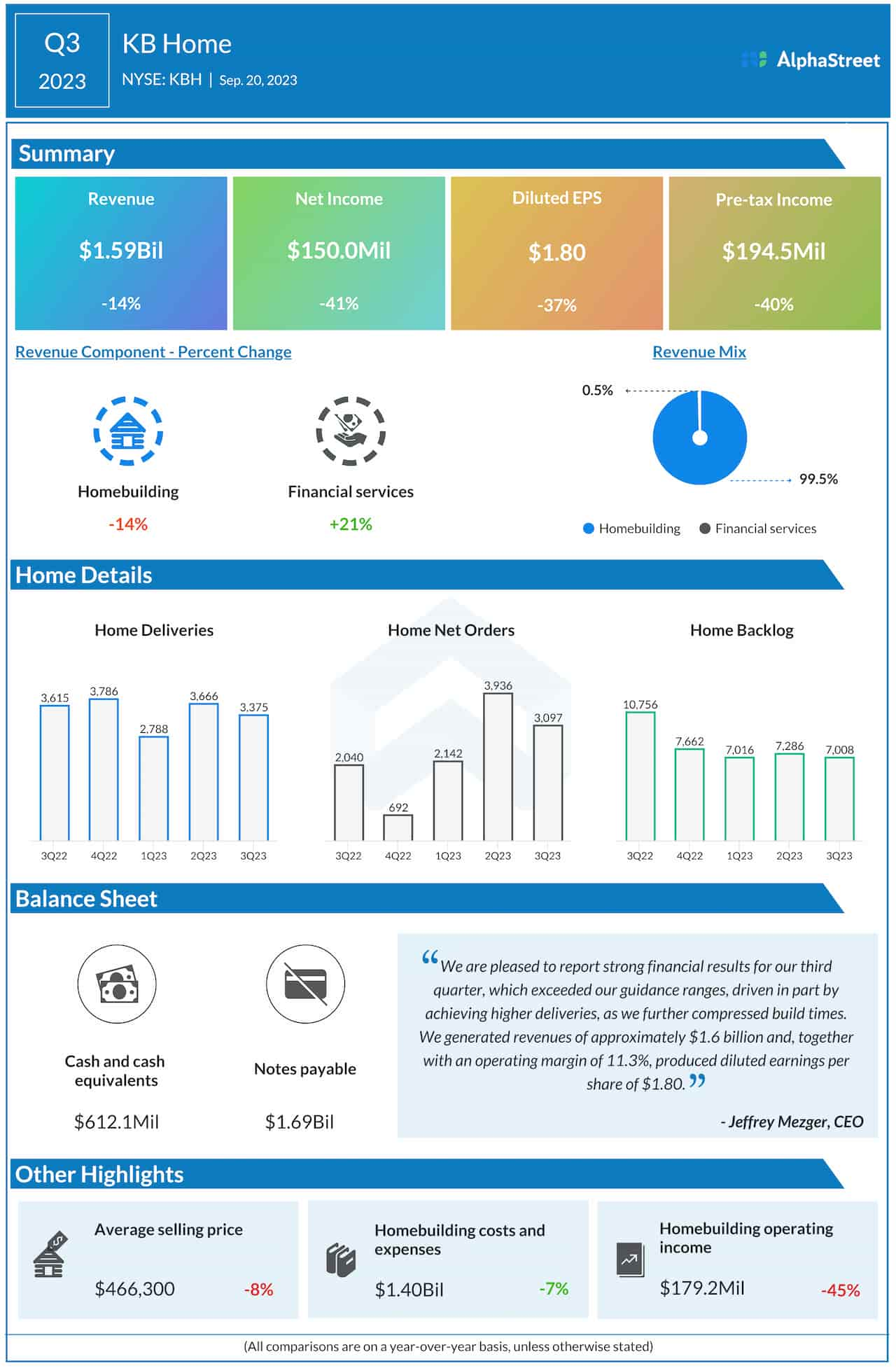

It is estimated that orders will continue to recover due to the shortage of homes and demographic tailwinds. In recent quarters, the company’s key financial metrics exceeded expectations, thanks to improved build times and lower selling prices. On the flip side, the dip in prices puts pressure on margins. It is worth noting that revenues of the core homebuilding segment declined by double digits in Q3. There is speculation that prices will bounce back in the final months of the year when a shift toward higher-price deliveries is expected to happen.

What’s in Cards

KB Home offers mortgage concessions to customers, wherever required, to drive sales. Such initiatives, combined with lower prices, have reduced cancellations, and the trend is expected to continue. The flexibility and affordability offered by the company’s built-to-order model should position it to navigate the challenges in the housing market.

KB Home’s fourth-quarter report is slated for release on January 10, after regular trading hours. On average, analysts following the company forecast earnings of $1.70 per share, compared to $2.47 per share in the comparable period of 2022. The year-over-year decline reflects an estimated 17% fall in Q4 revenues to $1.62 billion.

From KB Home’s Q3 2023 earnings call:

“Although KB Home is perceived to be a California builder, our business is becoming more diversified and we like the balance of our geographic footprint. Our Southeast region has grown into a larger business, approaching 20% of our revenues this year as compared to only 11% five years ago. This region has significantly improved its profitability and returns over this timeframe, and we look forward to its continued growth.”

Mixed Outcome

In Q3, earnings and sales beat estimates for the third consecutive quarter, though overall performance came under pressure from the slowdown in orders. The company generated net orders of 2,142 for the quarter, which is down 49% year-over-year but better than the 50-60% fall expected. As a result, Q3 revenues declined 14% from last year to $1.59 billion. Net income and earnings per share decreased by 41% and 37% to $150 million and $1.80, respectively.

Over the past two months, shares of KBH stayed above their 52-week average, after recovering from a six-month low. The stock traded slightly higher on Thursday afternoon after opening lower.