The housing market has been under pressure due to limited inventory and elevated mortgage rates for some time, which was reflected in the performance of KB Home (NYSE: KBH) last year. The homebuilder is preparing to publish first-quarter numbers next week, while market watchers forecast a year-over-year increase in sales and profit.

New High

Last week, the Los Angeles-headquartered company’s stock moved above the $70 mark, which is the highest in nearly two decades. With an impressive 100% growth in a year, KBH was one of the best-performing stocks last year. It has maintained a steady uptrend so far this year, and the trend is continuing ahead of the earnings.

It is widely expected that KB Home’s first-quarter 2024 revenue and profit increased compared to the year-ago period. That represents a reversal of the downtrend experienced throughout last year, though earnings and the top line exceeded estimates in all four quarters. The February quarter numbers will be published on Wednesday, March 20, at 4:10 p.m. ET. The consensus earnings estimate is $1.57 per share, compared to $1.45 in Q1 2023. Analysts predict a 6% increase in revenues to $1.46 billion.

Outlook

Earlier, the KB Home leadership provided a positive outlook for the first quarter, citing a sequential increase in new orders in the early weeks of the year. It looks like the company had a good start to the new fiscal year, thanks to the general improvement in market conditions and easing mortgage rates. That, combined with the management’s targeted sales strategies, should enable the company to stay resilient this year.

“The same factors that characterize the market today, low inventory levels, solid employment, and wage growth are those that we believe will sustain the longer-term health of the housing market. Demographics, have been and will continue to be a significant factor with the largest generational cohorts, millennials and Gen Z, demonstrating a strong desire for homeownership. One of our most important operational achievements of this past year was a significant reduction in our build times, which favorably impacted our business in several respects,” said KB Home’s CEO Jeffrey Mezger during the post-earnings interaction with analysts.

Q4 Outcome

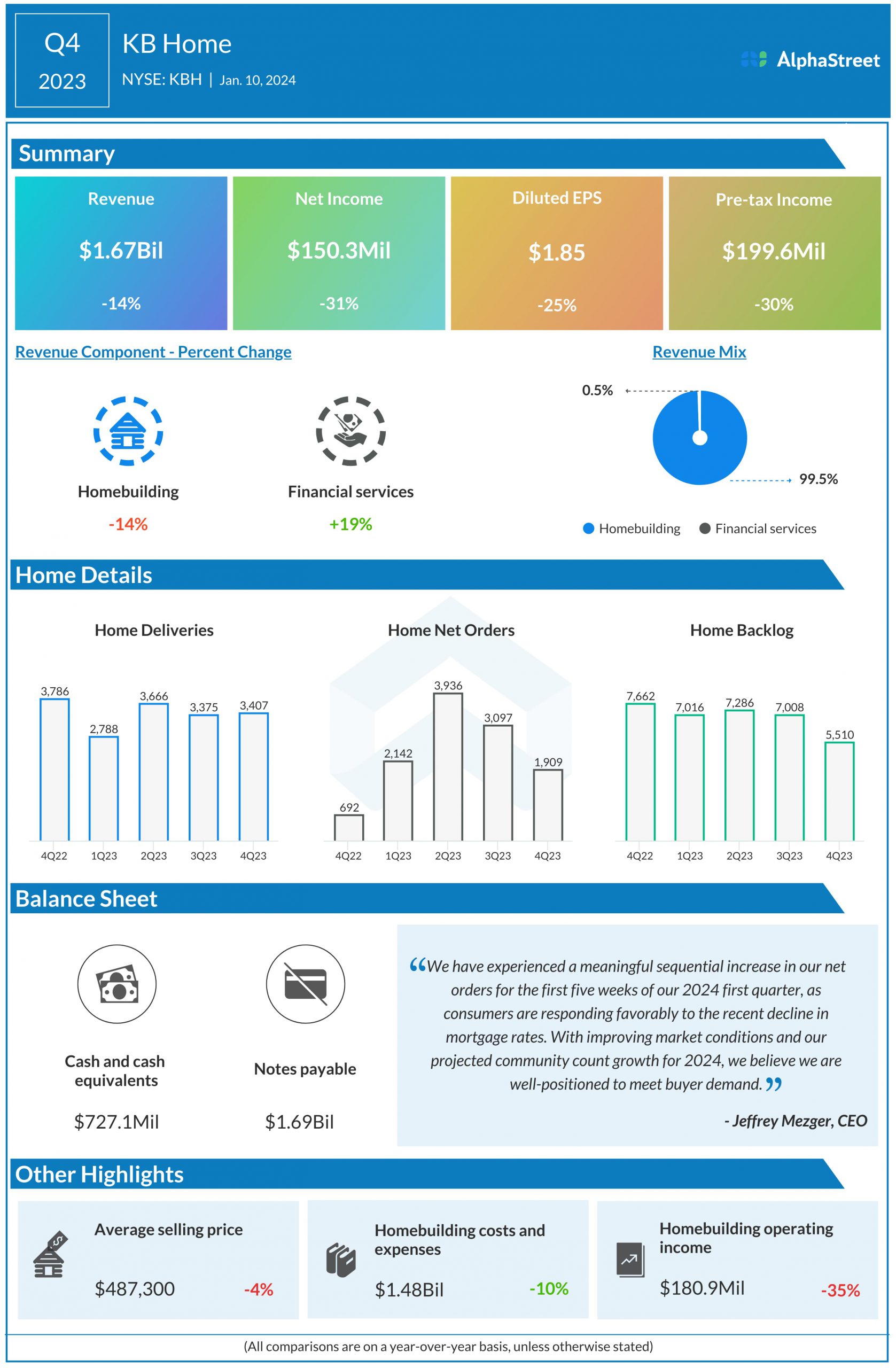

The company ended fiscal 2023 on a mixed note reporting a decline in Q4 revenue and profit which, however, topped Wall Street’s expectations. Net income and earnings per share decreased in double digits to $150.3 million and $1.85 per share, respectively, in the November quarter. The weak bottom-line performance reflected a 14% fall in revenues to $1.67 billion amid lower home deliveries. Meanwhile, all key Q4 metrics came in above the higher end of the company’s guidance.

Shares of Home Depot traded up 2% on Wednesday afternoon, after opening the session slightly below $70. The value has more than doubled in the past twelve months.