Q1 Report Due

When the Bentonville-headquartered company reports first-quarter results on May 16, at 7:00 am ET, the market will be looking for earnings of $0.52 per share. In the year-ago quarter, the company had earned $0.49 per share. The consensus revenue estimate is $159.41 billion, vs. $152.3 billion in the year-ago quarter.

After successfully transitioning from a brick-and-mortar-focused retailer to an omnichannel player — by building a strong e-commerce platform and setting up an extensive network of fulfillment centers — Walmart is now betting on its advertising business to boost revenues. E-commerce sales grew about 20% in fiscal 2024 and crossed $100 billion for the first time. The Walmart Connect advertising platform allows sellers to run campaigns, targeting their ads based on customers’ shopping habits, demographics, and product categories.

Tech Push

Interestingly, Walmart delivered decent profit margins last year despite keeping its prices low. The retailer has always strived to gain an edge over its peers like Target and Costco by integrating advanced technology, with the latest being the launch of AI-powered search and delivery using unmanned aerial vehicles. The company targets to make drone delivery available to about 75% of households in Dallas-Fort Worth by the end of this year.

From Walmart’s Q4 2024 earnings call:

“Beyond our stores and clubs, we’re continuing to strengthen our first- and third-party e-commerce capabilities and scale those businesses around the world. The combination of the marketplace and the commissions that go with it, fulfillment services, membership, advertising, and our smaller but fast-growing data monetization business enable us to grow our bottom line faster than our top line while delivering everyday low prices for our customers and investing in our associates at the same time.”

Strong FY24

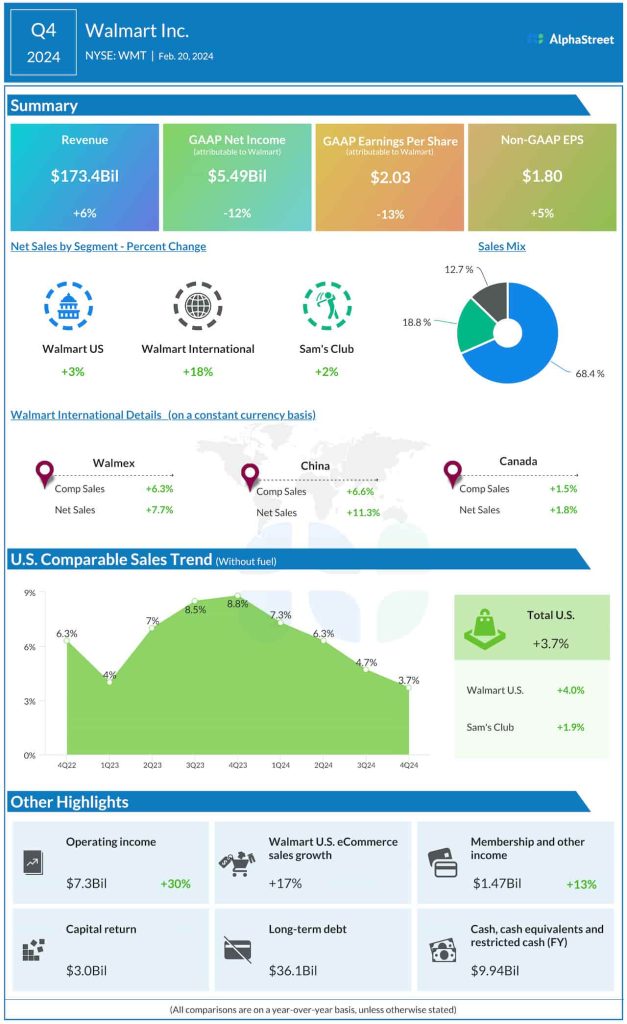

Walmart’s quarterly sales beat estimates consistently for about four years, and the trend continued in the fourth quarter when revenues increased 6% annually to $173.4 billion. Sales grew across all three operating segments – Walmart US, Walmart International, and Sam’s Club. Comparable store sales rose 3.7%, but growth decelerated for the fourth consecutive quarter.

E-commerce sales increased 17% in Q4, continuing the recent trend. Adjusted profit decreased 5% annually to $1.80 per share. Earnings also exceeded expectations, marking the seventh beat in a row. On a reported basis, net income declined in double digits to $5.49 billion or $2.03 per share.

Walmart’s stock has been above its 12-month average for over three months. On Thursday, it traded slightly above $60.