Revenue

eBay’s first-party advertising products delivered $232 million in revenue, which was up 2% on a reported basis and 6% on an FX-neutral basis. The company’s total advertising offerings generated revenues of around $275 million in Q2.

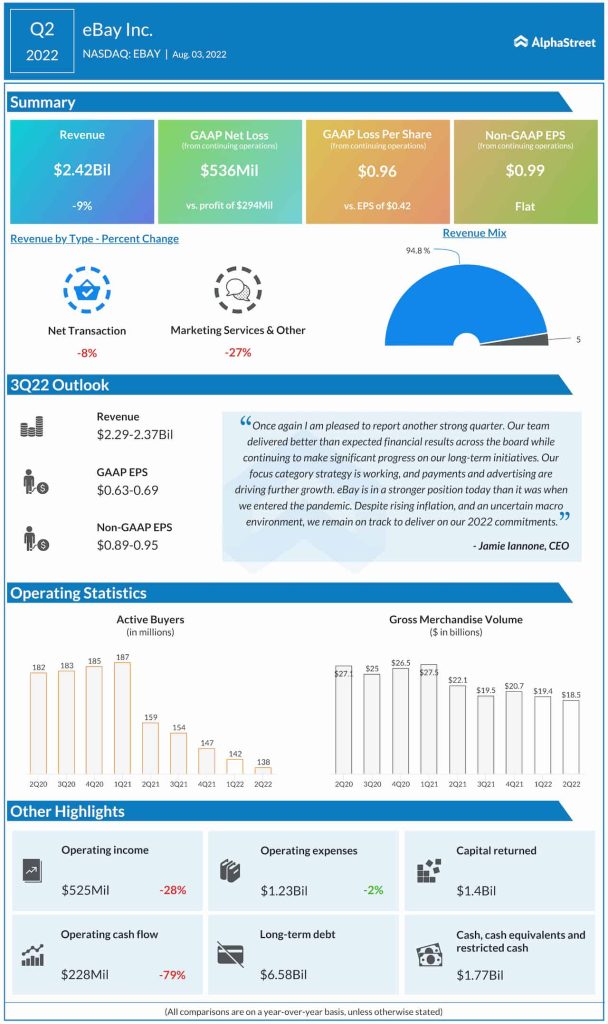

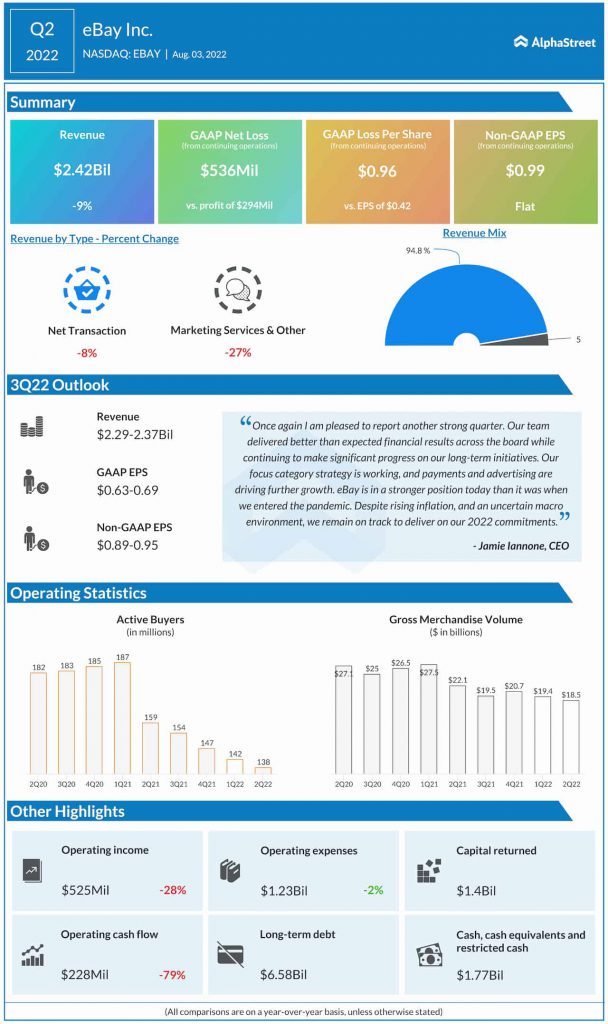

For the third quarter of 2022, eBay expects revenue to range between $2.29-2.37 billion, which represents a decline of 8-5% on a reported basis and 5-2% on an FX-neutral basis. For the full year of 2022, revenue is estimated to be $9.6-9.9 billion, representing a decline of 8-5% on a reported basis and 6-3% on an FX-neutral basis.

Profits and margins

eBay reported a net loss from continuing operations of $0.96 per share in Q2, driven mainly by losses in its investment portfolio caused by market volatility. Adjusted EPS amounted to $0.99, in line with the year-ago quarter. Operating margin was 21.7% on a GAAP basis and 28.7% on an adjusted basis, with both numbers reflecting declines versus the prior-year quarter.

For the third quarter of 2022, eBay expects adjusted EPS to be down 1% to up 6% versus the year-ago period and to range between $0.89-0.95. Adjusted operating margin is estimated to be 27-28%. For the full year of 2022, the company expects adjusted EPS to be down 2% to up 2% and to range between $3.95-4.10. Adjusted operating margin for the year is expected to range between 29-30%.

Gross merchandise volume

eBay’s gross merchandise volume (GMV) for Q2 was $18.5 billion, down 18% on a reported basis and 14% on an FX-neutral basis. The decline was caused by the lapping of the mobility restrictions in 2021 and macro headwinds caused by the Russia-Ukraine war, supply chain challenges, and rising inflation across major markets.

For the third quarter of 2022, GMV is expected to range between $17-17.6 billion. This represents a YoY decline of 15-12% on a reported basis and 9-6% on an FX-neutral basis. For the full year of 2022, GMV is estimated to be $72.7-74.7 billion. This represents a YoY drop of 17-15% on a reported basis and 12-10% on an FX-neutral basis.

Despite the resiliency of its business amid macro headwinds, eBay finds it difficult to predict the operating environment. The company believes the spread of COVID variants, supply chain issues, high inflation levels and the impact of rising interest rates are likely to take a toll on consumers’ discretional spending in the near future.

Click here to access the full transcripts of the latest earnings conference calls