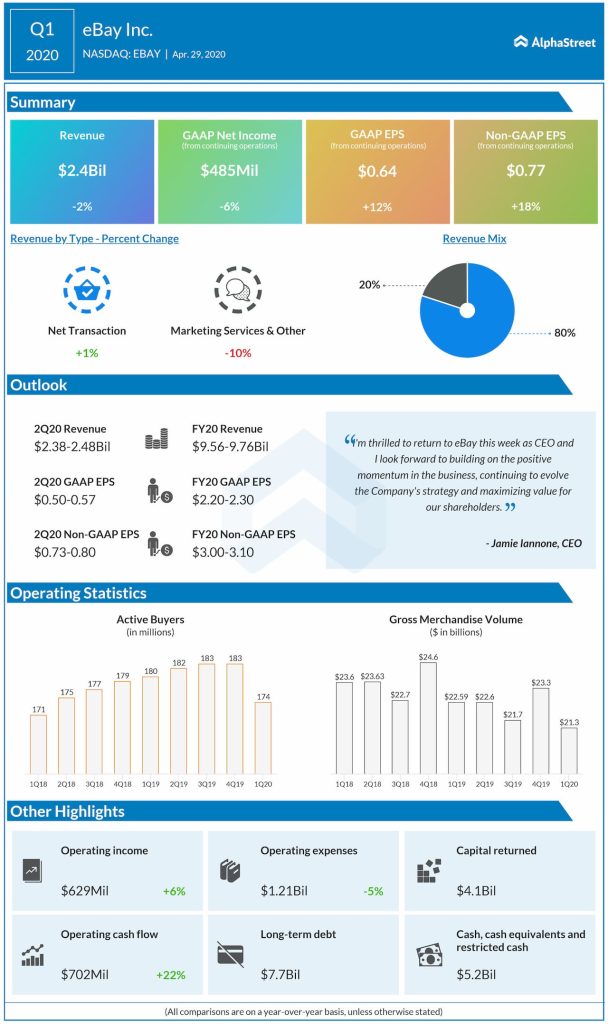

When eBay reported earnings after the regular trading hours on Wednesday, it managed to surpass both revenues and EPS estimates. It’s actually unsurprising, given eBay is among the elite club of firms that are set to benefit from the pandemic. And yet, the stock lingered in the red zone following the announcement.

Buying back confidence

Many felt the company pulled off the earnings beat only because of the share buyback. During the quarter, the company received $4.1 billion in cash from the sale of StubHub and spent it almost entirely on buybacks. This compares with $5 billion the firm spent on stock repurchase for the whole of fiscal 2019.

The huge buyback at a time when companies across industries are struggling to maintain liquidity raises a suspicion that it was done in order to inflate EPS. At least some investors feel the company would have surpassed bottom-line estimates without buyback if it had entirely taken advantage of the shelter-at-home order.

During the post-earnings conference call also, the management had little to offer on this adjustment. Even though the company focused on the nitty-gritty of COVID-19 impact, market response remained generally lukewarm.

COVID-19 impact

Probably the biggest benefit from the pandemic for the e-commerce firm was the addition of thousands of small brick-and-mortar retailers, who were allured with free store subscriptions and listings. Separately, for many unemployed people, the easiest way to raise cash would have been selling through eBay, further adding to the firm’s user base.

This, and higher lockdown-powered traffic, has helped improve buyer acquisition, conversion rates, sold items, and gross merchandise volume. During the conference call, interim CEO Scott Schenkel said:

“In Marketplace, there was an initial surge in home confinement categories in late March, which then expanded in April across all verticals including parts and accessories, fashion and more. Since the start of April, GMV has been growing over 20% in our major on-platform markets every week.”

Advertising revenues

As you might be well aware, third-party advertising took a hit once the pandemic hit. Earlier this week, Alphabet (NASDAQ: GOOGL) and Facebook (NASDAQ: FB) reported a deceleration in advertising revenue growth. Surprisingly, eBay’s 25% growth in overall advertising revenues was better than both the aforementioned tech giants who reported 10% and 17% respectively. And it was driven by eBay’s Promoted Listings, where revenue more-than-doubled to $137 million. According to the firm, close to 1.2 million sellers used the Promoted Listing feature during the quarter.

Meanwhile, Classifieds continue to be an area

of concern, and the management could provide very little information on what

was going to happen with this ailing business. On a positive note, Schenkel pointed

out:

“Following the ’08, ’09 financial crisis, used car sales outpaced new car sales for several years and the shift from offline to online advertising accelerated. Those two macro dynamics provided tailwinds and rewarded players with strong demand and supply and we believe our Motors verticals and ad-based horizontal platforms are well-positioned to perform strongly in that environment.”

In the retrospect, Q1 wasn’t as bad for eBay from an operational perspective. The newly appointed CEO Jamie Iannone comes with a lot of e-commerce experience and that adds to the confidence in the stock. However, the stock repurchase move and little clarity from the management overshadowed whatever benefits were evident during the quarter.

At the end of the day, it’s clarity that we seek.

DISCLAIMER: This article reflects the opinions of the writer alone and not necessarily that of AlphaStreet