Shares of Ford Motor Company (NYSE: F) were up 3% in afternoon hours on Thursday. The stock has gained 17% over the past three months. The company reported third quarter 2020 earnings results that nicely surpassed market estimates a day ago.

Ford benefited from its strategy of focusing on pickup trucks and SUVs that are in high demand as opposed to sedans and the company is looking to restructure the underperforming parts of its business to drive growth going forward.

Sales trends

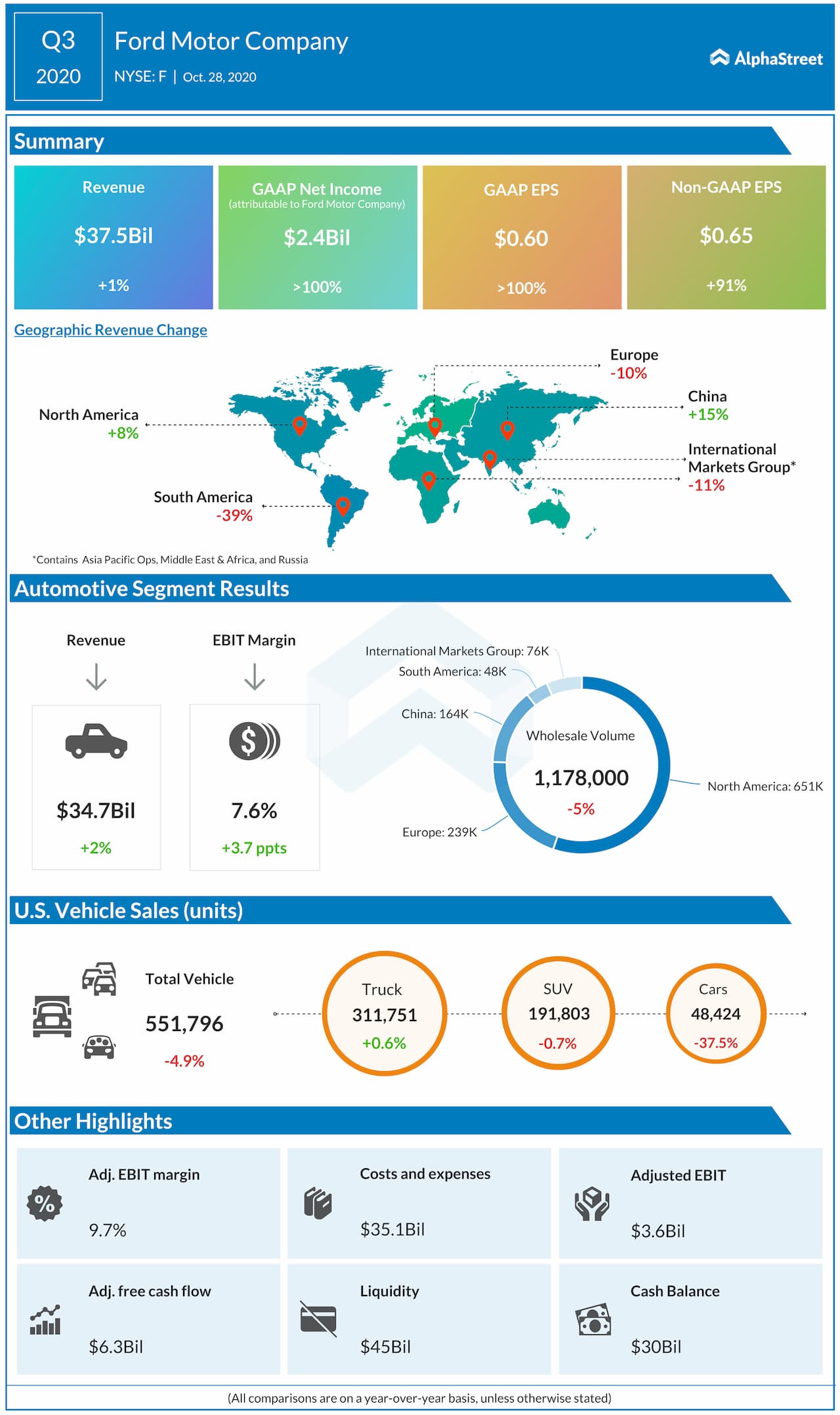

Revenues inched up slightly year-over-year by 1% to $37.5 billion but exceeded market expectations of $35 billion. Although total vehicle sales fell nearly 5% year-over-year in the US, on a sequential basis, they climbed 27.2%. Commercial van sales jumped nearly 94% versus the second quarter. In SUVs, sales of Explorer rose about 74% year-over-year. Sales of cars were down around 38% year-over-year.

In Europe, total vehicle sales were down 4.2% compared to a year ago but commercial vehicle sales rose 3.8% and the company grew its market share in commercial vehicles to 15.1%. SUVs accounted for over 30% of Ford’s vehicle mix in Europe, which was 9 points higher than the year-ago period. Ford’s total vehicle market share in Europe stands at 7.6%.

Sales in China increased 25.4% year-over-year and 3.6% sequentially driven by high demand and favorable product mix. Ford brand vehicle sales in Greater China were up 12.5% year-over-year with SUV sales up 72.2%.

Electric vehicles

A key part of Ford’s growth strategy revolves around electric vehicles. The company is developing electric versions of its highest-volume commercial vehicles – the F-150 and the Transit. Ford sees massive opportunity in fully electric commercial vans and pickups and plans to take advantage of the same.

Ford will continue to build further on its strategy of electrifying its leading commercial vehicles and high volume products going forward. As part of these efforts, the company is expanding its electric vehicle manufacturing footprint globally and has four plants in North America alone. Ford is also working on getting its electric SUVs built in Canada as well.

Outlook

Ford expects to see a reduction in wholesales of about 100,000 units associated with the F-150 changeover in the fourth quarter. The company also expects higher structural and other costs from the manufacturing launch activities for the Mustang Mach-E and the Bronco Sport, and advertising launch activities for the new products.

For the fourth quarter of 2020, Ford expects adjusted EBIT to range between a loss of $500 million and breakeven. Adjusted EBIT is expected to be profitable for the full year of 2020.

Click here to read the full transcript of Ford Q3 2020 earnings call