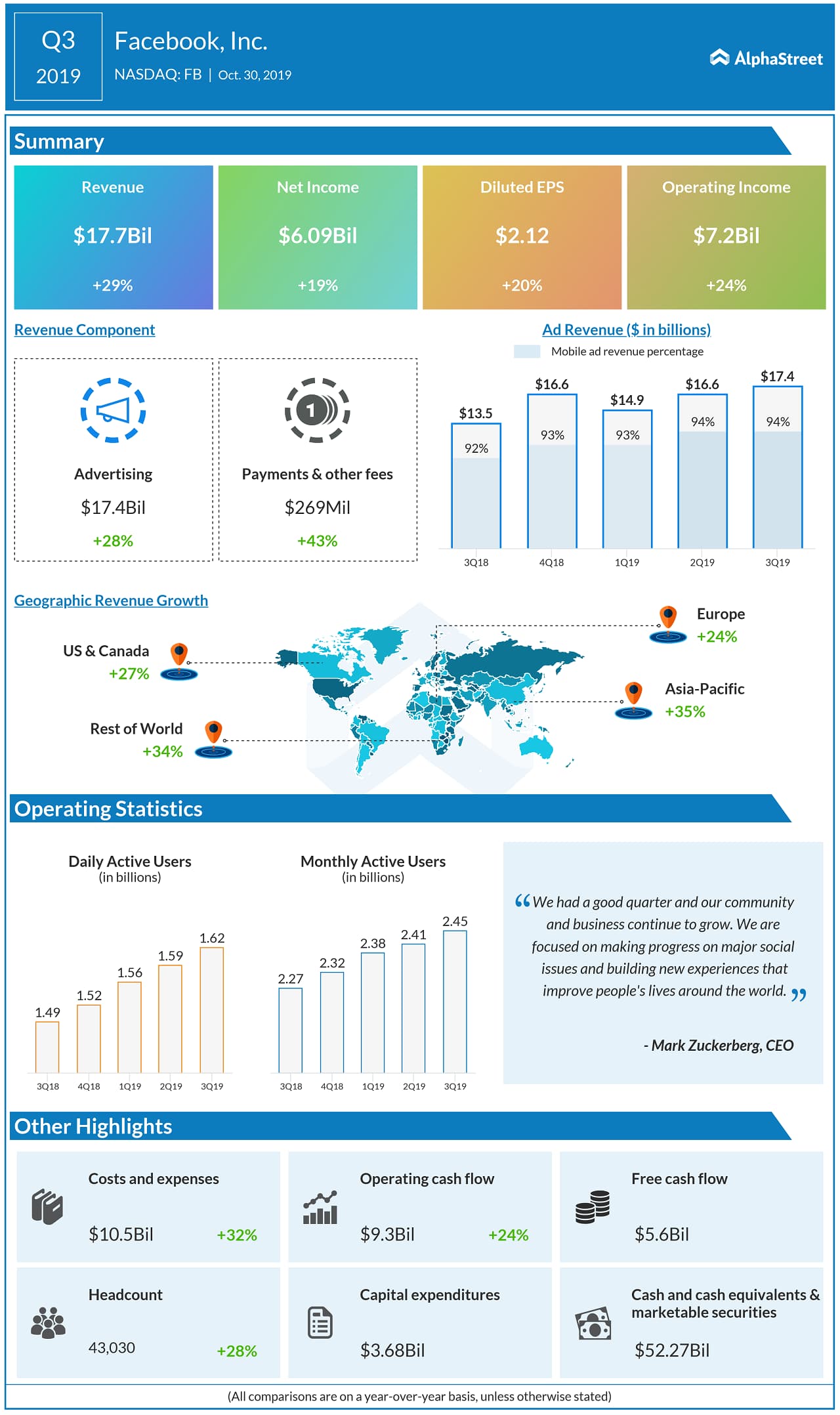

Net income grew 19% year-over-year to $6.1 billion, or $2.12 per share. Analysts had forecast Q3 EPS of $1.91.

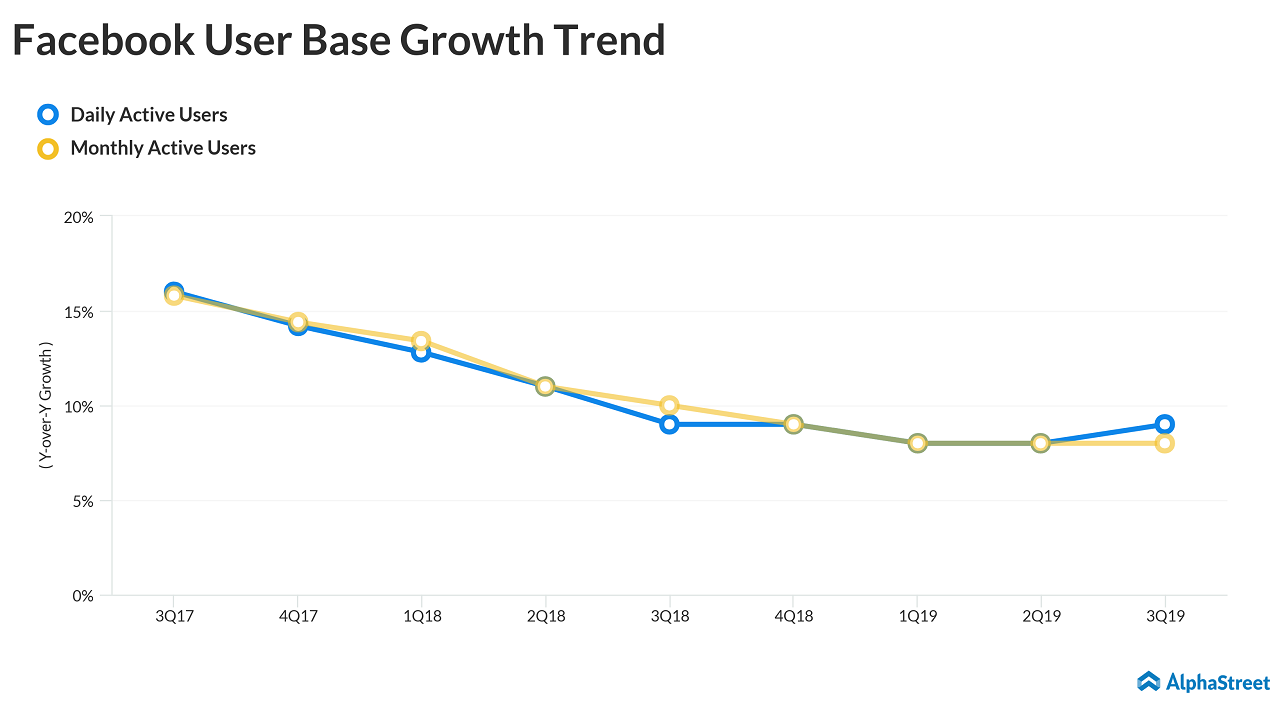

Meanwhile, the company once again posted lackluster DAU and MAU growth in Q3. Daily Active Users (DAUs) increased 9% year-over-year to 1.62 billion, while Monthly Active Users (MAUs) rose 8% to $2.45 billion.

Advertising revenues, which make up a majority of Facebook’s revenues, increased 28% year-over-year to $17.38 billion. Mobile advertising revenue represented approx. 94% of advertising revenue, up from approx. 92% of advertising revenue in the year-ago quarter. Revenue from payments and other fees rose 43%.

Though Facebook shares recovered after slipping to a multi-year low last year, they have been witnessing volatility since the beginning of 2019. The stock has surged about 36% so far this year, outperforming the tech sector and the S&P 500 index.

Snap Inc. (NASDAQ: SNAP), the owner of photo-sharing platform Snapchat that competes with Facebook’s Instagram, reported a narrower loss of $0.16 per share for the third quarter, aided by a 50% growth in revenues to $446 million. Microblogging site Twitter (TWTR) last week issued weak outlook for the December-quarter, after its third-quarter profit fell sharply to $0.17 per share and missed estimates.

The company is currently working to deliver on its promise of reducing toxic content on the platform, after being slapped heavy fines by the regulators. This has led to massive increase in its expenses over the past few quarters.

Interestingly, the initiatives have not prevented social media giant from going ahead with its expansion plans, with focus on new growth avenues.

Over the years, Facebook has maintained the growth momentum in its advertising business. The key to cashing in on the growing user engagement and steady rise in advertising revenue is to rein in costs and revive margin growth.