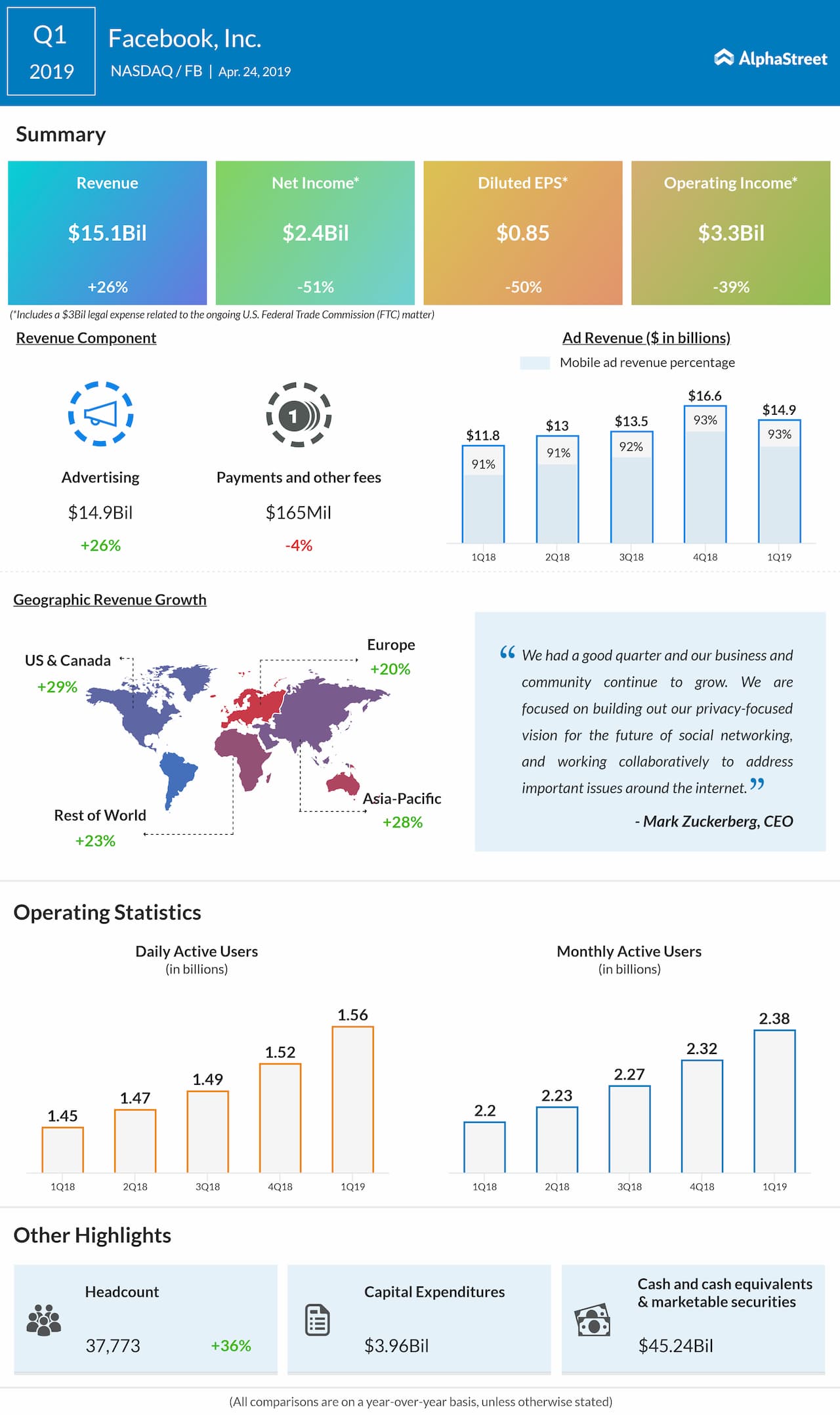

The one-time costs were associated with the inquiry of the Federal Trade Commission into Facebook’s user data practices. The social media giant estimates the range of loss in this matter between $3 billion and $5 billion.

LISTEN TO THE FULL EARNINGS CONFERENCE CALL: FACEBOOK Q1 2019

Total revenue jumped 26% to $15.08 billion, surpassing analysts’ expectation of $14.96 billion.

Facebook shares gained 4.7% during after-market trading on Wednesday. The stock has rallied 35% in the year-to-date period.

Mobile advertising revenue represented approximately 93% of advertising revenue in the first quarter of 2019, up from about 91% in the year-over period.

READ: 4 THINGS YOU NEED TO KNOW AHEAD OF AMAZON’S Q1 RESULTS

Daily Active Users increased 8% to 1.56 billion, while Monthly Active Users gained 8% to 2.38 billion. The popularity of its existing features like video, coupled with the addition of new features like music, are keeping users engaged at times of data privacy scandals.

Facebook is estimated to spend close to $4 billion this year to boost safety on its website. The social media giant has its share of litigation issues and might face fines that could run into billions of dollars, even as Facebook’s CEO Mark Zuckerberg appears to favor federal regulation that several parties have been advocating in recent times.

Rivals shine

Rivals Twitter (NYSE: TWTR) and Snap (NYSE: SNAP) both reported upbeat first-quarter results on Tuesday. Twitter reported solid earnings and revenue growth for the first quarter of 2019 amid stable growth in daily active users, driving the microblogging platform’s stock higher in the pre-market trading.

Snap’s revenue soared 39% to $320.4 million, while net loss shrunk 20% to $310.4 million.