File storage platform Dropbox, Inc. (NASDAQ: DBX) is a technology firm that foresaw the scope of remote work and took early steps to promote the pandemic-driven digital shift. The company is busy innovating its product portfolio lately, thereby prompting users to adopt multiple products and upgrade to the premium plan, at a time when the market is hit by macroeconomic challenges.

The San Francisco-based company, which offers cloud-based document management solutions, provides a smart workspace for digital content collaboration that is designed for both individual and team workflows. Being an innovative business with promising growth prospects, the impact of the recent tech selloff on Dropbox has been relatively small.

The Stock

DBX is a cheap stock that looks all set to enter the growth phase soon, providing a suitable entry point to those looking to play it safe. Going by the company’s impressive track record of strong revenue and cash flow generation, it has what it takes to deliver strong returns, and is unlikely to disappoint long-term investors.

Read management/analysts’ comments on quarterly reports

The stock has experienced high fluctuation this year, rebounding after every dip while staying close to the long-term average. It gained momentum following the recent earnings release and is currently trading near the levels seen at the beginning of the year. At the current valuation, it is a low-risk investment.

User Base

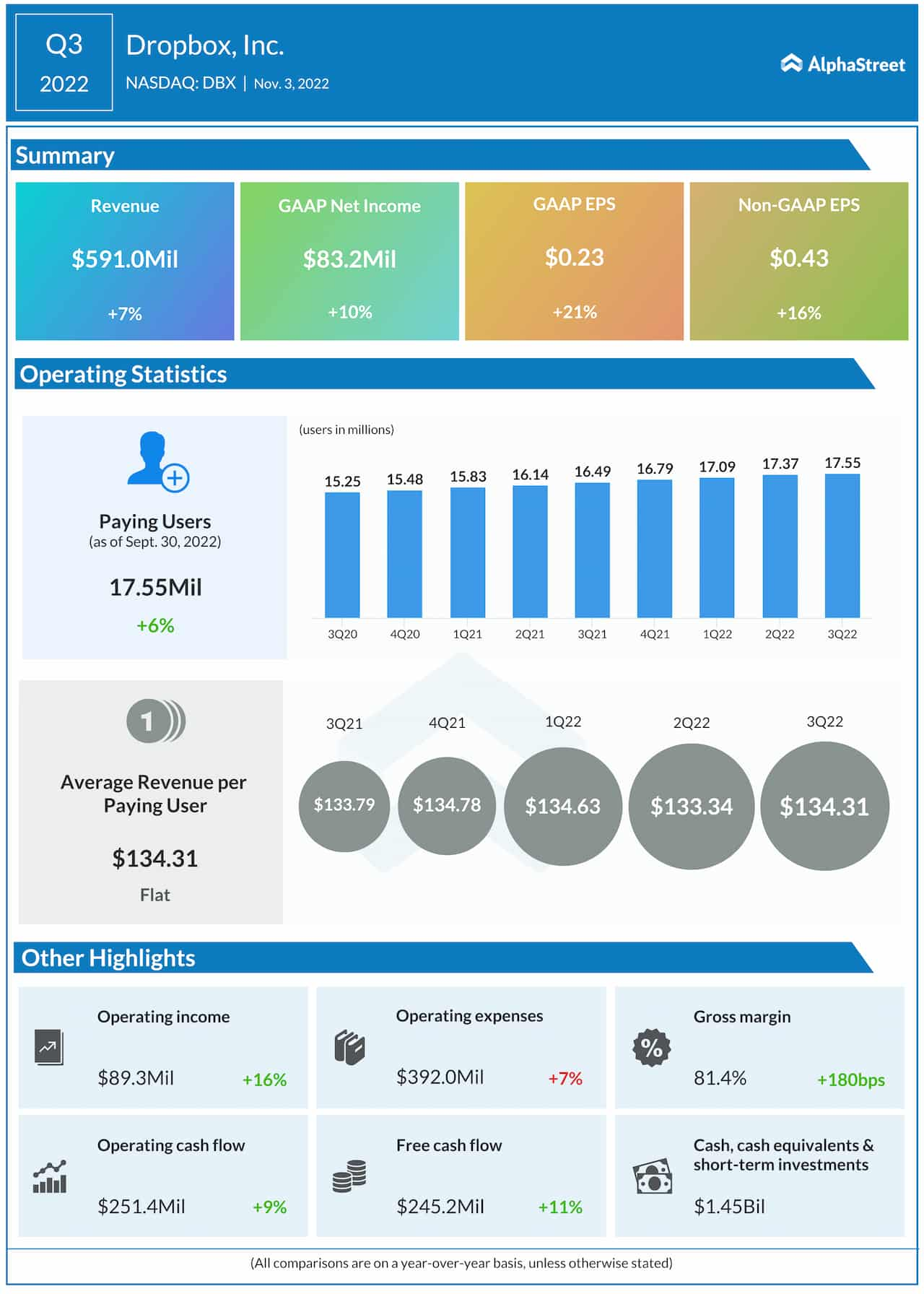

Of Dropbox’s near-700 million registered users, 17.55 million are paying users. The growth strategy is focused on converting registered users into paying users and prompting existing users to upgrade to premium. When it comes to innovation, efforts are on to ramp up existing products and drive the adoption of new ones, leveraging scale and user insights.

The management is optimistic about the sustainability of the widespread shift to remote work, and the company’s ability to contribute to that through various cloud-based products. It is rolling out new products like Shop, Replay, and Capture to empower users and enhance their experience. Dropbox is also exploring new revenue sources, like monetization of its Backup service.

Financials

In the past few years, there has been a constant uptick in the company’s key financial numbers like revenue, free cash flow, and margins. In a rare achievement, earnings and revenues beat estimates in every quarter since Dropbox started reporting quarterly results. In the third quarter of 2023, the average revenue per user was $134.31, which has remained stable in recent years. At $591 million, total revenue was up 7%, while adjusted profit grew in double digits to $0.43 per share.

Here’s a glance at DocuSign’s expectations for the near term

In the coming years, Dropbox’s growth will depend on the continued expansion of user base and ability to monetize its products more effectively. While the stable cash flows look impressive, the accumulation of debt is a negative as far as health of the balance sheet is concerned. In the near future, the economic downturn and unfavorable foreign exchange rates would weigh on revenues.

Dropbox’s stock started the week on a low note, reversing the uptrend that followed the earnings release. Trading slightly below $23, it is up 12% since mid-October.