Transport and courier companies were among the worst affected by the supply chain crisis that gripped the business world during the COVID era. Nearly two years into the pandemic, cargo movers like FedEx Corporation (NYSE: FDX) are still working hard to meet the high demand for parcel services amid persistent logistics disruption.

Stock Dips

While the vast global network helped the company stay largely unaffected by the pandemic so far, its unimpressive third-quarter results and management’s cautious outlook seem to have not gone well with investors. Extending a slowdown, the stock dropped soon after the last earnings announcement, but made a modest recovery later.

Read management/analysts’ comments on FedEx’s Q1 2022 results

The good news is that the stock is expected to continue the recovery – growing around 25% in the next twelve months — and is probably on its way to hitting a new peak. It offers a buying opportunity that investors wouldn’t want to miss. As far as the outlook is concerned, the top-line will continue benefitting from the virus-related tailwinds, like the e-commerce boom and spike in the demand for business-to-consumer parcel delivery.

Pricing Power

Margins benefit from the management’s revised pricing policy – hike in average revenue per price – and that offsets the impact of cost escalation, mainly related to the constrained labor markets and higher fuel prices. Freight rates are going up in high-single digits and surcharges are being revised up, which would help meet the growing demand and maintain stable bottom-line performance.

Elevated costs and supply chain issues would be the main challenges for the company this year. It also faces near-term risks related to restricted connectivity and inefficient routing. Recent developments on the pandemic front, like the resurgence in infections and the emergence of new variants like omicron, don’t bode well for the business.

From FedEx’s first-quarter earnings conference call:

“We reached a significant agreement with the social partners at our Liege Express operations regarding the intended European air network transformation. This is an important milestone in the completion of the air network integration, which remains on track for completion in spring 2022. That will bring the physical network integration of TNT into FedEx to a close and when combined with the benefits of our previously announced European restructuring, provides significant upside in our international profitability moving forward.”

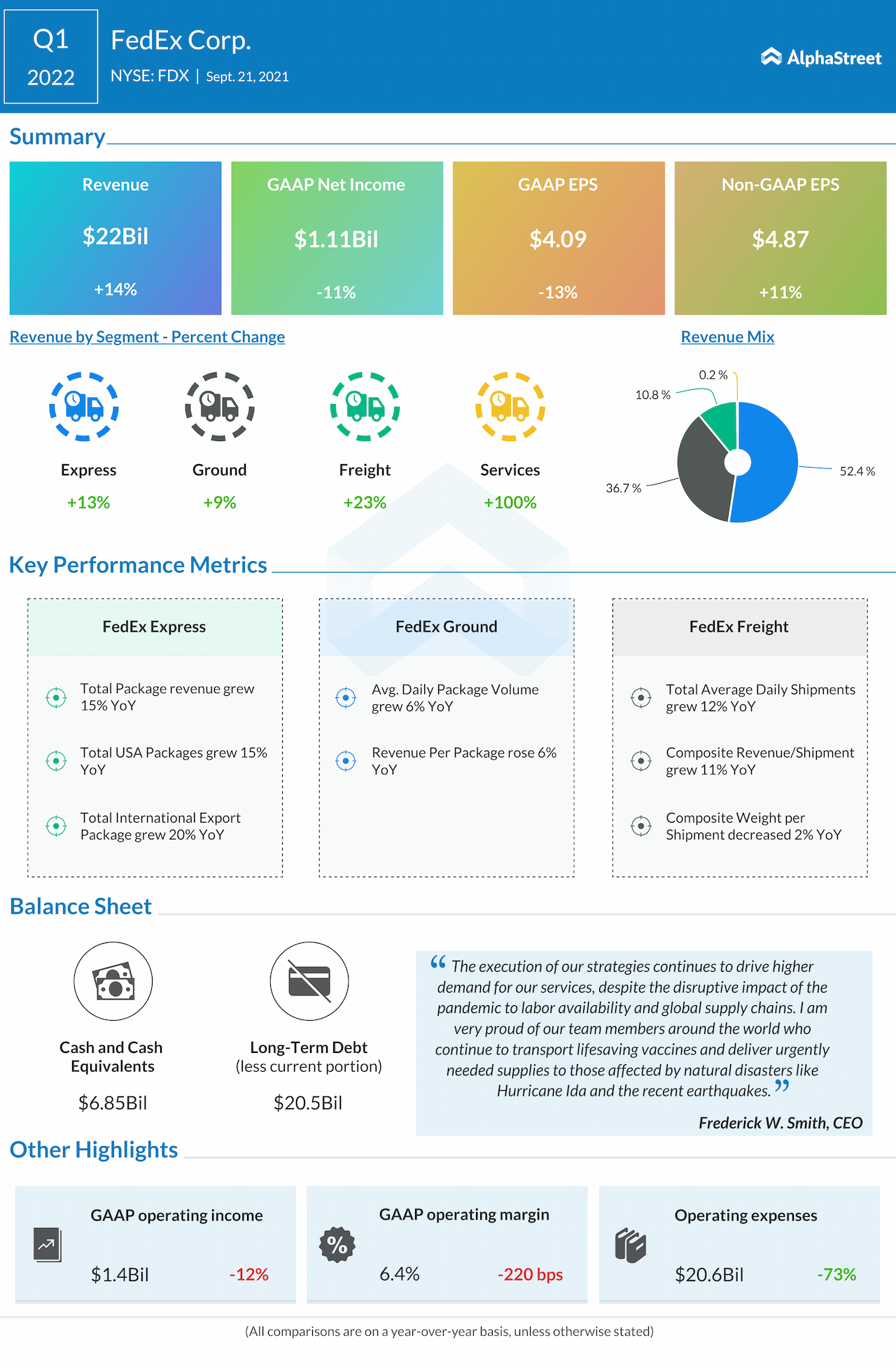

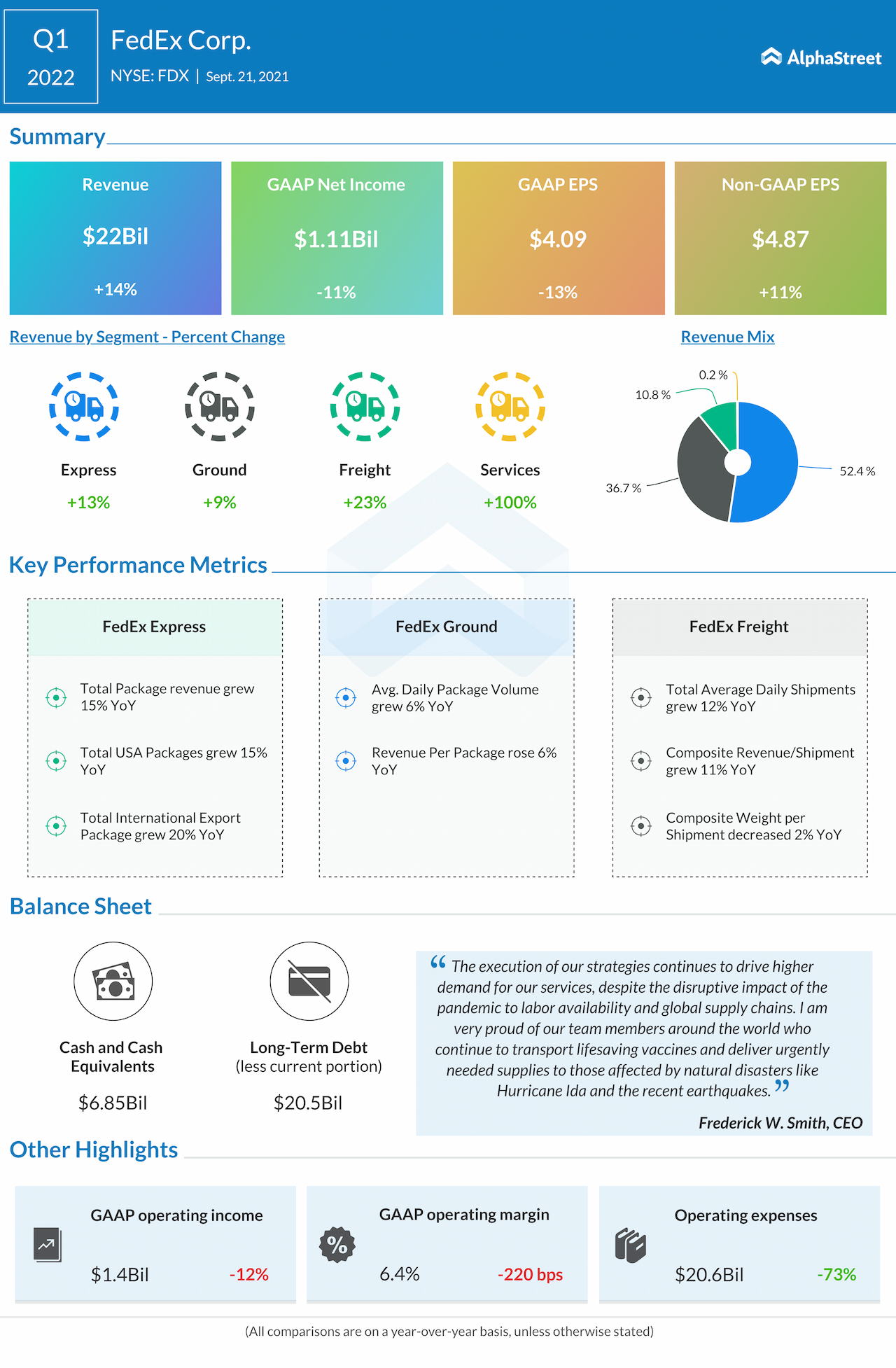

Q2 Report on Tap

When FedEx reports second-quarter results on December 16 after the closing bell, the market will be looking for a 12% decrease in earnings to $4.25 per share, on revenues of $22.44 billion. For the first quarter of 2022, it had reported a 10% fall in adjusted earnings to $4.37 per share, despite revenues increasing 14% to $22 billion. The numbers missed experts’ projection.

More recently, rival cargo company United Parcel Services (NYSE: UPS) said its third-quarter adjusted earnings increased in double-digits to $2.71 per share. Revenues grew 9% annually to $23.2 billion aided by broad-based growth across all business segments.

All you need to know about Amazon’s Q3 2021 earnings results

After peaking mid-year, FedEx’s stock entered a downward spiral and underperformed the market. The shares traded lower on Wednesday afternoon and stayed below their 52-week average.