Quarterly performance

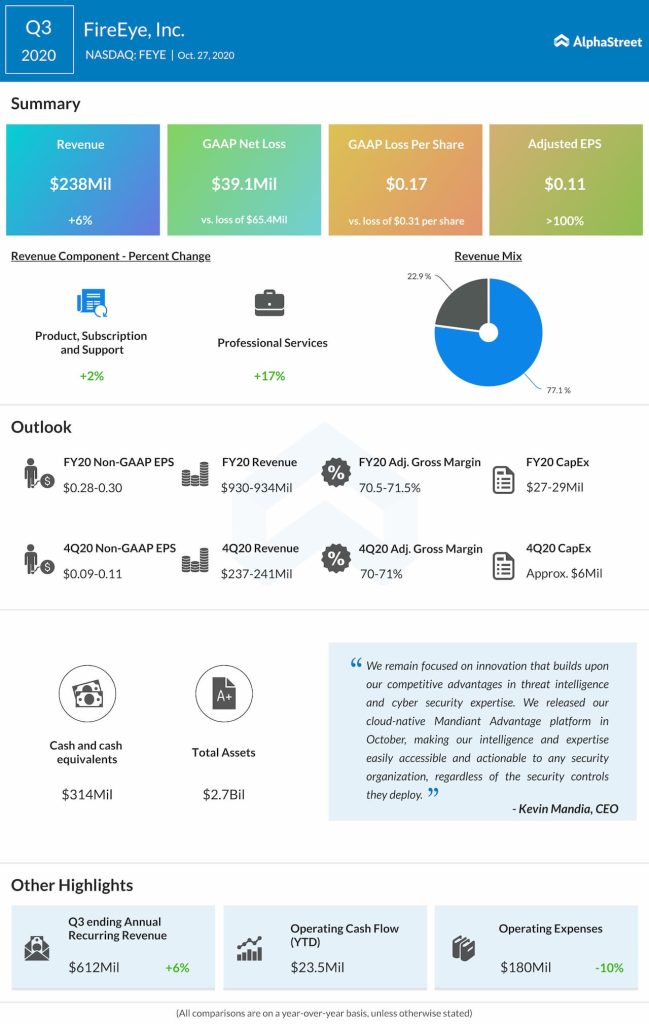

During the third quarter, FireEye’s topline increased 6% year-over-year to $238 million while adjusted EPS amounted to $0.11 versus $0.02 last year. The company saw strength in its platform, cloud subscription and managed services category which saw revenue growth of 21% year-over-year.

Revenue for the Mandiant consulting services grew 19% year-over-year. FireEye is seeing strong demand for its offerings and the combined revenue of the platform cloud category and professional services category accounted for 54% of total revenue.

Cloud services

The platform, cloud subscription and managed services category includes the security validation platform, threat intelligence and managed defense offerings along with the cloud-based security control products. This category saw a year-over-year growth of 18% in annual recurring revenue.

FireEye continues to see strength in cloud endpoint, threat intelligence and security validation. The company’s efforts in improving its cloud security management capabilities and increased compliance checks are expected to help in improving the detection and prevention of cyberattacks.

FireEye released three new modules which will help in the prevention of the theft of personal data and in taking remediation measures against cyberattacks. The company sees cloud endpoint as a key growth area and it continues to significantly invest in this space.

Outlook

Based on the strong results in the third quarter and the strength seen during the early part of the fourth quarter, FireEye raised its guidance for the full year of 2020. The company expects revenues to range between $930-934 million, reflecting an increase of $17 million at the midpoint. Gross margin is expected to come between 70.5-71.5% while operating margin is estimated to range between 7.5-8%.

FireEye expects services revenue in the fourth quarter to remain relatively unchanged from the third quarter due to less billable days owing to the holiday period. The company is cautious about the impact of the pandemic on its services billings growth rates. While demand and revenues are expected to stay strong in services, billings are projected to decline year-over-year during the fourth quarter.

Click here to read the full transcript of FireEye Q3 2020 earnings conference call