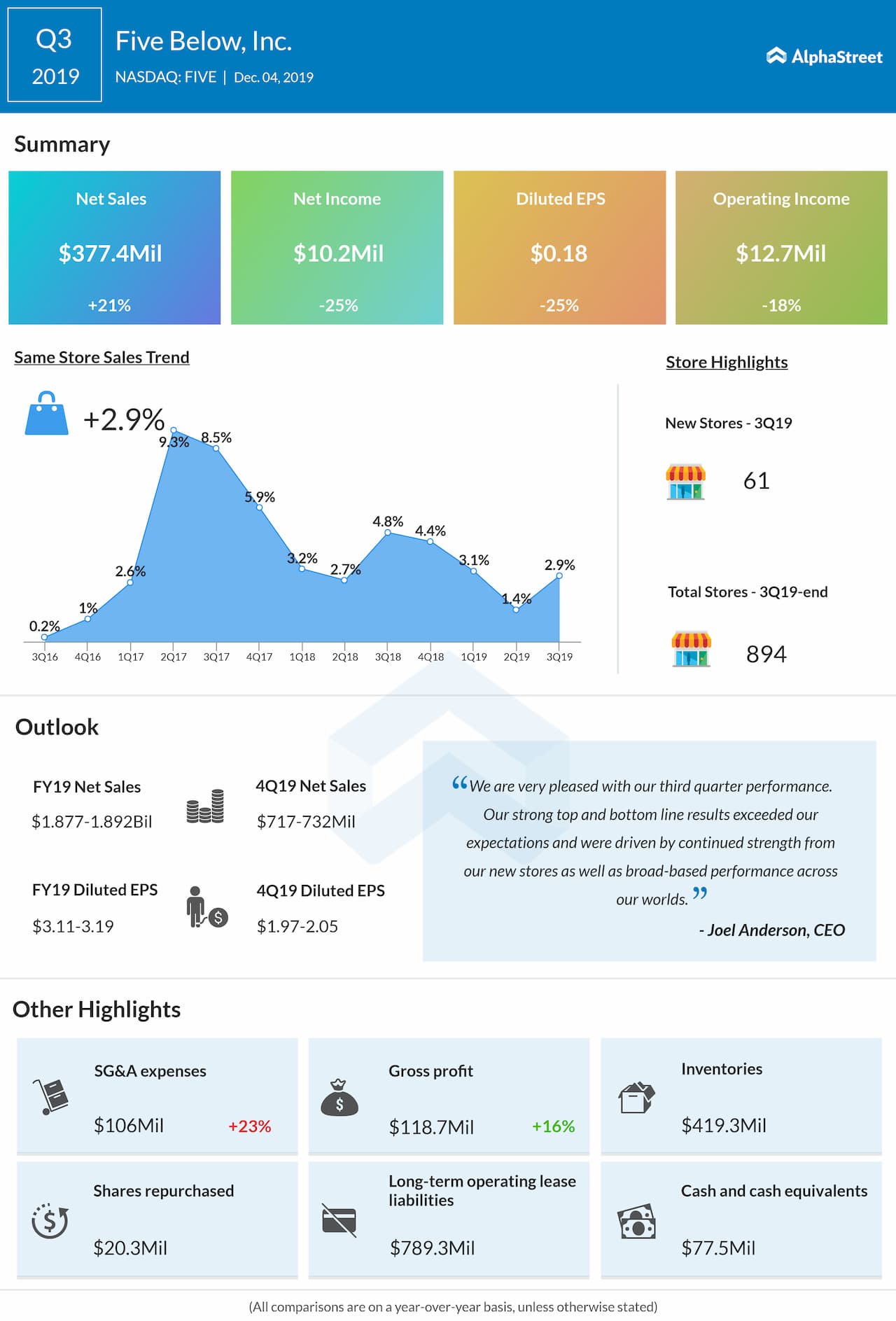

— The company opened 61 new stores and ended the quarter with 894 stores in 36 states. This represents an increase in stores of 20% from the end of the third quarter of fiscal 2018.

— Looking ahead into the fourth quarter, the company expects net sales of $717-732 million, based on opening about 6 new stores and assuming a 2-3% increase in comparable sales. This is below the consensus estimates of $733.97 million.

— Net income is predicted to be in the range of $110.7-115.2 million or $1.97-2.05 per share for the fourth quarter. This is in-line with the analysts’ forecast of $2.02 per share.

— For the full year 2019, Five Below narrowed its net sales outlook to the range of $1.877-1.892 billion from the previous range of $1.872-1.892 billion. In contrast, the consensus view is $1.89 billion.

— The net sales guidance for the full year is based on opening 150 new stores and assuming an approximate 2.5% increase in comparable sales.

— For the full year, net income guidance is tightened to the range of $175.4-179.9 million or $3.11-3.19 per share from the previous range of $173.4-179.9 million or $3.08-3.19 per share. This is compared to the Street’s view of $3.15 per share.