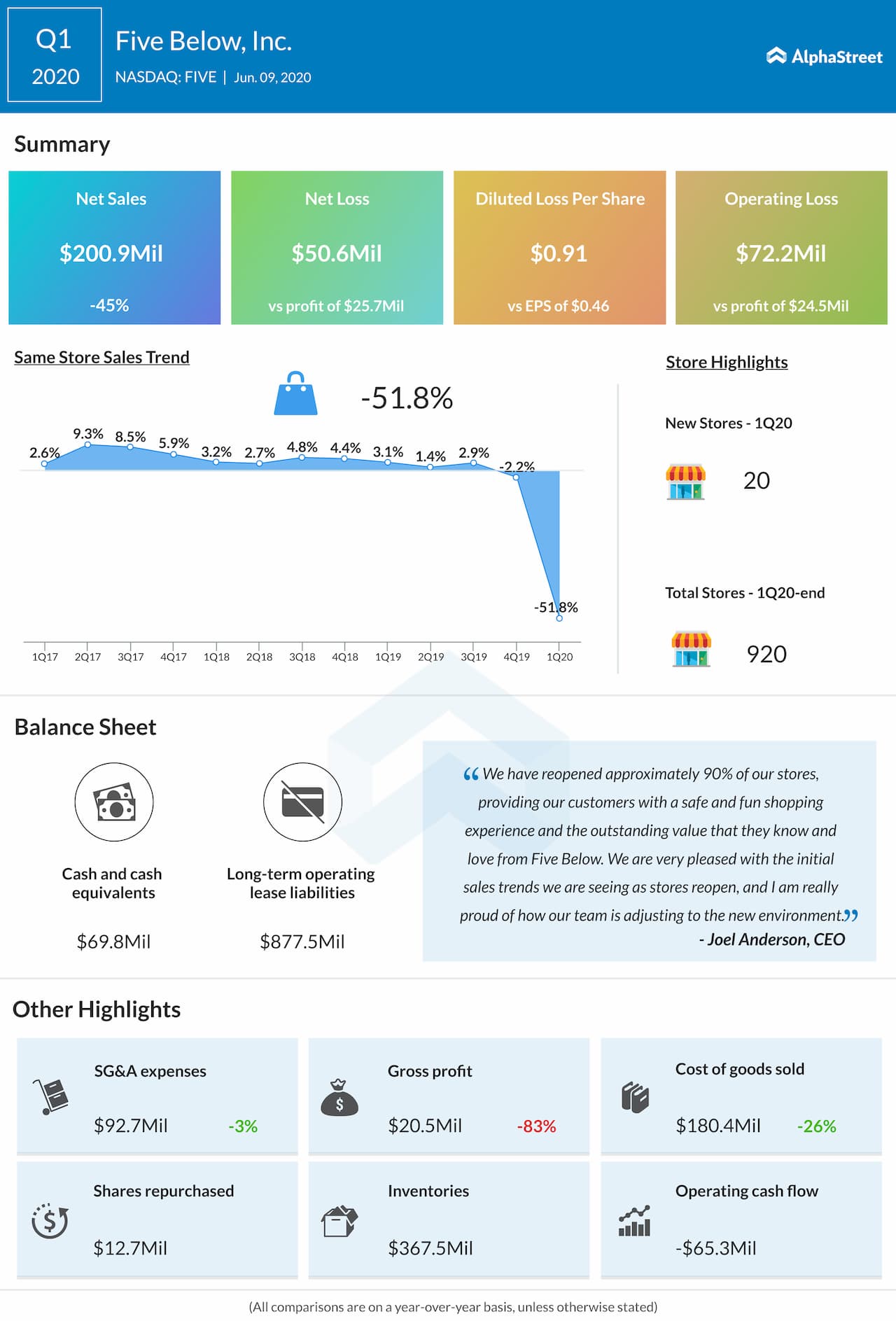

Five Below Inc. (NASDAQ: FIVE) slipped to a loss in the first quarter of 2020 from a profit last year, due to the temporary closures of its stores after the rapid spread of the COVID-19 pandemic. The bottom-line was wider than the analysts’ expectations while the top-line missed consensus estimates.

The top-line dropped by 44.9% year-over-year and comparable sales dipped by 51.8%. The company opened 20 net new stores and ended the quarter with 920 stores in 36 states. This represents an increase in stores of 16.6% from the end of the first quarter of fiscal 2019.

Given the uncertainty related to COVID-19, the company will not be providing sales or earnings guidance for the second quarter or for fiscal 2020. The company continues to expect to open 100 to 120 net new stores in 2020.

On May 29, the company announced that over 75% of its stores have been reopened with strict health and safety protocols implemented. In addition to reopening over 700 stores since April 21, Five Below has opened a total of 40 new stores to date in 2020 and continues to expect to open 100 to 120 new stores this year.

Take a look at our Retail articles here