Elusive Profit

After making steady gains and peaking towards the end of the year, Spotify’s stock looks overvalued in relation to its financial performance. The company has not been able to come out of its prolonged losing streak, despite adding new subscribers regularly. The recent trend indicates a pull-back is imminent, which calls for caution as far as investing in the company is concerned. Those with an appetite for risk can still try it, and long-term investors might not be disappointed.

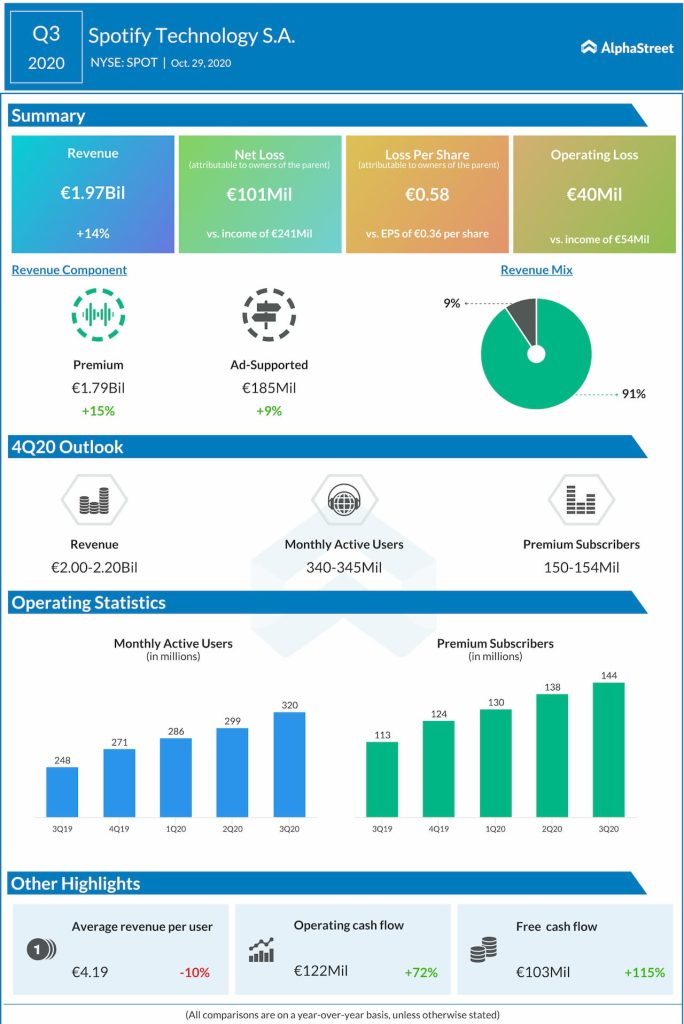

The Sweden-based music streaming platform slipped into a loss of EUR 0.58 per share in the third quarter from a profit last year, despite double-digit growth in revenues to EUR 1.97 billion. The top-line benefited from a further expansion of the company’s user base, with monthly active users and premium subscribers growing to 320 million and 144 million, respectively. The bottom-line was impacted by high content costs. The company has reported net loss for each of the previous four quarters.

Cost Pressure

Spotify’s turnaround prospects would depend on its ability to contain costs and improve ad sales. Meanwhile, the pandemic-driven spike in the consumption of digital content bodes well for the company, which is seeing an uptick in demand and improvement in cash flow. Enterprise spending on advertisement should pickup and boost margins once normalcy returns to the market, leveraging the streamer’s dominance in the industry. Also, the recent increase in prices has started yielding results, thereby easing the cost pressure to some extend.

“While our primary focus remains user growth based on our maturity in certain markets, and the increasing value we provide to our subscribers, including of course enhanced content, we’ve seen engagement and more specifically value per hour grow substantially over these past few years. And I believe an increase in value per hour is the most reliable signal we have in determining when we’re able to use price as a lever to grow our business,” Spotify’s chief executive officer Daniel Ek told analysts in his opening remarks during the latest earnings conference call.

Growth Drivers

Potential growth drivers include geographical expansion, especially in Asia, and contributions from recently acquired podcast ad-tech firm Megaphone. Of late, expanding podcast content has been the focus of the management’s growth strategy, under which the company earlier acquired Gimlet Media, Anchor, and The Ringer. While experts are bullish on Spotify’s revenue performance next year, they don’t expect it to come out of the losing streak anytime soon.

Can Netflix hold its ground as the streaming space gets crowded?

Spotify’s market value more than doubled this year, with the stock making steady gains and hitting an all-time high early this month. The stock, which outperformed the market in recent months, flattened and pared a part of the early gains since then. At $316.08, it traded slightly lower in the New York Stock Exchange in early trading on Tuesday.