Product line-up

In FY21, Electronic Arts launched six new sports games, including FIFA 21 and Madden NFL 21 on the new Xbox and PlayStation consoles. In December, FIFA Ultimate Team reached a new record of nearly 6 million daily active players. The company will also bring back its popular college football video games soon.

There is significant opportunity for growth within live services and mobile games. The company saw sales growth of 5% in live services during the third quarter. Apex Legends saw a year-over-year growth of 30% in new players, with competitive play helping in driving user growth and engagement. In mobile, games like Star Wars: Galaxy of Heroes continue to drive high engagement. EA is working on growing its mobile portfolio and plans to roll out a new Apex Mobile game in FY2022.

Bookings

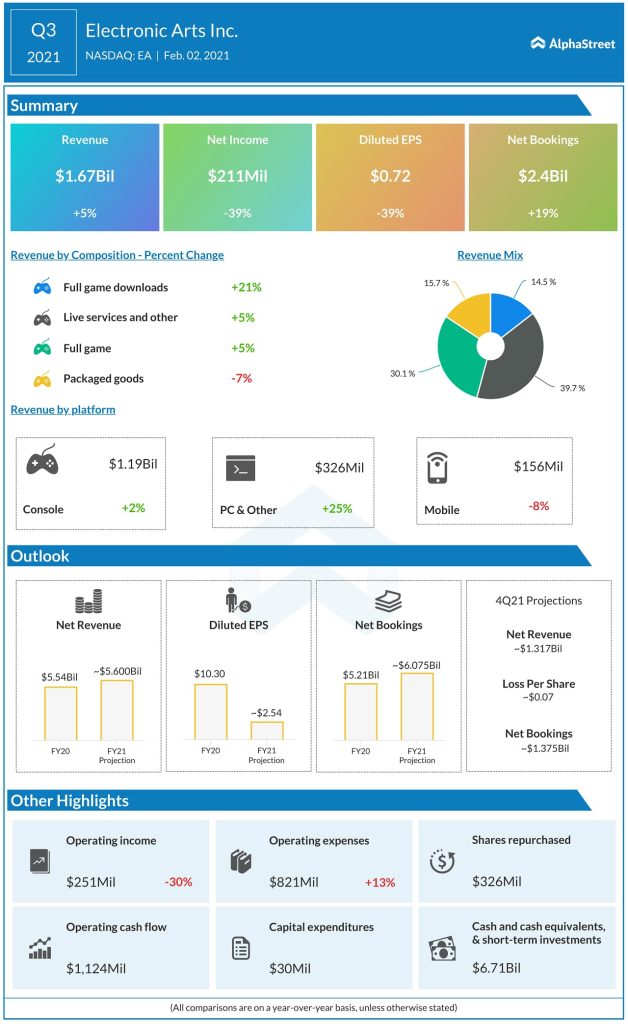

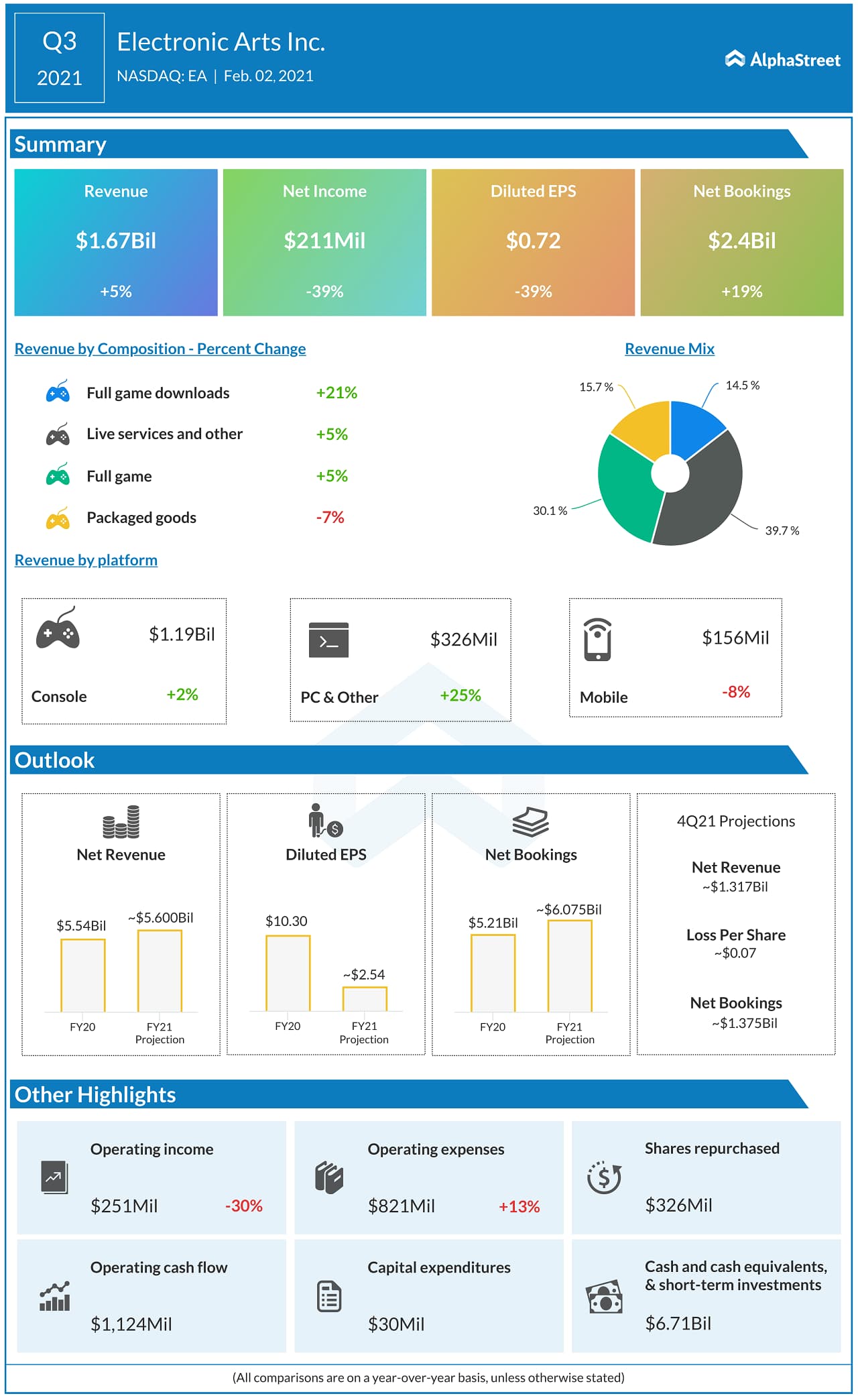

Bookings, which includes the sale of physical and digital products and services, is a key performance indicator. In the third quarter, net bookings increased 19% year-over-year to $2.4 billion, ahead of the company’s expectations. The growth was driven by momentum in live services, particularly Ultimate Team and Apex Legends.

EA now expects Apex to deliver over $500 million in net bookings this year versus its original estimate of $300-400 million. The company raised its FY2021 net bookings guidance to $6.075 billion, based on strong momentum in live services, particularly FIFA and Apex Legends. This should reflect a growth of 13% from the prior year. Net bookings are expected to total $1.375 billion in the fourth quarter of 2021.

Sports opportunity

The worldwide console/PC sports market has grown by about 13% annually since 2016 and is currently estimated at about $7 billion. The global mobile sports market is rapidly growing at about 24% a year and currently stands at about $4.3 billion in size. EA has several projects in flight that will help take advantage of the vast opportunity in this space.

Codemasters

The acquisition of Codemasters is expected to help EA expand its presence in racing entertainment and allow the company to release new racing experiences annually. The deal is also expected to create further opportunities within EA SPORTS. It is also expected to help drive net bookings growth and underlying profitability.

Click here to read the full transcript of Electronic Arts Q3 2021 earnings conference call